22 min

22 min 1.6K

1.6KBest P2P Cryptocurrency Trading Platforms in 2025: Review & Recommendations

Discover the top P2P cryptocurrency trading platforms of 2025. Get honest reviews and tailored recommendations to make informed trading choices. Read now!

Let me tell you something that might surprise you: I used to be terrified of cryptocurrency. Yep, this guy who now writes about crypto for a living once thought Bitcoin was just some weird internet money scam. (Oh, how wrong I was! 🤦♂️)

My journey into the crypto world began a couple of years ago when my cousin showed me how he'd made enough from trading to put a down payment on his house (I have shared the story here before, this is just a recap). I was intrigued but completely overwhelmed by traditional crypto exchanges' technical jargon and complicated interfaces.

Then I discovered P2P trading platforms, and everything changed. Instead of navigating complex order books and candle charts, I could simply connect with another human being who wanted to buy or sell crypto. It felt like the neighborhood farmers market of cryptocurrency – personal, straightforward, and oddly comforting.

Today, I'm going to share what I've learned about the best P2P cryptocurrency trading platforms in 2025. Whether you're a complete beginner (like I was) or a seasoned trader looking for better options, I've got you covered with honest reviews and recommendations.

Explanation of the concept of peer-to-peer (P2P) services,

What Are P2P Cryptocurrency Trading Platforms?

Think of P2P (peer-to-peer) platforms as digital marketplaces where you can meet directly with other crypto enthusiasts to trade crypto. No middlemen, no corporate entities setting the prices – just people trading with people.

Here's the simple breakdown:

- You create an account on a P2P platform

- You browse listings from sellers (if you want to buy) or create your own listing (if you want to sell)

- Once you find a match, the platform holds the crypto in escrow while you complete the payment

- After payment confirmation, the crypto is released to the buyer

Why Choose P2P Over Traditional Crypto Exchange Options?

- Payment Flexibility: Use almost any payment method you can imagine

- Price Negotiation: Often find better rates than on centralized exchanges

- Global Access: Trade with users worldwide, bypassing local restrictions

- Human Connection: Build relationships with regular trading partners

- Greater Privacy: Some platforms require minimal identity verification

The beauty of P2P trading lies in this flexibility. Want to pay with PayPal? Bank transfers? Mobile money? Gift cards? There's probably someone willing to trade with you using your preferred payment method. This accessibility has driven explosive growth in P2P trading volumes, especially in emerging markets like Kenya and Nigeria, where fiat currency devaluation has pushed people toward cryptocurrency as a store of value.

Best P2P Cryptocurrency Trading Platforms in 2025: Detailed Reviews

After three years of trial and error (and yes, some embarrassing mistakes), I've narrowed down the best crypto exchanges based on security, user experience, fees, and available payment methods. Here's my honest take:

1. Binance P2P: The All-Rounder Champion for Crypto Trading

Binance P2P has consistently remained my go-to platform for most trades. Why? It combines the security of the world's largest crypto exchange with the flexibility of P2P trading.

Key Features:

- ✅ Supports over 800 payment methods (seriously, EIGHT HUNDRED!)

- ✅ Zero trading fees (this saved me about $430 last year alone)

- ✅ Integrated with Binance's extensive ecosystem

- ✅ Robust escrow services to protect both buyers and sellers

- ✅ Supports 350+ crypto assets for trading

My Experience: Last summer, I needed to convert some savings to Bitcoin quickly while traveling in Southeast Asia. Through Binance P2P, I found a seller who accepted my home country's bank transfers, and the entire process took less than 30 minutes. The reputation system helped me choose a trusted seller, and the escrow service ensured my funds were protected throughout the transaction.

Perfect For: Both beginners and experienced traders who value security and payment flexibility.

Drawbacks: The verification process can be lengthy for new users (took me about 2 days), and the platform can be overwhelming at first glance.

2. KuCoin P2P: The User-Friendly Option

If Binance feels too complex, KuCoin P2P might be right up your alley. Their user-friendly interface is clean, intuitive, and designed with simplicity in mind.

Key Features:

- ✅ Exceptionally intuitive interface

- ✅ Strong security measures including escrow protection

- ✅ Detailed reputation system to identify trustworthy traders

- ✅ Competitive trading fees compared to other platforms

- ✅ Low trading fees structure that won't eat into your profits

My Experience: When my mom wanted to try buying crypto (yes, my 60-year-old mother!), KuCoin P2P was the platform I recommended. The clean design and straightforward process meant she could navigate it without constant help from me. The platform's priority on user reputation systems also gave her peace of mind when selecting trading partners.

Perfect For: Crypto newcomers and those who value simplicity.

Drawbacks: Fewer payment options than Binance, and sometimes liquidity can be limited for less popular crypto assets.

3. Paxful: The Payment Method King

If you've got unusual payment methods, Paxful is your best friend. Gift cards, online wallets, digital goods – you name it, someone on Paxful probably accepts it.

Key Features:

- ✅ Over 350 payment options (including some really obscure ones!)

- ✅ Strong presence in emerging markets

- ✅ Built-in wallet for convenient storage

- ✅ Escrow protection for secure transactions

- ✅ Educational resources for crypto beginners

My Experience: I once had a bunch of Amazon gift cards I didn't need, and through Paxful, I converted them to Bitcoin at about 80% of their value. Not the greatest rate, but try doing that anywhere else! The platform's wide reach across different regions has made it particularly valuable when I'm traveling in countries with limited banking access.

Perfect For: Users with alternative payment options and those in regions with limited banking options.

Drawbacks: Higher transaction fees than some competitors, and rates can vary widely between traders.

4. LocalBitcoins: The Veteran Platform

Think of LocalBitcoins as the wise old grandparent of P2P trading. It's been around since 2012 (practically ancient in crypto years!), and while it might not have all the fancy features of newer platforms, it's built a reputation for reliability.

Key Features:

- ✅ Established reputation and long track record

- ✅ Simple, no-frills interface

- ✅ Strong escrow services for transaction security

- ✅ Global reach with users worldwide

- ✅ Supports in-person cash payments in some locations

My Experience: LocalBitcoins was actually where I made my very first P2P crypto trade! I met someone at a local coffee shop (bringing along my tech-savvy friend for security), and exchanged cash for Bitcoin. It was exhilarating and made the concept of cryptocurrency suddenly feel real in a way that online trading never did.

Perfect For: Bitcoin-focused traders who value simplicity and reputation.

Drawbacks: Only supports Bitcoin, higher fees than newer platforms, and fewer payment methods than competitors like Binance or Paxful.

5. Hodl Hodl: The Privacy Champion

For privacy-conscious traders, Hodl Hodl offers P2P trading without KYC requirements (in most cases). This is a big deal for those who value financial privacy.

Key Features:

- ✅ Non-custodial trading (the platform never holds your coins)

- ✅ Minimal KYC requirements

- ✅ Multisig escrow for enhanced security

- ✅ Global platform with no geographical restrictions

- ✅ Lending services in addition to trading

My Experience: I value my privacy, so I've used Hodl Hodl for several trades. The multi-sig escrow system took me a bit to understand, but once I got it, I appreciated the extra security it provided. The non-custodial nature means you're always in control of your keys – something I've come to value more after witnessing several centralized exchange collapses.

Perfect For: Privacy-focused users and those comfortable with self-custody.

Drawbacks: Lower liquidity than larger platforms, steeper learning curve for beginners.

6. BTCC: Trading Tools for Advanced Traders

If you're moving beyond basic buying and selling into more advanced trading strategies, BTCC might be worth exploring.

Key Features:

- ✅ Supports multiple order types (market, limit, OCO, stop orders)

- ✅ P2P platform integrated with traditional exchange features

- ✅ Advanced trading tools for experienced traders

- ✅ Spot and futures trading available

- ✅ Strong security measures to protect user funds

My Experience: When I started getting more serious about trading strategies, BTCC's diverse order types helped me execute more complex trades. Their support for both spot trading and futures trading allowed me to experiment with different approaches without switching platforms.

Perfect For: Intermediate to advanced traders looking for more sophisticated tools.

Drawbacks: Can be overwhelming for beginners, higher fees for certain services.

7. Coinflare: For Diverse Crypto Assets

If you're looking to trade cryptocurrencies beyond the big-name coins, Coinflare offers an impressive range of digital assets.

Key Features:

- ✅ Supports 60+ cryptocurrencies

- ✅ User-friendly interface with advanced options

- ✅ Multiple payment methods supported

- ✅ Strong security features including cold storage

- ✅ Active community for trading advice

My Experience: When I wanted to diversify my portfolio beyond Bitcoin and Ethereum, Coinflare's wide selection of altcoins was exactly what I needed. The platform strikes a good balance between accessibility for newcomers and features for experienced traders.

Perfect For: Traders interested in a wide variety of crypto assets.

Drawbacks: Less name recognition than larger platforms, which can mean fewer active traders.

8. Bitget: The Diversification Expert with Copy Trading

Bitget has earned a reputation for supporting an extensive range of cryptocurrencies, making it perfect for building a diverse portfolio.

Key Features:

- ✅ Impressive selection of cryptocurrencies

- ✅ User-friendly interface for quick trading

- ✅ Copy trading features for newcomers

- ✅ Low trading fees compared to competitors

- ✅ Strong security measures for user protection

My Experience: The copy trading feature on Bitget was a game-changer when I was still learning. Being able to automatically mirror the trades of successful investors helped me learn patterns and strategies while actually growing my portfolio. The platform's user-friendly interface also makes it easy to react quickly to market movements.

Perfect For: Portfolio diversifiers and those interested in copy trading.

Drawbacks: The P2P section is less developed than some dedicated P2P platforms.

9. Kraken: The Security Fortress

If security is your top priority (and honestly, it should be high on everyone's list), Kraken's P2P options deserve consideration.

Key Features:

- ✅ Industry-leading security features

- ✅ Support for 200+ cryptocurrencies

- ✅ Regulated in multiple jurisdictions

- ✅ Strong reputation in the crypto market

- ✅ Excellent customer support for resolving issues

My Experience: After losing a small amount of crypto in an exchange hack years ago (a painful lesson!), security became my top priority. Kraken's perfect security track record and robust security measures have made it my go-to platform for larger transactions. Their customer support actually helped me recover funds from a transaction that went wrong – something rare in the crypto world.

Perfect For: Security-conscious traders and those handling larger amounts.

Drawbacks: P2P features are more limited than dedicated P2P platforms, and verification can be lengthy.

10. VOOX: The AI-Powered Newcomer for Advanced Traders

For tech enthusiasts who want cutting-edge features, VOOX offers an AI-driven trading experience that adapts to market conditions.

Key Features:

- ✅ AI-powered trading platform

- ✅ Supports spot trading, margin trading, futures trading, and copy trading

- ✅ Dynamic adaptation to market conditions

- ✅ User-friendly interface despite advanced features

- ✅ Automated trading strategies for a smooth trading experience

My Experience: I'm still exploring VOOX, but the AI recommendations have already helped me identify a few trading opportunities I might have missed. The platform feels like it's from the future – analyzing patterns and suggesting optimizations for my trading strategy. It's been particularly useful for spot trading when markets are volatile.

Perfect For: Tech-savvy traders interested in AI assistance.

Drawbacks: Newer platform with a less established track record, steeper learning curve for those unfamiliar with AI concepts.

11. Coinbase: The Beginner's Friend

While not primarily a P2P platform, Coinbase has introduced P2P elements that make it worth mentioning, especially for newcomers.

Key Features:

- ✅ Extremely user-friendly interface

- ✅ Strong reputation and regulatory compliance

- ✅ Supports 240+ cryptocurrencies

- ✅ Educational resources for beginners

- ✅ Solid security features and insurance protection

My Experience: Coinbase was my first entry point into crypto before I discovered P2P trading. Their intuitive interface makes it incredibly easy for beginners to buy their first crypto, and their educational content (which actually pays you in crypto for learning!) is unmatched. While their P2P features are still developing, they're a great starting point for those new to cryptocurrency.

Perfect For: Complete beginners looking for a safe entry point.

Drawbacks: Higher fees than dedicated P2P platforms, limited P2P features compared to specialists.

12. Volet.com: The International Payment Specialist

If your P2P trading is focused on international transfers and merchant services, Volet.com offers an interesting blockchain-based alternative.

Key Features:

- ✅ Blockchain technology for fast, low-cost international transactions

- ✅ Supports over 150 countries and 110+ fiat currency options

- ✅ Instant P2P transfers without requiring crypto expertise

- ✅ Focus on merchant services and business applications

- ✅ Operating since 2014 with an established track record

My Experience: When my small business started accepting international clients, Volet.com's blockchain-based payment processing saved me from excessive bank fees and long waiting times. The platform doesn't require deep crypto knowledge to use, which made it accessible for both me and my clients who weren't crypto-savvy.

Perfect For: Small businesses engaging in international commerce and individuals who frequently send money across borders.

Drawbacks: More focused on international transfers than comprehensive trading features, relatively newer to the merchant services space compared to traditional payment processors.

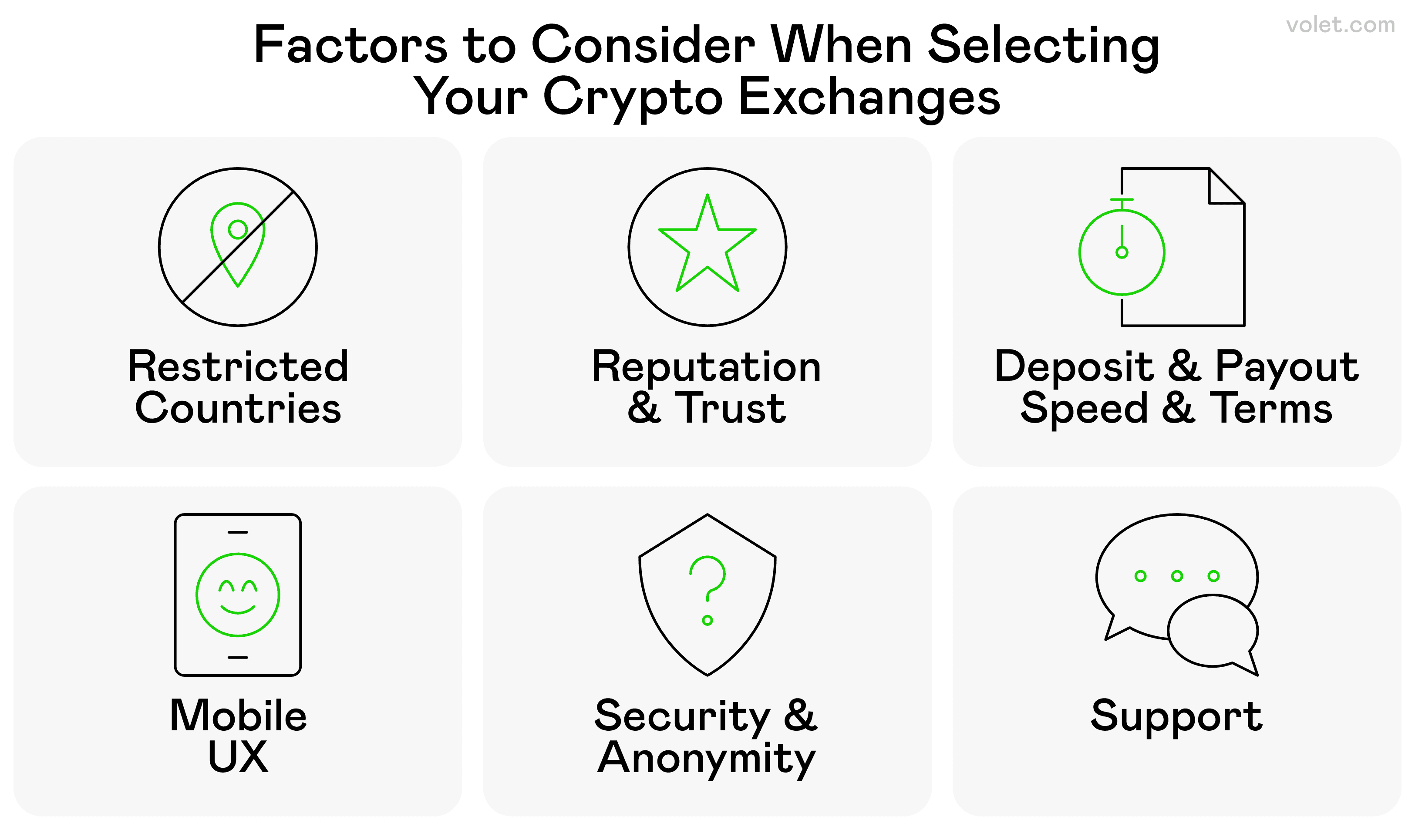

Outlines of the key factors to evaluate when choosing a cryptocurrency exchange.

Choosing a Crypto Exchange: What Really Matters

After three years of trial, error, and yes – some painful losses – I've learned that choosing the right platform comes down to a few key factors:

Security: Your Protection Checklist

Let's be real: security isn't just a feature, it's THE feature. I learned this the hard way when I first started trading on a sketchy platform that disappeared overnight. (Thankfully I only lost about $50, but the lesson was priceless.)

What to look for:

- ✅ Escrow services: The platform holds crypto until payment is confirmed

- ✅ Reputation Systems: Can you see other users' ratings and history?

- ✅ Two-Factor Authentication: Mandatory for account security

- ✅ Cold Storage: Majority of funds stored offline

- ✅ Insurance Protection: Some platforms offer coverage for losses

- ✅ Regulatory Compliance: Follows local laws and regulations

- ✅ Transparent Company History: Research the team and track record

Red Flags to Watch For:

- ❌ No escrow service

- ❌ Missing or limited customer support

- ❌ Poor user reviews about security

- ❌ History of hacks or breaches

- ❌ Unclear company ownership

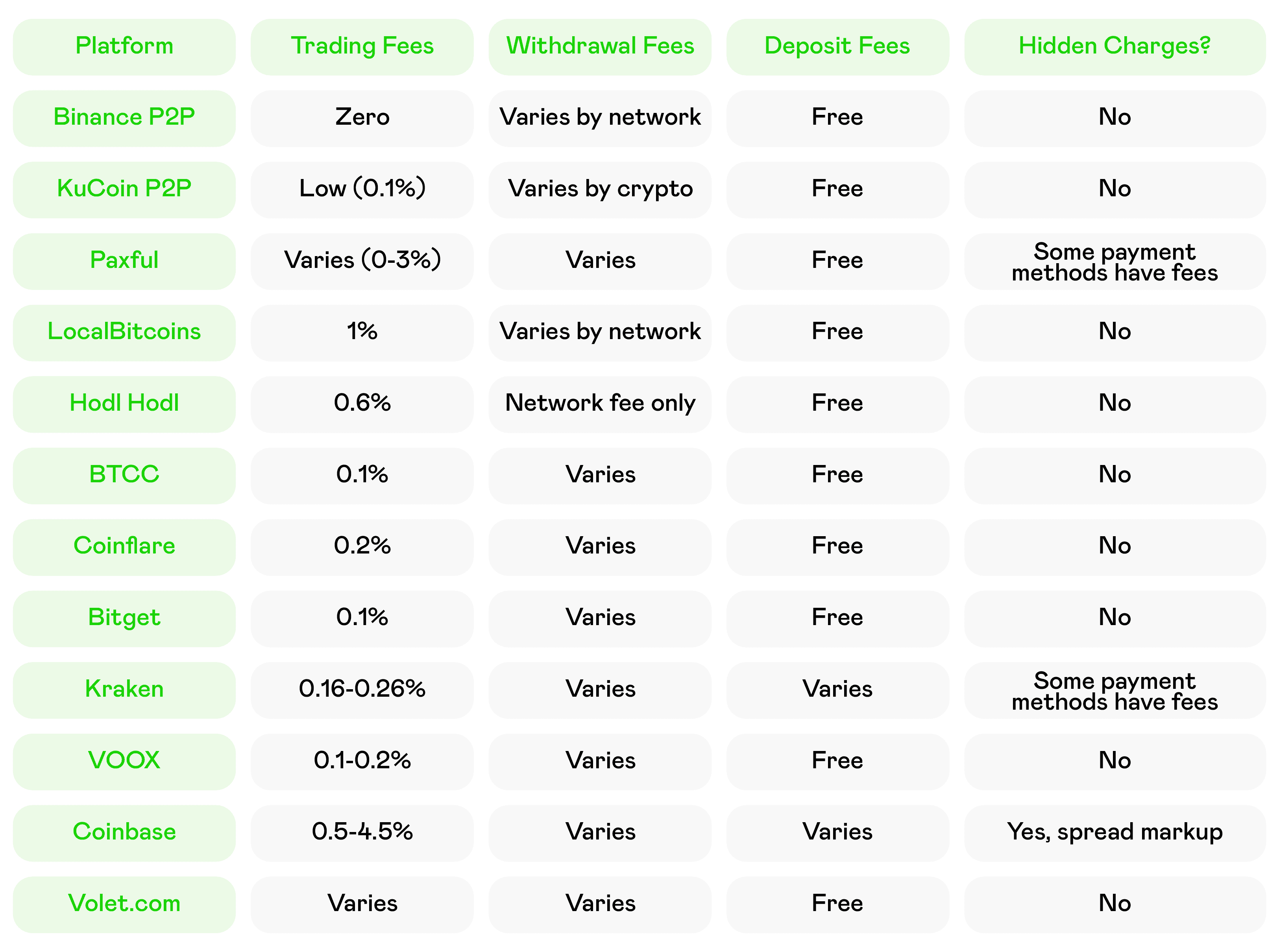

The Silent Profit-Killer: Trading Fees Comparison

When I first started trading crypto, I barely paid attention to fees. Big mistake! Over time, even small fees add up to significant amounts.

Payment Methods: Finding Your Perfect Match with Local Payment Methods

The best P2P platform is the one that accepts your preferred payment method. Period.

What to look for:

- Local payment methods: Does the platform support payment methods popular in your country?

- Bank Transfer Support: Most platforms support bank transfers, but the process and speed can vary.

- Alternative Payment Methods: If you need to use gift cards, mobile money, or other alternative methods, check if the platform supports these.

My Quick Payment Method Guide:

- Looking for the most payment options? → Binance P2P (800+ methods)

- Need gift card trades? → Paxful (specializes in this)

- Want fast bank transfers? → KuCoin or Binance

- Prefer cash payments? → LocalBitcoins (in some regions)

- Need international payment processing? →Volet.com

Need Help When Things Go Wrong? Customer Support Matters

I can't stress this enough – responsive customer support is INVALUABLE when you're dealing with financial transactions.

Top Platforms for Customer Support:

- Coinbase: 24/7 support, multiple channels

- Binance: Large support team, but can be slow during high volume

- Kraken: Known for quality human support

- KuCoin: Responsive live chat

Support Elements to Check:

- Response time guarantees

- Available support channels (chat, email, phone)

- Support hours (24/7 is ideal)

- Language support for your native language

- Dispute resolution process and timeframes

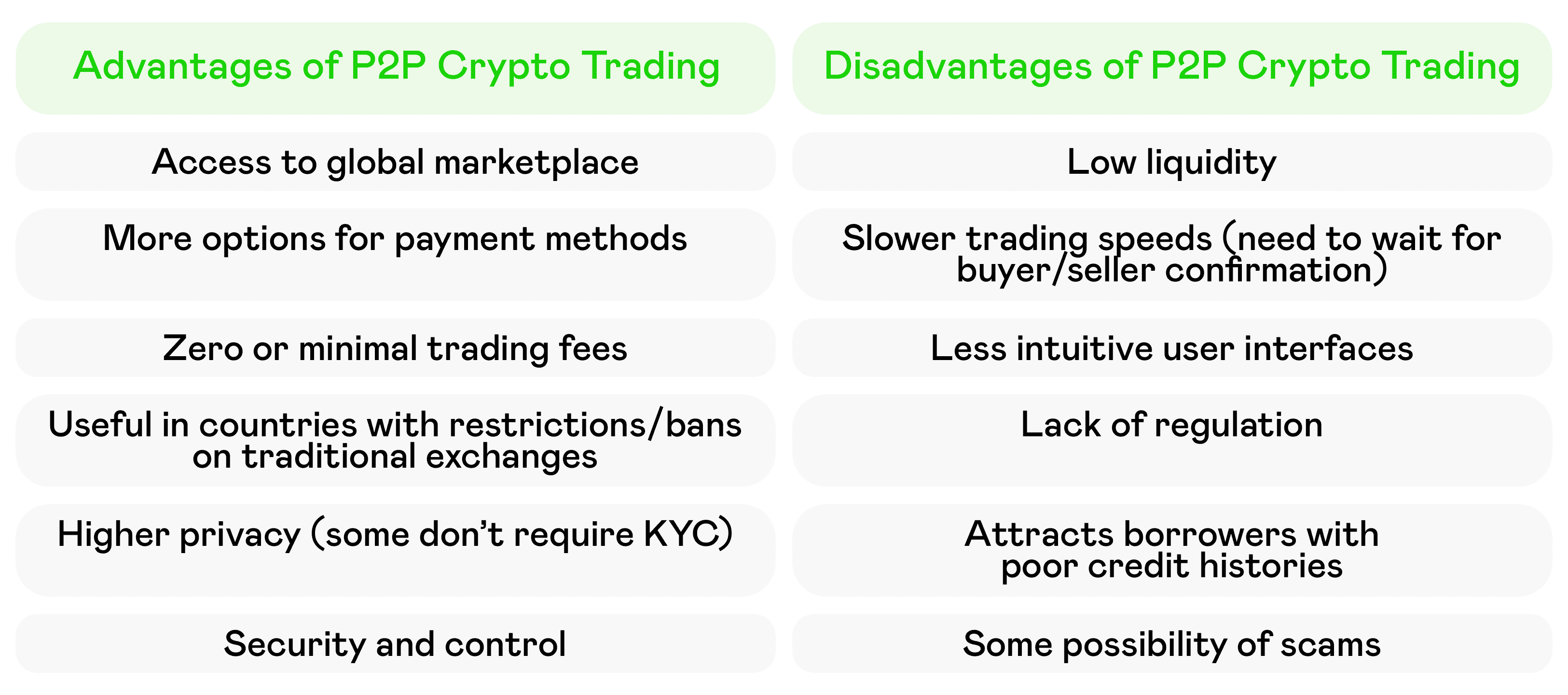

A side-by-side comparison of the key advantages and disadvantages of peer-to-peer (P2P) crypto trading.

Benefits and Risks of P2P Trading

P2P crypto trading has transformed my crypto experience, but like anything in life, it comes with both advantages and potential downsides.

The Good Stuff (Why I Love P2P Trading)

Freedom to Choose Your Terms: Unlike traditional exchanges where you take whatever price the market offers, P2P trading lets you set your own terms. Want to sell at 2% above market price? Go for it! Prefer to buy only from verified sellers? You can filter for that too.

Payment Method Flexibility: This is huge, especially if you're in a country with limited banking options. I've seen successful P2P trades using everything from bank transfers to gift cards to mobile money services.

Global Access: P2P platforms connect you with traders worldwide. This global market has been particularly valuable in emerging economies like Kenya and Nigeria, where fiat currency devaluation has driven people toward crypto as a more stable store of value.

Privacy Options: Some P2P platforms offer more privacy than traditional exchanges, with limited or no KYC requirements (though this is becoming less common due to regulatory pressure).

Human Connection: There's something refreshingly personal about P2P trading. I've made genuine connections with regular trading partners, and that trust adds another layer of security to transactions.

The Risks (Yes, I've Experienced Some of These)

Scam Potential: Let's be honest – where there's money, there are scammers. I've encountered people who tried to claim they'd sent payment when they hadn't, or who attempted to use stolen payment information. The escrow services offered by reputable platforms are absolutely essential in mitigating this risk.

Liquidity Limitations: P2P platforms generally have lower liquidity than centralized exchanges, which can make it harder to execute large trades quickly or at optimal prices. I've sometimes had to break large trades into smaller ones or wait longer to find the right trading partner.

Price Volatility During Transactions: Crypto prices can fluctuate dramatically in short periods. On P2P platforms, transactions might take longer to complete than on centralized exchanges, exposing you to price changes during the process.

KYC Requirements: While some users seek P2P platforms for privacy, most reputable platforms now require some form of identity verification to combat fraud and comply with regulations. The verification process can sometimes be lengthy and intrusive.

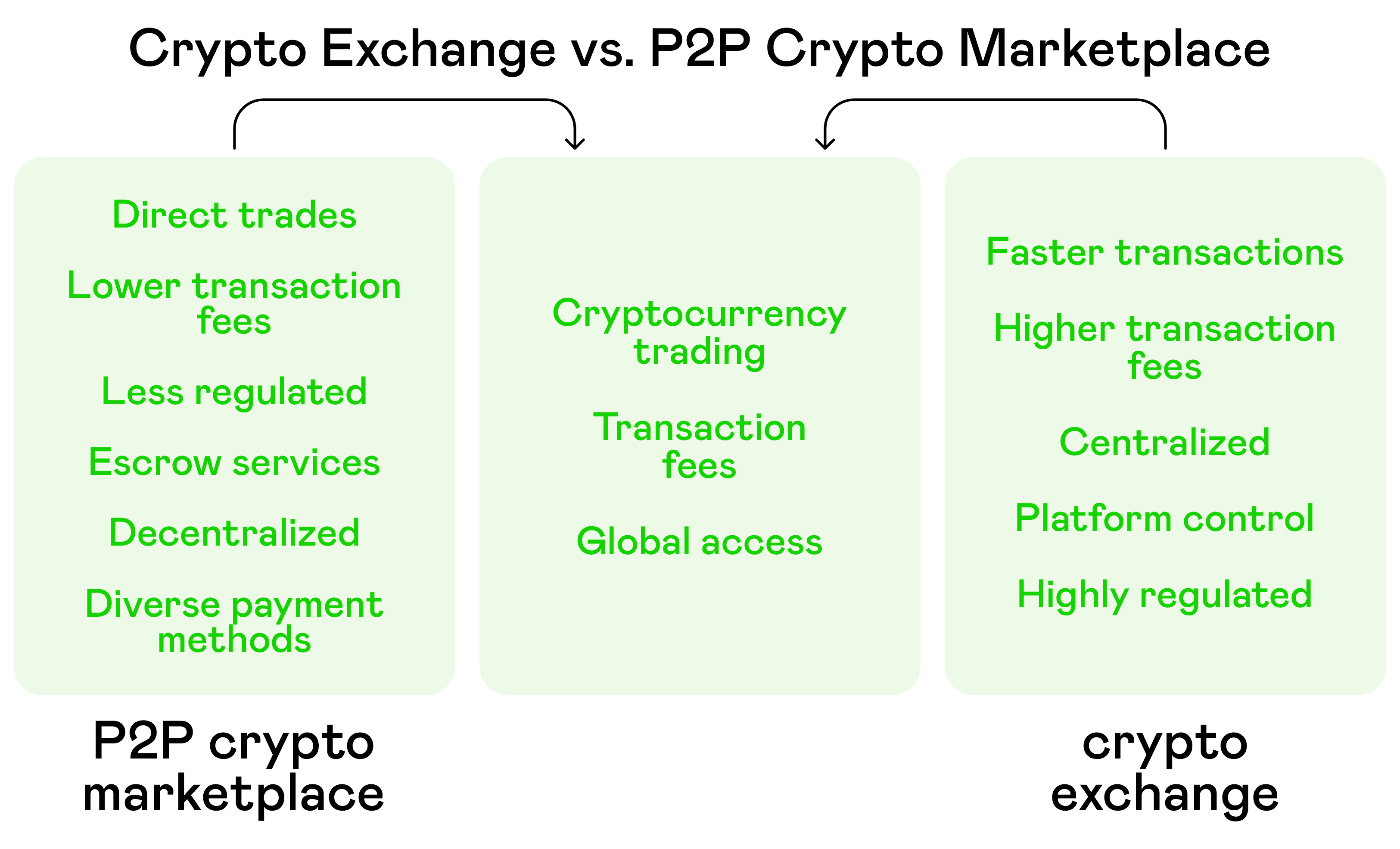

Comparison of P2P crypto marketplaces and crypto exchanges, highlighting their differences and shared features.

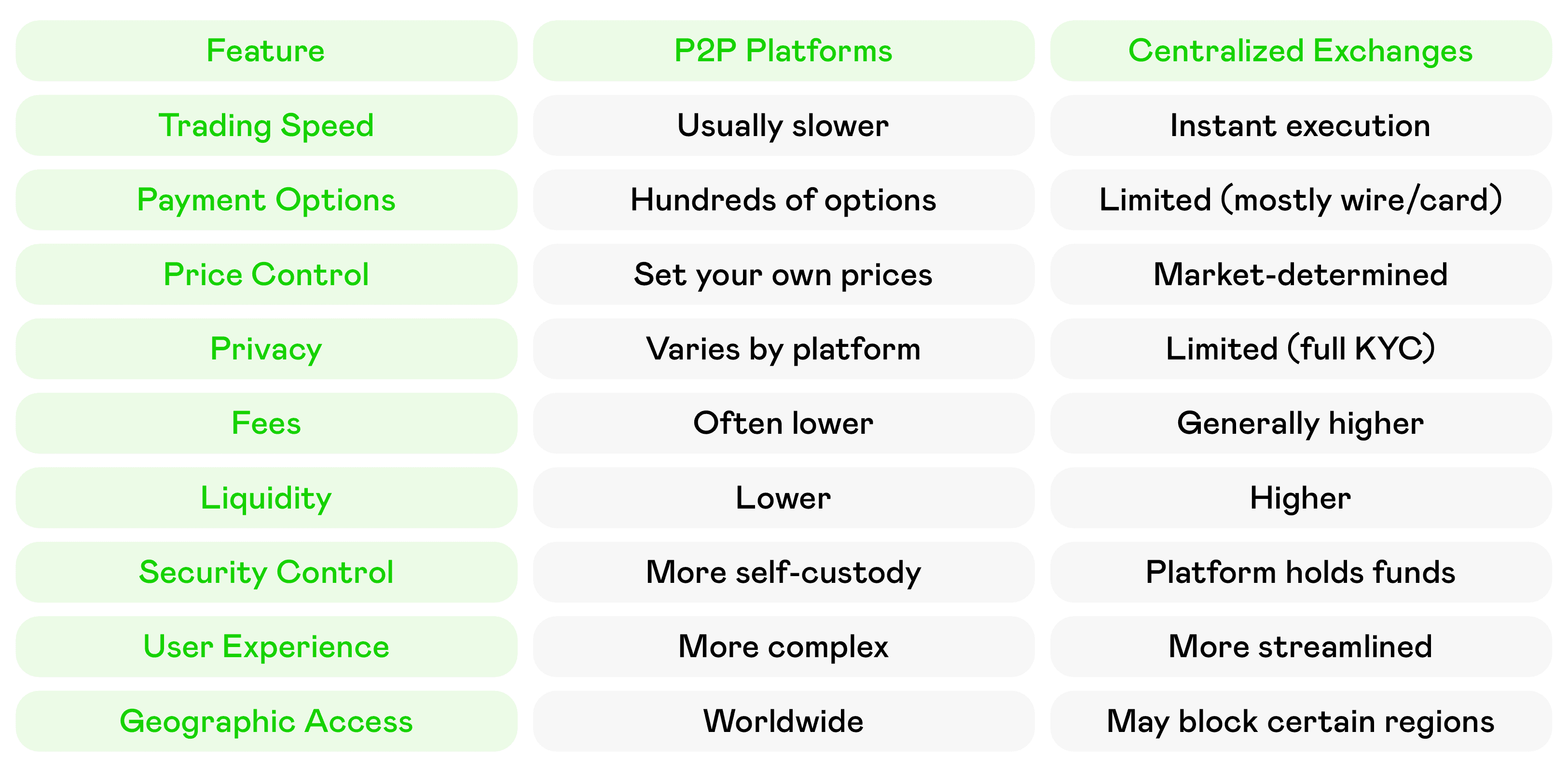

P2P vs. Centralized Exchanges: Quick Comparison

Comparative Analysis of Best Crypto Exchanges

Let's break down how these platforms compare across key metrics:

User Experience Comparison

Beginner-Friendly Champions:

- Coinbase (exceptionally intuitive)

- KuCoin P2P (clean and straightforward)

- Bitget (user-friendly despite advanced features)

Technical But Powerful:

- Binance P2P (feature-rich but can be overwhelming)

- BTCC (designed for more experienced traders)

- Kraken (prioritizes functionality over simplicity)

I remember spending hours just trying to figure out how to make my first trade on a complex platform. Now I appreciate interfaces that are intuitive from the start. For beginners, I strongly recommend starting with a user-friendly interface before moving to more complex platforms.

Want to Save on Every Trade? Fee Comparison

Low-Fee Leaders:

- Binance P2P (zero fees for trading)

- Hodl Hodl (competitive fees)

- Bitget (low fee structure)

Higher Fee Platforms:

- Coinbase (convenience comes at a price)

- Paxful (fees vary but can be high)

- LocalBitcoins (higher than newer platforms)

A quick tip from my experience: always calculate what the fees mean in real terms. A 1% fee on a $10,000 transaction is $100 – significant money that could be saved by choosing a lower-fee platform.

Need More Than Just Bitcoin? Cryptocurrency Support Breakdown

Top Platforms by Number of Supported Cryptocurrencies:

- Binance: 350+ cryptocurrencies

- Coinbase: 240+ cryptocurrencies

- Kraken: 200+ cryptocurrencies

- Bitget: 180+ cryptocurrencies

- BTCC: 150+ cryptocurrencies

- Coinflare: 60+ cryptocurrencies

- VOOX: 50+ cryptocurrencies

- KuCoin P2P: 40+ cryptocurrencies

- Paxful: 5+ cryptocurrencies

- LocalBitcoins: Bitcoin only

- Hodl Hodl: Limited selection

- Volet.com: Focus on payment processing

While Bitcoin remains the dominant cryptocurrency, the ability to trade cryptocurrencies beyond the main coins has become increasingly important. Platforms like Binance and Coinflare offer opportunities for portfolio diversification that simply wasn't possible a few years ago.

Feature Comparison for Serious and Advanced Traders

Must-Have Tools for Advanced Traders:

- ✅ Multiple order types (limit, market, stop-loss)

- ✅ Advanced charting capabilities

- ✅ API access for trading bots

- ✅ Copy trading functionality

- ✅ Futures trading and margin trading options

- ✅ Portfolio analytics

Feature-Rich Platforms:

- BTCC (various order types for advanced strategies)

- VOOX (AI-driven trading assistance)

- Binance P2P (integrated with extensive trading ecosystem)

Trading Tools:

- Bitget (copy trading for learning from professional traders)

- Kraken (advanced charting and analysis)

- VOOX (automated trading strategies)

As my trading has evolved, so has my appreciation for advanced features. Copy trading in particular has been a valuable learning tool – watching how successful traders respond to market conditions taught me strategies I wouldn't have discovered on my own.

Security in P2P Trading: Lessons from the Trenches

After nearly losing crypto to scammers twice in my early days, security has become my obsession. Here's what I've learned:

KYC Verification Explained

Know Your Customer (KYC) requirements – the process of verifying your identity – have become standard on reputable P2P platforms. While this reduces privacy, it significantly enhances security by deterring fraud.

My Experience: I used to resist KYC verification, but after witnessing how it has reduced scams on platforms like Binance P2P and KuCoin, I've come to accept it as a necessary trade-off. The platforms with the strongest KYC processes tend to have the lowest rates of fraud.

Common KYC Requirements by Level:

- Basic: Email verification, phone number

- Intermediate: Government ID, proof of address

- Advanced: Video verification, additional documentation

The Ultimate Safety Net: Understanding Escrow Protection

Escrow services are the backbone of secure P2P trading. The platform holds the seller's cryptocurrency until the buyer confirms payment, protecting both parties and enabling users to trade with confidence.

How Escrow Works in 5 Steps:

- Seller places crypto in platform-controlled escrow

- Buyer sends payment directly to seller

- Seller confirms receipt of payment

- Platform releases crypto to buyer

- Both parties can rate each other

My Experience: I once had a buyer claim they'd sent payment when they hadn't. Because we were using Binance P2P's escrow service, my crypto remained safe while the dispute was resolved. Without escrow protection, I would have lost everything.

Need to Find Trustworthy Traders? Reputation Systems Guide

Many P2P platforms enable users to rate each other after transactions, building a reputation system that helps identify trustworthy traders.

What to Look For:

- Completion Rate: 98%+ is ideal

- Number of Trades: Higher is better (100+ is excellent)

- Average Response Time: Faster responses often indicate professionalism

- Account Age: Older accounts are generally more reliable

- Verification Level: Fully verified users present less risk

My Experience: On platforms like KuCoin and Binance, I always check a trader's completion rate and user reviews before engaging. This simple step has helped me avoid several potentially problematic trades. I also work hard to maintain my own perfect rating – your reputation is valuable currency in P2P trading!

The Future of P2P Crypto Trading and Decentralized Exchanges

P2P trading has evolved dramatically since I started, and the trend suggests even more exciting developments ahead:

What's Next for P2P Crypto Trading in 2025 and Beyond?

- Integration with DeFi: We're seeing early steps toward integrating P2P trading with decentralized exchanges, potentially offering new ways to earn yield while waiting for trades.

- Enhanced Automation: AI tools like those used by VOOX are just the beginning. Expect smarter matching algorithms and risk assessment tools that make trading safer and more efficient.

- Regulatory Clarity: While increased regulation might seem contrary to crypto's ethos, clearer rules will likely increase mainstream adoption of P2P trading.

- Expanded Payment Options: As digital payment methods proliferate globally, P2P platforms will continue adding support for local payment methods.

- Cross-Chain Trading: The ability to trade directly between different blockchains without centralized intermediaries is improving, which could revolutionize P2P trading.

Want to Trade On the Go? Mobile P2P Trading in 2025

The mobile experience for P2P trading has come a long way. Here's what to look for in a great mobile P2P platform:

- Real-time notifications for trade updates

- Biometric security for faster, safer logins

- QR code functionality for in-person trades

- Offline mode capabilities for viewing trade details without internet

- Chat integration for communicating with trading partners

Top Mobile Experiences:

- Binance P2P (most comprehensive)

- KuCoin P2P (clean interface)

- Paxful (excellent for mobile payments)

Final Thoughts

When I look back at my journey from crypto-skeptic to daily trader, P2P platforms were the bridge that made cryptocurrency accessible and real for me. They transformed abstract digital assets into practical tools for saving, investing, and transferring value.

If you're just starting, remember that everyone begins somewhere. Choose a platform with robust security measures, a user-friendly interface, and good customer support. Start with small trades until you build confidence, and always use the platform's security features to complete trades efficiently.

For experienced traders looking to optimize, consider diversifying across multiple P2P platforms to take advantage of different payment methods, fee structures, and liquidity pools. The perfect platform doesn't exist – but the perfect combination of platforms for your specific needs might.

Whatever your level of experience, approach P2P trading with a healthy mix of enthusiasm and caution. The opportunity is real (I'm living proof of that!), but so are the risks.

Happy trading, and maybe I'll see you on one of these platforms someday! 🚀

Disclaimer

This article is provided for informational purposes only and does not constitute legal, financial, or professional advice. All content is based on publicly available information and personal opinions. Readers are advised to seek professional guidance before making decisions or acting based on the material presented. The author and publisher assume no liability for any actions taken or not taken by the reader based on the information contained herein.

Frequently Asked Questions

P2P trading connects buyers and sellers directly, allowing them to negotiate terms and choose payment methods, unlike centralized exchanges which use order books and set the available trading pairs. P2P platforms typically offer more payment options and don't hold your crypto (except in escrow during trades), giving users more control over their assets.

Escrow services hold the seller's cryptocurrency in a secure intermediary account until the buyer confirms payment has been sent. This prevents sellers from scamming buyers by never sending the crypto and protects sellers from buyers claiming to have paid when they haven't. Platforms like Binance and LocalBitcoins offer robust escrow services that have significantly reduced fraud.

Most reputable P2P platforms now require some form of KYC (Know Your Customer) verification, which may include providing government ID, proof of address, and sometimes a selfie or video verification. The level of verification required often depends on your trading volume, with higher limits requiring more extensive verification.

Look for traders with high completion rates (98%+), positive reviews from other users, and a substantial trading history. Many platforms also display badges for verified traders or those who have completed a certain number of successful trades. Starting with smaller transactions is also a good way to build trust gradually.

Immediately contact the platform's customer support and open a dispute case. Provide all relevant evidence, including screenshots of communications and payment confirmations. Most reputable platforms have dedicated teams for resolving disputes. Avoid making threats or accusations in your communications with the other party, as this can complicate resolution.