13 min

13 min 620

620A Simple Guide on How to Do an Electronic Bank Transfer Effectively

Learn how to perform electronic bank transfers safely and efficiently. Follow our simple guide for hassle-free transactions

Co-authored with Varda Sardana and Shubham Singhania

Where were you on February 14th, 2022? Does that date ring a bell? 🔔 Maybe it does. Valentine's Day—probably the day you proposed to someone or got proposed to. 💍 While others were going down on bended knees at Grace Bay Beach in the Turks & Caicos Islands for their lovers 🏝️❤️, I was literally on bended knees for a different reason—I was about to miss out on my own true love (my dream apartment) because I didn't know how to make a same-day bank transfer! 🏠

I still remember exactly where I was—frantically calling my bank from the real estate office, palms sweating 💦 as the agent gave me that look. You know the one—half pity, half "I've got three other buyers waiting." 😬 There I was, with all the money sitting in my account 💰, but no idea how to move it quickly enough to secure the deal. The property market was so hot that day that waiting for a regular 3-day ACH transfer meant losing my chance completely. 🏠💨

When the agent mentioned I needed to wire the deposit within the hour or lose my spot, I panicked. 😱 I'd never done a wire transfer before! What was a routing number? Did I need to go to a physical bank? Was this even safe? 🚨 The clock was ticking ⏰, and I was completely unprepared for this financial hurdle.

That moment was my wake-up call. ⏰ If someone like me—tech-savvy in most areas of life—could be caught off guard by something as fundamental as moving my own money quickly, how many others were in the same boat? What about YOUR money? 💵

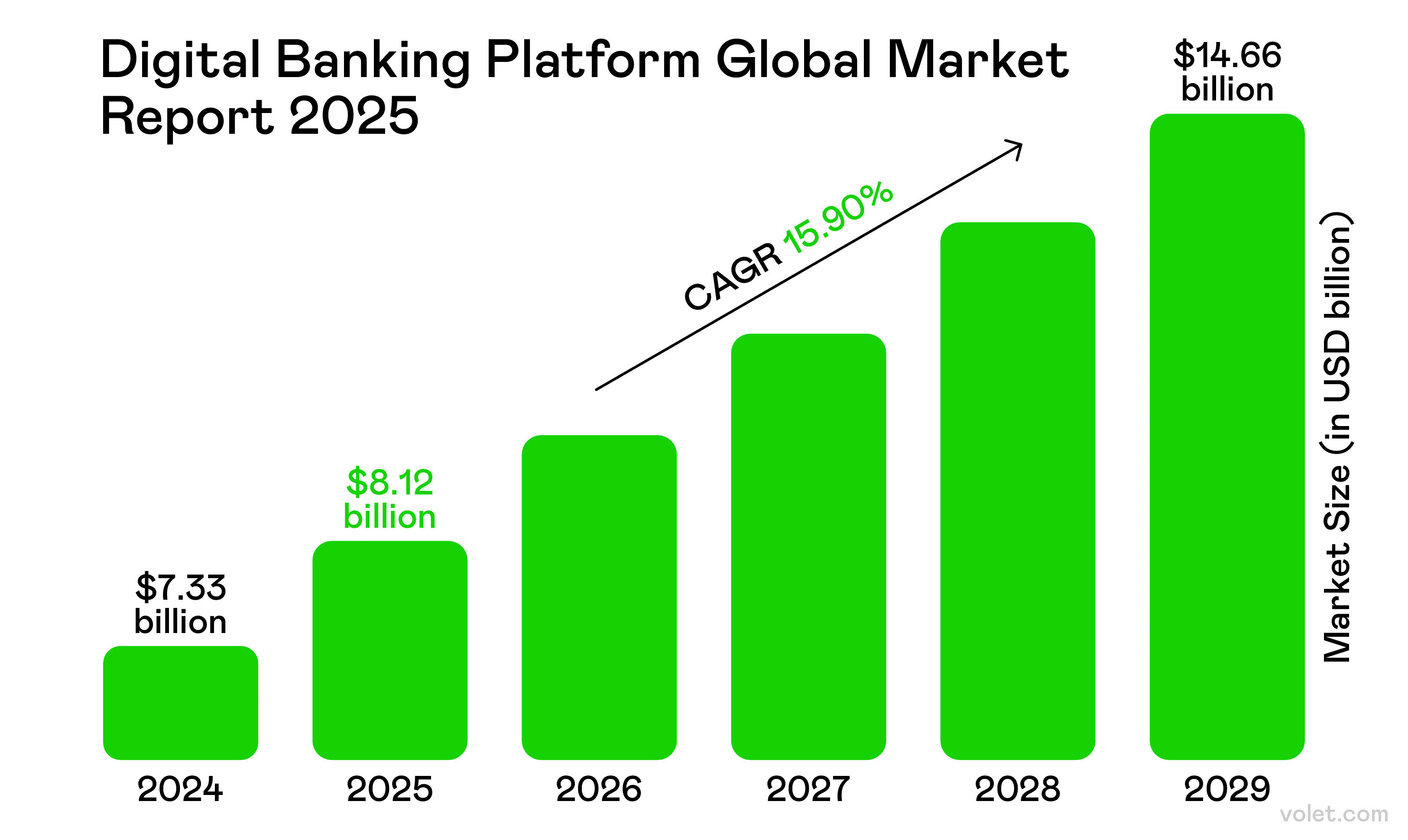

In today’s digital economy of 2025, understanding how to do an electronic bank transfer isn’t just convenient—it’s essential. 🛡️ As digital technologies continue reshaping global finance, the Indian banking industry offers a particularly instructive case study. In a widely cited review by Varda Sardana and Shubham Singhania, digital banking is described not simply as online access to funds, but as a full-scale shift in how financial services are structured, regulated, and delivered.

Their research emphasizes that true digital transformation isn’t about apps alone—it’s about building adaptable platforms, balancing innovation with trust, and ensuring financial access for all demographics.

I did end up getting that apartment (after a crash course in wire transfers from a very patient bank representative 🙏), but I promised myself I’d never be caught unprepared again. Now I’m sharing everything I learned with you—plus some hard-earned insights from global banking research.

So grab a cup of something strong ☕, and let’s talk about everything you need to know about sending money between accounts effectively and safely. Trust me—in today’s fast-paced world, this might be the most important financial skill you learn all year! 🔐

What is an Electronic Bank Transfer? (No, Really, What IS It?)

So what exactly are we talking about here? An electronic bank transfer is basically just moving money from one bank account to another without physical cash involved. Pretty simple, right?

But here's something I didn't realize at first: in 2025, these transfers happen through super advanced, secure electronic networks connecting financial institutions worldwide. The tech behind this stuff is WILD compared to just a few years ago!

I still remember my first time sending money internationally—I was sweating bullets wondering if my hard-earned cash would actually arrive. (Spoiler: it did, but not before I refreshed my banking app about 500 times! 🙈)

When you transfer funds electronically, your bank talks to the recipient's bank through these networks to make sure everything's legit. It's like your money has its own private security detail! And with cashless transactions becoming king in 2025, knowing how this all works is pretty much mandatory these days.

Types of Bank Transfers: Finding Your Money's Perfect Ride

There are TONS of ways to transfer money electronically, and honestly, I've tried most of them (some more successfully than others). Let me break them down for you:

ACH Transfer - Your Steady Eddie Option

ACH transfers process payments in batches through the Automated Clearing House network. They're like the reliable friend who's never in a hurry but always shows up eventually.

✅ Great for: Regular bills, moving money between your own accounts ✅ Cost: Usually free or super cheap ($0-$3) ✅ Speed: Takes about 1-3 business days ❌ Not ideal for: When you need money there YESTERDAY

Fun fact I learned the hard way: Bank debit transfers happen when you authorize someone else to pull funds from your bank account. I once set up recurring donations and completely forgot about them—surprise budget shortage! 😬

Wire Transfer - The Speed Demon

When you absolutely, positively need money there RIGHT NOW, wire transfers are your best friend. They move money directly from one bank to another.

✅ Speed: Domestic wire transfers usually complete within hours ✅ Security: Super secure and traceable ❌ Cost: Pricey ($26 on average for domestic transfers) ❌ Setup: Some banks still require you to visit in person (I found this out at 4:45 PM on a Friday... not my best moment)

Wire transfers take place on networks operated by the Federal Reserve and are settled in real time. For big-time transfers over $3 million, there's something called CHIPS in the US (Clearing House Interbank Payments System).

I once had to wire money for a business deal, and let me tell you—watching that money leave my account instantly was both terrifying and impressive!

Real-Time Payments (RTP) - The New Kid on the Block

This newer system allows for instant transfers between participating banks, 24/7/365. The funds arrive in the recipient's account within seconds.

✅ Speed: INSTANT (like, seriously instant) ✅ Timing: Works nights, weekends, holidays ❌ Limitation: Both banks need to participate

Zelle - The Friend-to-Friend Express

Remember when splitting dinner bills was awkward? Zelle changed all that! It's connected directly to your bank account for quick person-to-person transfers.

✅ Integration: Works with many major banks ✅ Speed: Typically processes payments within minutes ❌ Limitation: Everyone needs to be enrolled

I use this ALL the time with friends. Last week I forgot my wallet at a restaurant (classic me) and Zelle'd my friend before the waiter even brought the check. Crisis averted! 🎉

Digital Apps - The Cool, Casual Option

Apps like Venmo, PayPal, and Cash App make sending money feel like texting. They can transfer money within minutes for enrolled users.

✅ User-friendly: Super intuitive interfaces ✅ Social: Some have social feeds (turn this off unless you want everyone knowing you paid for "Secret Pizza Night Again 🍕") ❌ Extra step: You'll need to transfer to your bank eventually

International Transfer Options - Going Global

Sending money across borders? You've got options:

- SWIFT Transfers: The traditional network connecting 11,000+ banks globally

- SEPA: For easy transfers between banks in the EU

- CHAPS: Used in the UK for same-day payments

- Bank redirects: These are actually more popular internationally than in the US

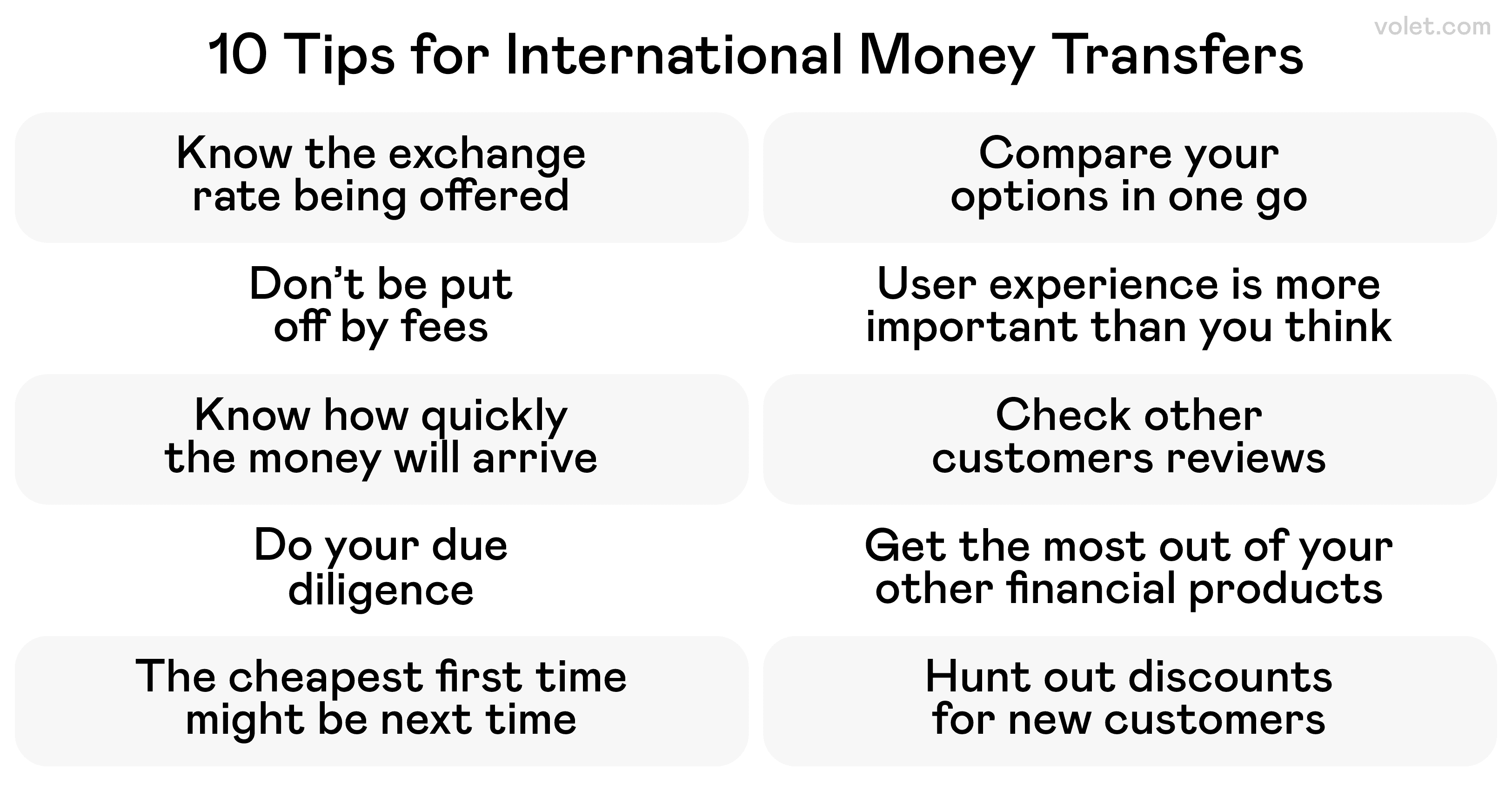

I've sent money to family overseas using several methods, and I've learned that exchange rates matter MORE than fees sometimes. One time I saved money by using a "slower" service that actually had better rates—saved nearly $50 on a $500 transfer!

Other Bank Transfer Types Worth Knowing

- Internal Transfers: Moving money within the same bank (usually instant and free)

- External Transfers: Bank to bank transfers between different banks (1-3 days)

- Bill Pay: Scheduling regular payments to service providers

- Fedwire: Popular in the US for real-time settlement between banks

How to Do an Electronic Bank Transfer: My Step-by-Step Guide

Alright, let's get down to business! Here's how to actually send money through online banking without losing your mind (or your funds):

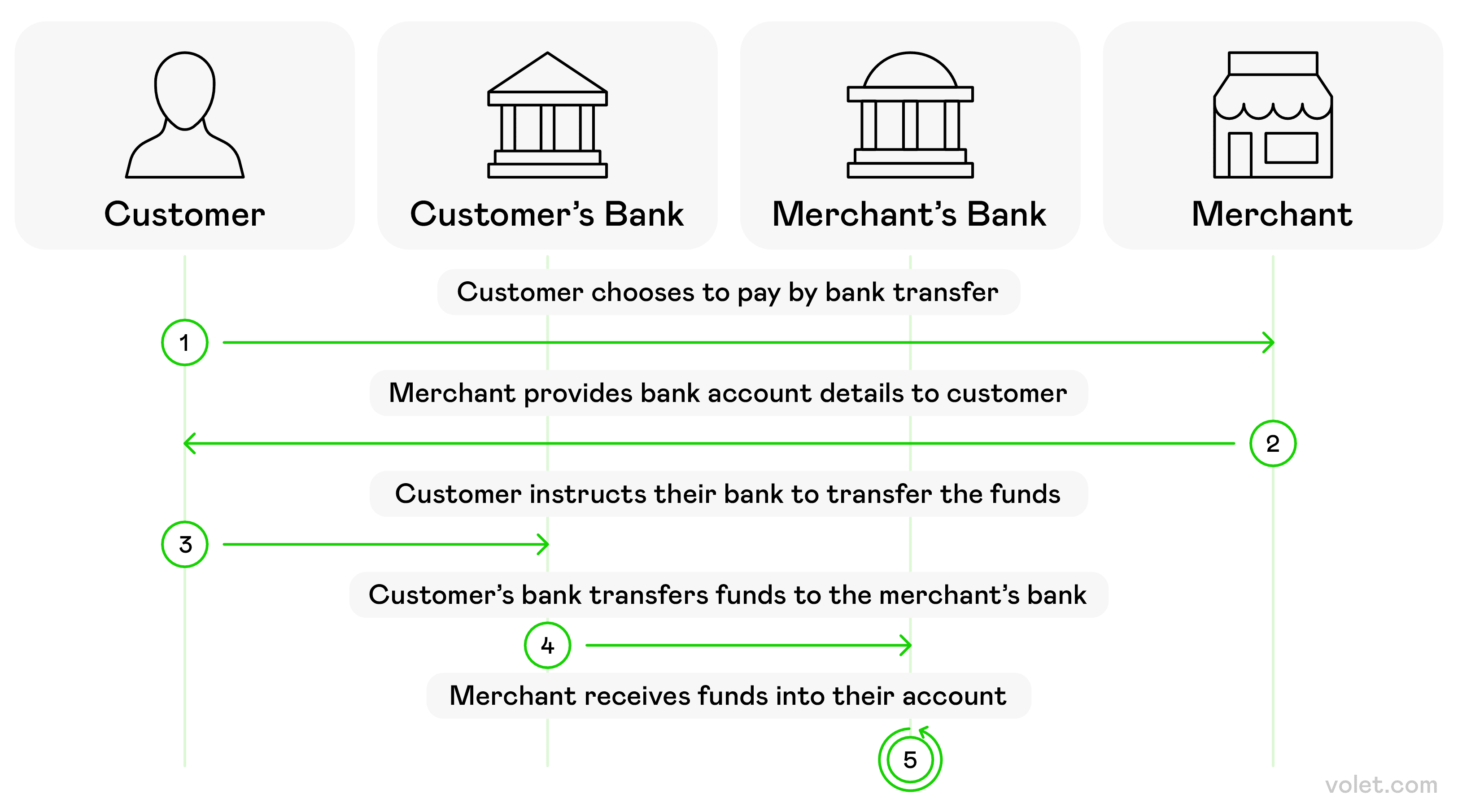

1. Log Into Your Online Banking Platform

First things first—log into your bank's website or mobile app.

🔐 Pro tip: I always make sure I'm on secure WiFi or using mobile data. That coffee shop free WiFi? Maybe not the best place to move your life savings! I learned this lesson after a minor heart attack when I got a security alert. Nothing bad happened, but still... 😅

2. Navigate to the Transfer Section

Look for options like "Transfer Money," "Send Money," or "Make a Payment" in your dashboard.

Real talk: Every bank's website is weirdly different! The first time I used my new bank's site, I spent 10 full minutes just trying to find the transfer button. (It was hiding under a dropdown menu called "Services" instead of "Transfers" — why?!)

3. Select the Transfer Type

Here's where you choose what kind of money move you're making:

- Between your own accounts (like checking to savings account)

- To someone else at your bank

- Bank to bank transfer (to someone at a different bank)

- International transfers

4. Enter Account Details

This part is SUPER important. For a bank to bank transfer, you'll need:

- The recipient's name (EXACTLY as it appears on their account)

- The recipient's account number

- The bank routing number (for domestic transfers)

- SWIFT/BIC code (for international wire transfers)

- The recipient's address (sometimes required)

✍️ Double-check EVERYTHING! I once typed one digit wrong in a routing number and my money went on a little vacation without me for 5 business days while the banks sorted it out.

5. Specify the Amount and Date

Enter how much you want to send. You can often schedule for future dates too!

⚠️ Important reminder: Make sure you have sufficient funds in your account before making a bank transfer to avoid overdraft fees. I've been hit with these before, and they are NOT fun. Paying $35 because you were $5 short feels like a special kind of financial insult.

6. Review and Confirm

Triple-check all details, especially any fees. Some transfers—especially wire transfers and international transfers—can have sneaky charges.

For domestic wire transfers, information is typically inputted into a bank transfer form. Some banks make this super easy, others make you feel like you're filing your taxes. The experience varies wildly!

7. Authorize the Transaction

Complete the process by authorizing the transfer. This might require:

- A verification code sent to your phone

- Your banking password

- Biometric verification

Same-day bank transfers typically have an extra charge associated with them. I usually decide if speed or saving money is more important for that particular transfer.

8. Save or Print Confirmation

ALWAYS save the confirmation number. Trust me on this one!

I once had a transfer that seemed to disappear into the digital void, and having that confirmation number was the only reason the bank could track it down quickly. Lesson learned!

Transfer Money Safely and Efficiently: Security Lessons I Learned the Hard Way

When you transfer funds electronically, security should be top priority. Here are some best practices (some of which I unfortunately learned through experience):

Security Best Practices

✅ Use secure networks when banking online

✅ Enable two-factor authentication (this has saved me MULTIPLE times)

✅ Monitor your account regularly (I check mine every morning while having coffee)

✅ Never share account information with others

✅ Be suspicious of any emails asking for bank details

Avoiding Common Pitfalls

❌ Assuming transfers are always instant (bank transfer networks sometimes have processing delays)

❌ Forgetting about daily transfer limits

❌ Ignoring exchange rates for international transfers

❌ Not keeping records of transactions

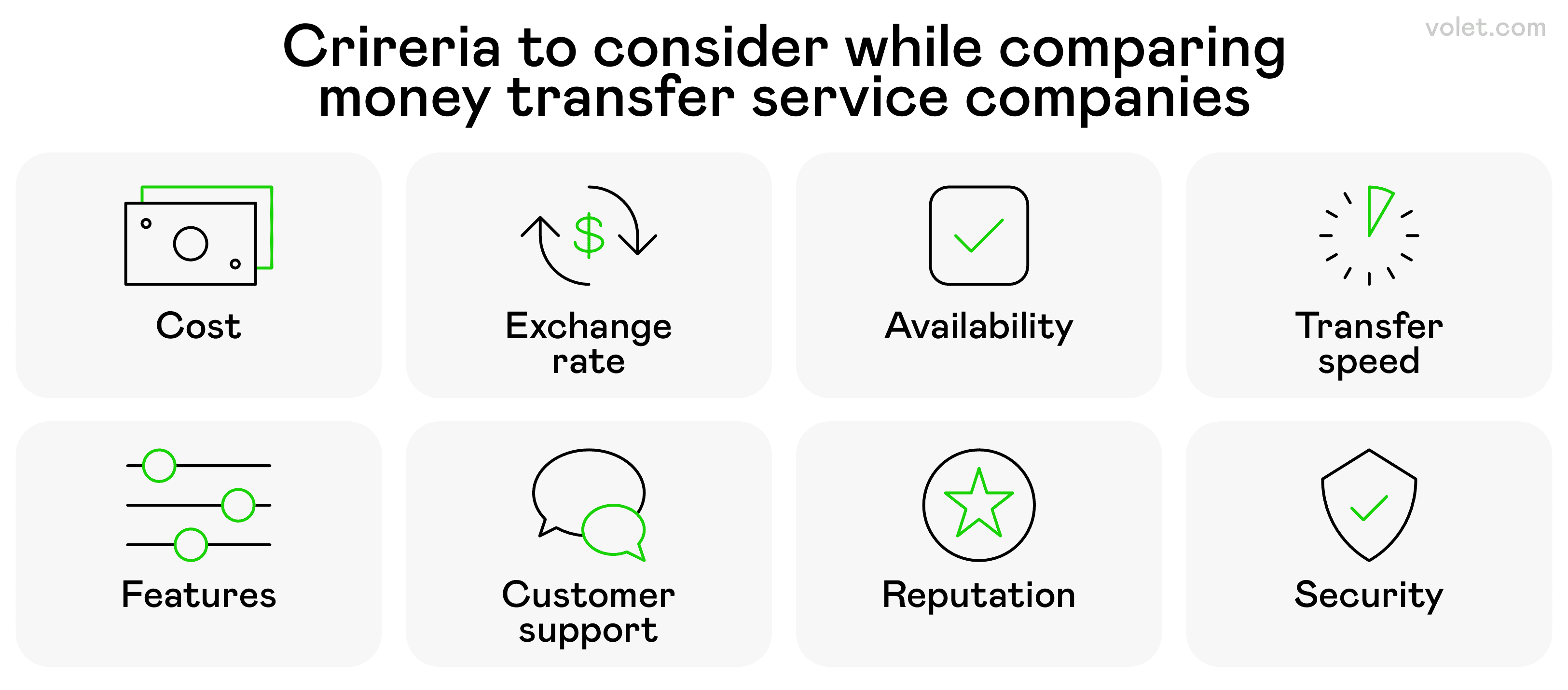

Bank Transfer Costs and Speed: What to Expect

Different methods come with different price tags and waiting times:

ACH Transfers

- 💰 Cost: Often free or cheap ($0-$3)

- ⏱️ Speed: 1-3 business days

- Best for: Regular transfers or recurring payments

Domestic Wire Transfers

- 💰 Cost: $15-$35 for sending, $0-$15 for receiving

- ⏱️ Speed: Same-day or next business day delivery

- Best for: Time-sensitive larger amounts

In my experience, domestic wire transfers are usually delivered within one business day. That said, if you initiate the transfer late in the day, it'll likely process the next business day.

International Wire Transfers

- 💰 Cost: $35-$50 plus possible intermediary bank fees

- ⏱️ Speed: 1-5 business days

- Best for: Sending money abroad securely

International bank transfers often utilize the SWIFT network, and I've noticed they're rarely as fast as promised. When I send money to my cousin in London, I always add a 1-2 day buffer to whatever timeline they give me.

P2P Services (Zelle, Venmo)

- 💰 Cost: Usually free for basic transfers

- ⏱️ Speed: Minutes to a few days

- Best for: Sending money to friends quickly

Did you know? Many customers prefer to use bank transfers instead of credit cards for payments these days. The trend has definitely shifted since the early 2020s!

Sending Money Online: Beyond Traditional Banking

While bank transfers remain popular, there are several alternatives I've tried:

- PayPal: Connect your bank account or debit card to send money using just an email address.

- Wise: My go-to for international transfers with competitive exchange rates.

- Western Union: Great when recipients need cash pickup options globally.

- Digital Wallets: Apple Pay, Google Pay, and Samsung Pay can transfer between users.

- Cryptocurrency Transfers: Bitcoin hit $108,000 in late 2024, and crypto transfers have become much more mainstream in 2025! I've used crypto for a few international transfers and was shocked at how much I saved on fees.

For most online services, you just need the recipient's email or mobile number to send money. So much easier than collecting all those bank details!

One really cool development in 2025 is how blockchain technology has made transfers faster. I've been experimenting with some of the newer blockchain-based transfer services, and they're impressive—especially for international transfers.

Closing Thoughts

Electronic bank transfers have completely transformed how we handle money in our increasingly digital world. As we navigate through 2025, everything keeps getting faster, more secure, and (thankfully) more user-friendly.

Looking back at my journey with digital banking, I've gone from being completely confused by routing numbers to confidently sending money across continents with just a few taps. It's been quite the evolution!

Whether you're paying bills, helping out family, or running a business, understanding your transfer options helps you choose the best method for your specific situation. Some days you need speed, other days saving on fees matters more.

The future of money movement is definitely digital, and I'm excited to see what comes next. Until then, I hope my experiences help make your transfer journeys a little smoother than mine were at the beginning!

Remember: different transfer methods serve different purposes. Choose what works for your specific situation, and don't be afraid to ask your bank questions. (They've heard worse from me, I promise!)

Disclaimer

This article is provided for informational purposes only and does not constitute legal, financial, or professional advice. All content is based on publicly available information and personal opinions. Readers should seek professional guidance before making decisions or acting based on the material presented. Data rates may apply when using mobile banking services.

Frequently Asked Questions

Most domestic transfers take 1-3 business days. Wire transfers are faster, often processing the same day. International transfers typically take 1-5 business days, depending on the destination country and banks involved.

You'll need the recipient's full name, account number, and their bank routing number. For international transfers, you'll also need the bank's SWIFT/BIC code and possibly the recipient's address.

Yes, most banks impose daily and monthly limits on transfer amounts. These limits vary by bank and account type. Check with your financial institution about your specific limits.

Most online banking platforms provide a transaction history where you can check the status of your transfers. For wire transfers, you can request a tracking number from your bank to monitor the progress.

First, verify that you entered the correct account details. Then contact your bank's customer service with your confirmation number and transaction details. They can trace the transfer and help resolve the issue.