9 min

9 min 1.1K

1.1KCan You Use a Coinbase Card at an ATM? A Complete Guide for Users

Learn how to use your Coinbase Card at ATMs, including tips, fees, and limitations. Read our complete guide to maximize your crypto experience!

I was standing in line at a busy airport ATM last month when it hit me – here I am with thousands of dollars worth of crypto sitting in my Coinbase account, but I needed cold, hard cash for a taxi that didn't accept cards. The irony wasn't lost on me. After fumbling through my wallet for a traditional debit card (which I rarely carry anymore), I started wondering: could I have just used my Coinbase Card instead?

Turns out, the answer is a resounding yes – but there's more to it than just sliding your card into any old machine. Let me walk you through everything I've learned about using your Coinbase Card at ATMs, including some hard-earned lessons about fees, limits, and the occasional hiccup.

What Exactly Is the Coinbase Card?

Before we dive into ATM specifics, let's make sure we're on the same page about what this card actually is. The Coinbase Card isn't just another piece of plastic in your wallet, it's essentially a bridge between your crypto world and the traditional financial system.

This Visa prepaid debit card turns everyday purchases into crypto rewards, which honestly feels like magic when you first experience it. You can spend cash or crypto using the Coinbase Card anywhere Visa debit cards are accepted (which is pretty much everywhere these days). The card automatically converts your crypto holdings to USD at the point of sale, so you're not stuck trying to explain Bitcoin to confused cashiers.

What makes this card stand out from your regular debit card? Well, for starters, you can stack unlimited crypto rewards on every purchase – there's literally no cap on how much you can earn back. The Coinbase Card has zero spending fees and no annual fees for users, making it incredibly cost-effective for regular use. Plus, there's no credit check required, and no need to stake assets just to become eligible. It's refreshingly straightforward in a world where financial products often come with more strings attached than a puppet show.

Highlights of the various ways users can make payments and withdrawals with the Coinbase card.

Can You Use a Coinbase Card at an ATM? The Short Answer

Yes, you absolutely can use your Coinbase Card to withdraw cash from ATMs worldwide. I've personally tested this in multiple countries, and it works just like any other Visa debit card. The process is pretty standard – insert your card, enter your PIN, choose your withdrawal amount, and wait for the machine to dispense your cash.

But here's where things get interesting (and where I learned some expensive lessons). While you can access ATMs globally with your Coinbase Card, the experience isn't always seamless, and the costs can add up faster than you'd expect.

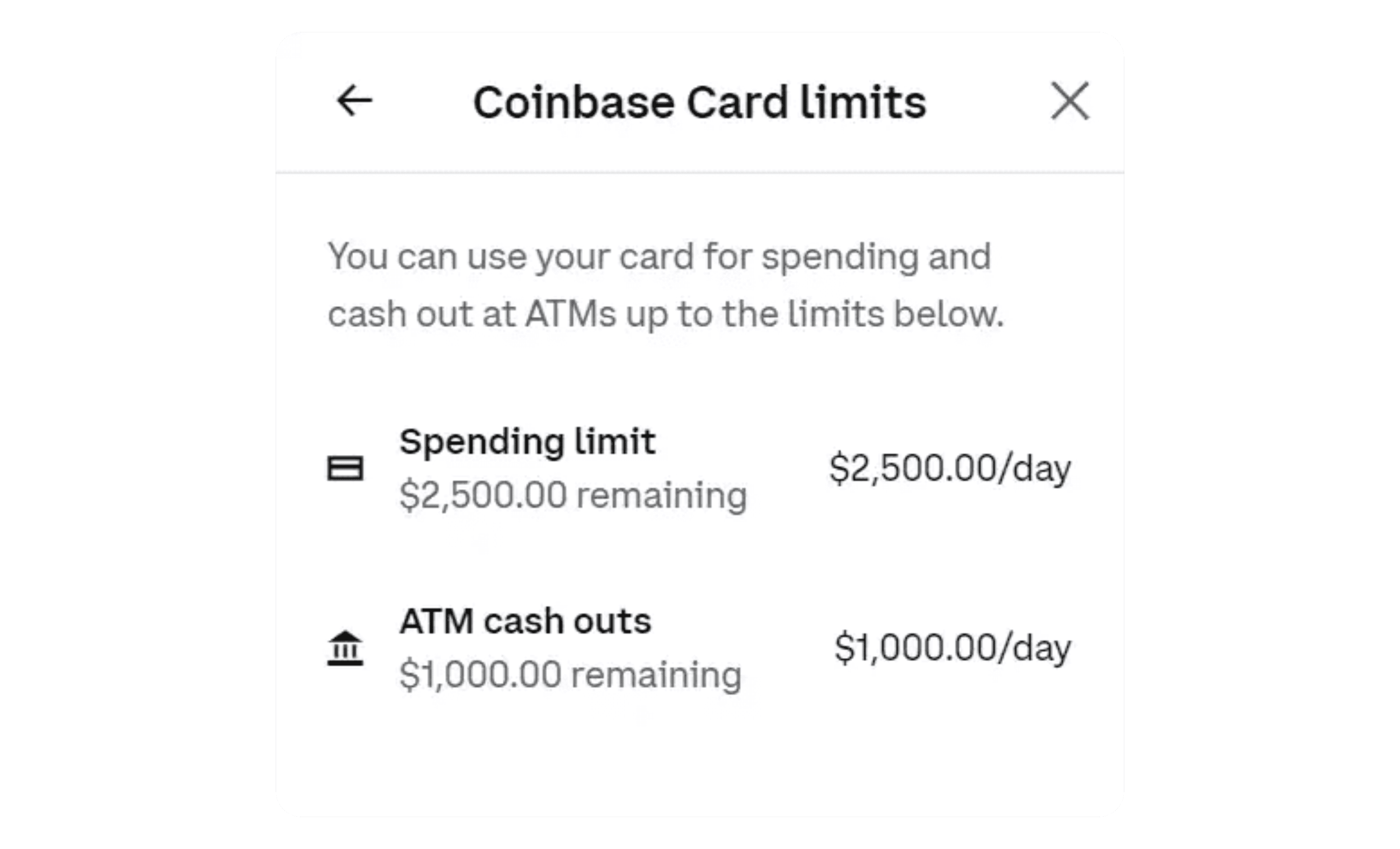

A visual description of Coinbase Card’s daily spending and withdrawal limits.

Understanding ATM Withdrawal Limits and Fees

Daily Withdrawal Limits

The maximum ATM withdrawal limit for the Coinbase Card is $1,000 per day. A friend discovered this the hard way when he tried to withdraw $1,200 for a security deposit on a rental car in Barcelona. The machine simply rejected his transaction, leaving him scratching his head until he checked Coinbase's website for the specifics.

This $1,000 daily limit is separate from your overall spending capacity. The Coinbase Card has a spending limit of $2,500 per day for purchases, which means you could theoretically withdraw $1,000 from an ATM and still spend another $2,500 on purchases – though I’d recommend keeping track of these limits to avoid any embarrassing declined transactions.

The Fee Situation (Brace Yourself)

Here's where things get a bit painful for your wallet. ATM fees may be charged by the ATM operator on top of any Coinbase charges. This means you’re looking at double fees every time you make a withdrawal.

The ATM owner (think of those machines in gas stations or hotels) will typically charge their own fee, which can range from $2 to $5 or more depending on the location. Coinbase may also charge their fees for ATM withdrawals, though these vary depending on your account type and location.

I learned this lesson on a weekend trip where I ended up paying almost $8 in combined fees for a $200 withdrawal. At that point I was paying 4% just to access my own money – not exactly what you’d call financially savvy.

How to Withdraw Cash Using Your Coinbase Debit Card

Let me walk you through the step-by-step process I follow when using my Coinbase Card at ATMs:

Step 1: Find a Compatible ATM

Look for any ATM that accepts Visa debit cards. This includes most bank ATMs, standalone machines, and even some international ATMs. The Visa logo is your friend here.

Step 2: Insert Your Card and Enter Your PIN

Just like with any other debit card, insert your Coinbase Card and enter your four-digit PIN when prompted. Make sure you're covering the keypad – security basics still apply, even with crypto-funded cards.

Step 3: Choose Your Account Type

When the screen prompts you to choose between checking or savings, select "checking." Your Coinbase Card functions as a checking account for ATM purposes.

Step 4: Enter Your Withdrawal Amount

Choose the amount you want to withdraw, keeping in mind that $1,000 daily limit. Also, consider the fees we discussed earlier – sometimes it makes sense to withdraw more at once to minimize the per-transaction fee impact.

Step 5: Complete the Transaction

Review the fee details on the screen (they should be displayed before you confirm), then complete your transaction. Keep your receipt – trust me, you'll want to track these fees for your records.

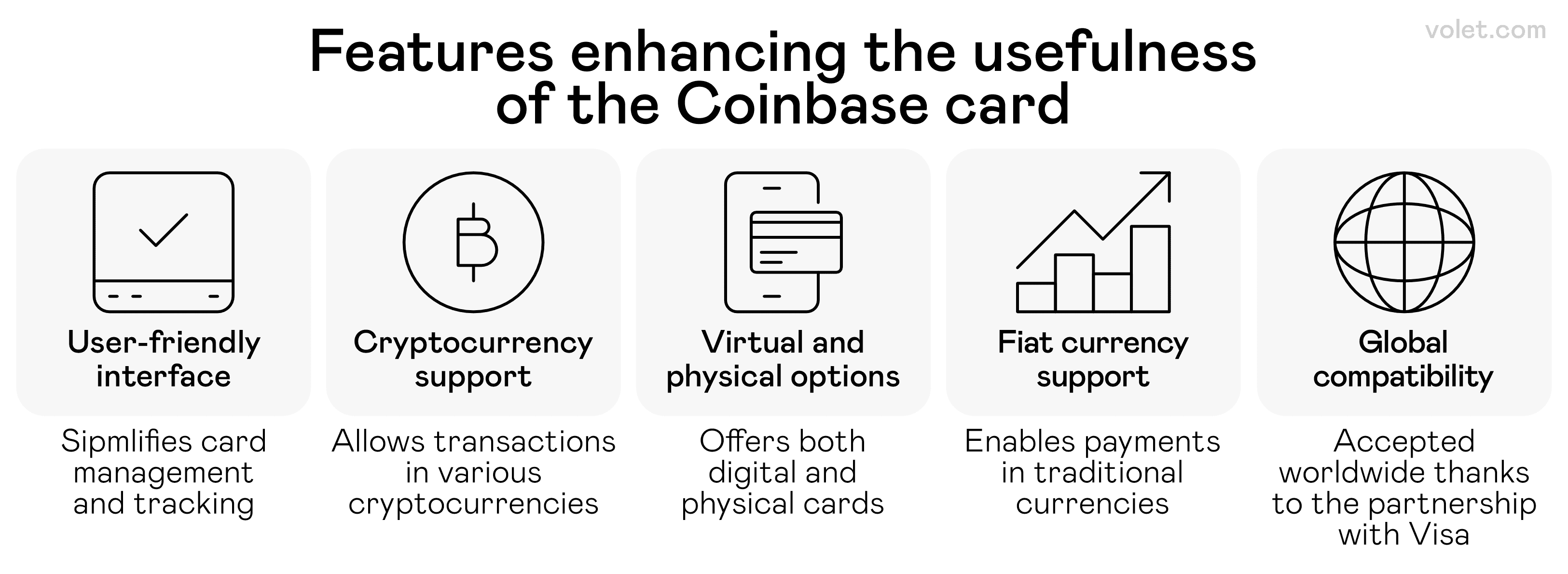

An illustration highlighting the key advantages and benefits of using the Coinbase Card.

The Real Benefits of Using Coinbase Card for ATM Withdrawals

Despite the fees (which I'll admit can sting), there are some genuine advantages to using your Coinbase Card for cash withdrawals:

✅ Global Access: You can access cash in virtually any country that accepts Visa, which has saved me multiple times during international travel.

✅ No Need for Traditional Banking: If you're trying to minimize your relationship with traditional banks, this gives you cash access without maintaining a separate bank account.

✅ Automatic Crypto Conversion: Your crypto assets are automatically converted to USD (or local currency) at the current market rate, which can be convenient during bull markets.

✅ Integrated Experience: Everything happens within your Coinbase account, so tracking your spending and withdrawals is straightforward via the Coinbase mobile app.

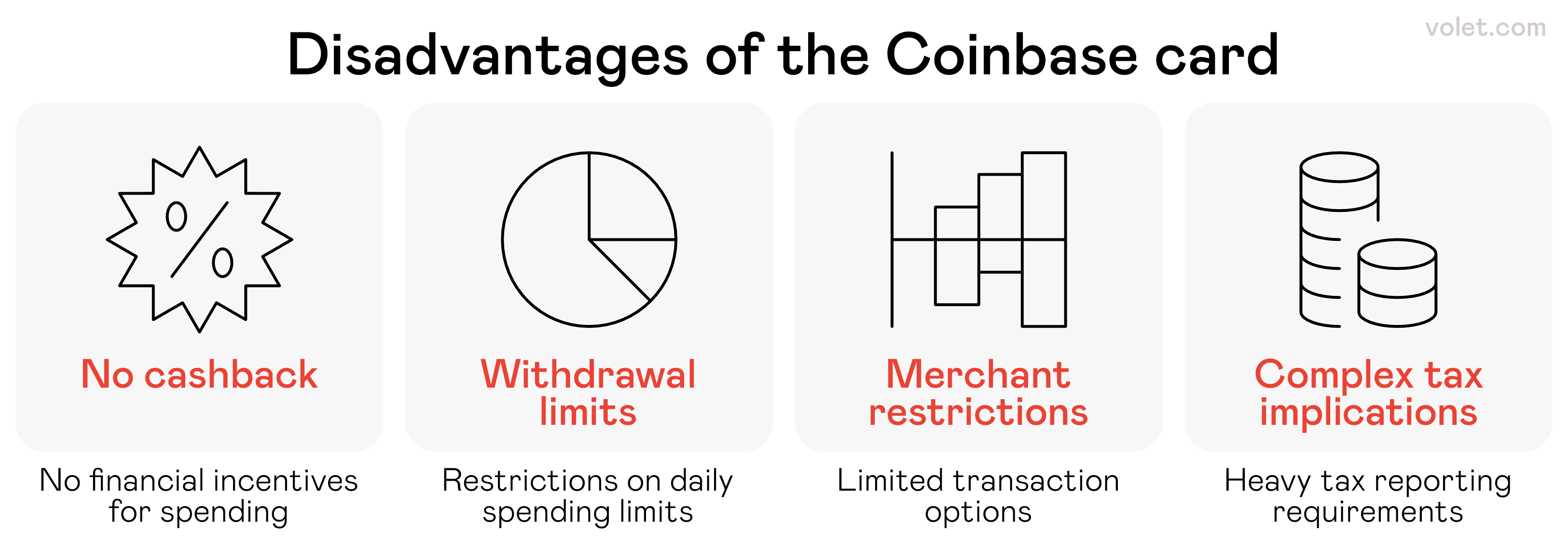

Summary of the drawbacks of using the Coinbase card.

The Drawbacks You Should Know About

Let's be honest about the downsides because there are definitely some:

❌ Fee Stacking: Those double fees (ATM operator + potential Coinbase fees) can make small withdrawals particularly expensive.

❌ Daily Limits: The $1,000 daily withdrawal limit might not be sufficient for larger cash needs.

❌ Market Timing Risk: If you need cash during a crypto market dip, you might be converting your assets at an unfavorable rate.

❌ Limited ATM Options: While Visa is widely accepted, you're still limited to ATMs that specifically support international cards in some regions.

Coinbase Card Features That Make It Worth Considering

Beyond ATM functionality, the Coinbase Card offers several features that make it attractive for crypto enthusiasts:

Crypto Rewards System

US users can earn crypto rewards from their everyday spending, and the rewards program is quite generous. The Coinbase Card allows users to select from a list of rotating crypto rewards and maximize their crypto portfolio, with rotating rewards that can be as high as 5% for certain cryptocurrencies. You can stack unlimited crypto rewards on every purchase, which honestly feels like getting paid to spend money while building your crypto holdings.

Zero Spending Fees

The card maintains its competitive edge with zero spending fees and no annual fees for users, which makes it superior to many traditional debit cards. No credit check or requirement to stake assets either – they've really simplified the qualification process.

Easy Funding Options

The card can be funded easily by linking a bank account or receiving part of a paycheck deposited directly into Coinbase. This makes it convenient to maintain a balance without constantly transferring funds.

Customer Support

One of the best features is 24/7 support for the Coinbase Card through dedicated phone and email support, which has been helpful the few times I’ve needed it. Having round-the-clock access to knowledgeable support staff makes a big difference when you’re dealing with financial transactions.

Security Features

The card includes standard Visa security protections, and you can freeze/unfreeze it instantly through the Coinbase app if it's lost or stolen.

Closing Thoughts

After using my Coinbase Card at ATMs in different countries and situations, I’d say it’s a good option for crypto enthusiasts who want cash on hand. Being able to convert crypto to cash on demand is really useful especially if you want to reduce your reliance on traditional banking.

That being said, the fees can add up fast and the daily limits might not work for everyone. I’ve found it works best as part of a broader financial strategy rather than my sole means of getting cash.

The key is to know what you’re paying for and make sure the convenience is worth the cost. For occasional use and travel, it’s been worth it for me. For frequent cash withdrawals, you might want to keep some funds in a traditional checking account to avoid those stacking fees.

If you’re already using Coinbase for crypto trading and want a seamless way to access cash from your crypto holdings, the Coinbase Card is definitely worth considering. Just go in with realistic expectations about fees and limits and you’ll likely find it as useful as I have.

Disclaimer

This article is provided for informational purposes only and does not constitute legal, financial, or professional advice. All content is based on publicly available information and personal opinions. Readers should seek professional guidance before making decisions or acting based on the material presented. The author and publisher assume no liability for any actions taken or not taken by the reader based on the information contained herein.

FAQs

The Coinbase Card has a daily ATM withdrawal limit of $1,000. This is separate from the $2,500 daily spending limit for purchases.

Yes, you may face two types of fees: charges from the ATM operator (typically $2-5) and potential fees from Coinbase. These fees vary depending on the ATM location and your account details.

Yes, the Coinbase Card works at ATMs worldwide wherever Visa debit cards are accepted. However, foreign transaction fees may apply depending on your account terms.

Insert your card into any Visa-compatible ATM, enter your PIN, select "checking" as the account type, choose your withdrawal amount (up to $1,000 daily), and complete the transaction.

You need a fully verified Coinbase account with completed identity verification and linked funding sources before you can apply for and use the Coinbase Card at ATMs.