14 min

14 min 1K

1KComparison of TRC-20, ERC-20, BEP-20 Token Standards in 2025

Explore the differences between TRC-20, ERC-20, and BEP-20 token standards in 2025. Learn their strengths and weaknesses to make informed decisions

Remember May 2022? That’s when Terra’s UST stablecoin lost its $1 peg, crashed to 35 cents, and LUNA went from $80 to cents in one of the biggest crypto crashes ever. The Terra-LUNA crash wiped out over $40 billion and shook the entire crypto market.

The crash mostly affected Terra’s native CW-20 tokens, with UST’s algorithmic design failing to maintain its peg and triggering a death spiral with LUNA. Users holding wrapped Terra assets like UST as ERC-20, BEP-20, or TRC-20 tokens on Ethereum, Binance Smart Chain, or TRON respectively experienced different network performances for transfers and trading.

I was managing a DeFi portfolio during that crazy week and I learned a hard lesson: token standards aren’t just technical details—they’re critical infrastructure that can mean the difference between protecting your wealth or watching it disappear in a crisis. Some users moved assets quickly on low-cost networks while others were stuck with Ethereum’s high fees or delays.

That chaos got me thinking not just about how tokens move, but how we secure and represent real-world assets in a volatile market. A groundbreaking whitepaper, "Blockchain-Powered Asset Tokenization Platform," co-authored by Pranav M Pawar, Assistant Professor at BITS Pilani, Dubai, UAE, opened my eyes to tokenization’s potential. He and his team showed how their WDApp platform uses ERC-20 and ERC-721 standards to turn assets—real estate, jewelry, even digital data—into secure, liquid tokens on Ethereum, bypassing clunky traditional transfers and centralized control.

Suppose you’ve ever wondered why certain tokens handle market stress better than others, why some assets move fast in an emergency, or how tokenization can protect your wealth. In that case, you’re about to find out the crucial role token standards like TRC-20, ERC-20, BEP-20, and SPL play in the crypto ecosystem—and how ideas like WDApp could reshape asset ownership.

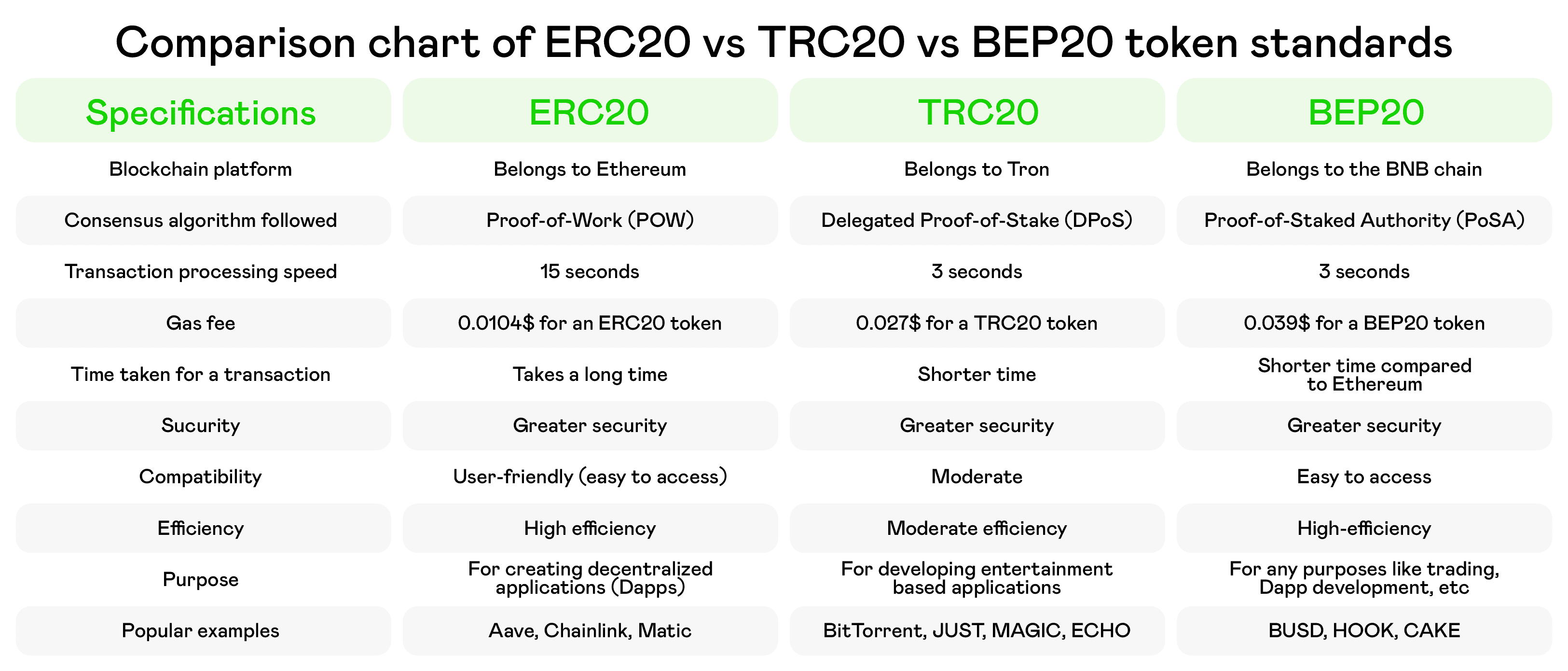

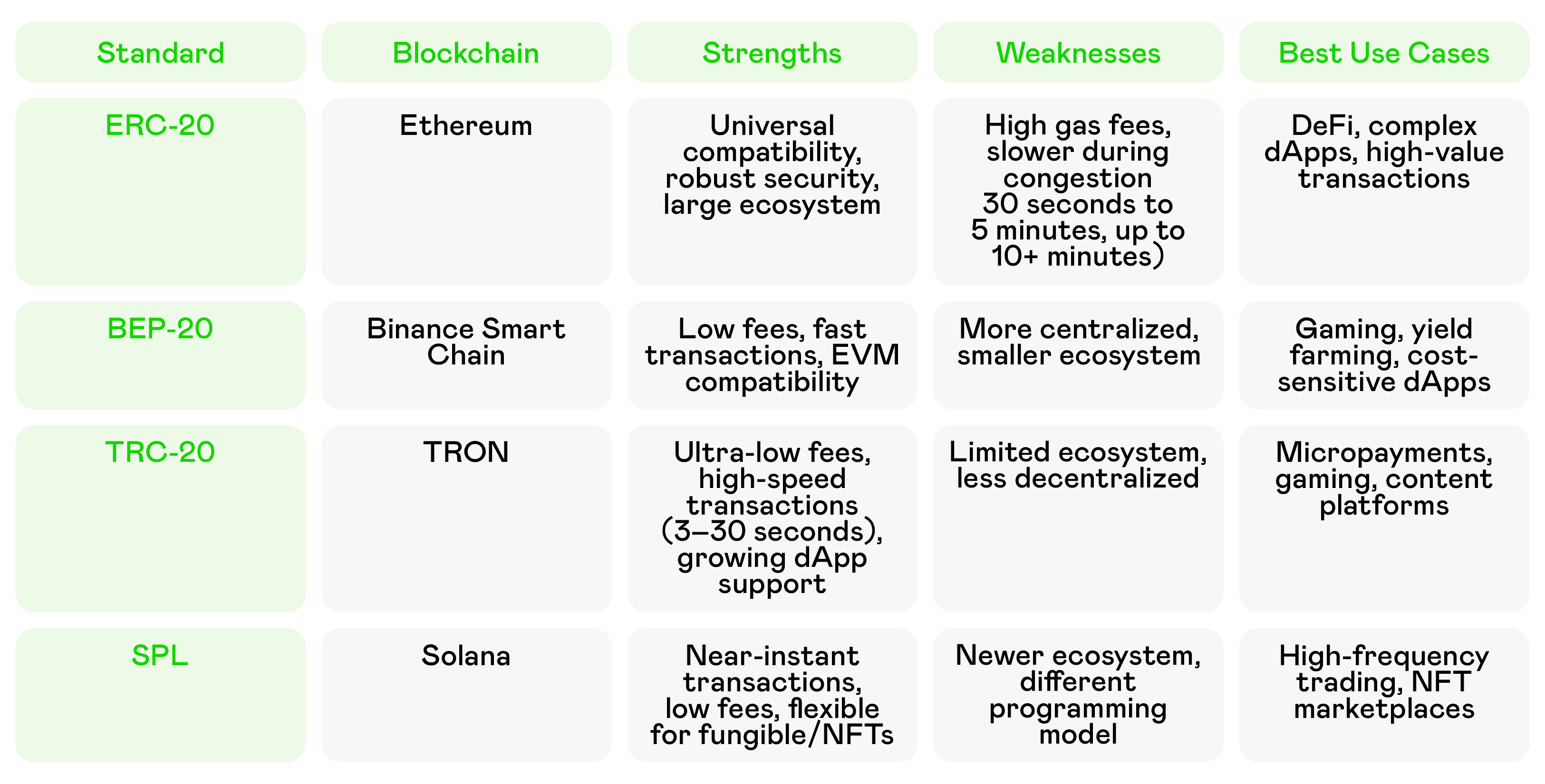

Side-by-side look at ERC20, TRC20 & BEP20 standards by speed, fees & use cases

What Are Crypto Token Standards?

Before we dive into the comparison of TRC-20, ERC-20, and BEP-20 token standards, let's get something straight. Crypto token standards aren't just boring technical specs—they're the rulebook that makes crypto tokens play nice with each other.

Think of token standards as the DNA of digital assets. They provide predefined rules dictating how tokens behave on their respective blockchain network. Token standards ensure compatibility, they define the process of token creation, minting, deployment and destruction.

Whether you’re dealing with fungible tokens (like your everyday crypto coins) or non-fungible tokens (those NFTs) these standards keep everything running smoothly. Token standards are important for Bitcoin blockchains with smart contract capabilities, they govern token creation and deployment of new tokens.

These standards define how tokens function, interact with smart contracts, and maintain compatibility across the token ecosystem.

ERC20 vs TRC20 vs BEP20: a quick snapshot of their speeds, fees & use cases

My First Time at Token Creation

I'll never forget my first attempt at token creation. Picture a complete newbie (me) trying to launch a simple utility token for a client's loyalty program. I picked ERC-20 because, well, everyone uses it, right?

Wrong move. The gas fees ate up half my budget before I even got started.

That expensive lesson taught me something crucial: different crypto token standards serve different purposes. Some focus on security (hello, ERC-20), others on speed and low fees (looking at you, TRC-20), and some try to do everything (what’s up, BEP-20).

Understanding Fungible Tokens vs Non-Fungible Tokens

Let me break this down. Fungible tokens are like cash—one dollar bill is the same as any other dollar bill. They’re interchangeable, which makes them good for:

- Utility tokens (think in-app currencies)

- Governance tokens (voting rights in crypto projects)

- Regular cryptocurrencies (Bitcoin, Ethereum, etc.)

Non-fungible tokens, on the other hand, are like collectible trading cards. Each one is unique. We're talking digital art, virtual real estate, gaming items—you name it.

Here's where it gets interesting: different token standards handle these token types differently. Some excel at fungible tokens, others shine with NFTs using specialized non-fungible token standards, and a few (like SPL tokens) can handle multiple assets in the same contract.

ERC-20

ERC-20 tokens live on the Ethereum blockchain and are the crypto token. When someone says “crypto tokens” without specifying, they mean ERC-20. This widely used token standard on Ethereum network is the foundation for creating and managing tokens on the blockchain.

Why ERC-20 dominates:

- Universal compatibility: Almost every wallet, exchange, and dApp supports ERC 20 tokens

- Smart contracts: The Ethereum network's smart contract functionality is rock-solid

- Battle-tested: Years of real-world use have proven its reliability

- Smart contract standards: Most mature and tested protocols

Illustratration that ERC-20 is a technical standard used for developing and deploying tokens on the Ethereum blockchain

The Dark Side of ERC-20

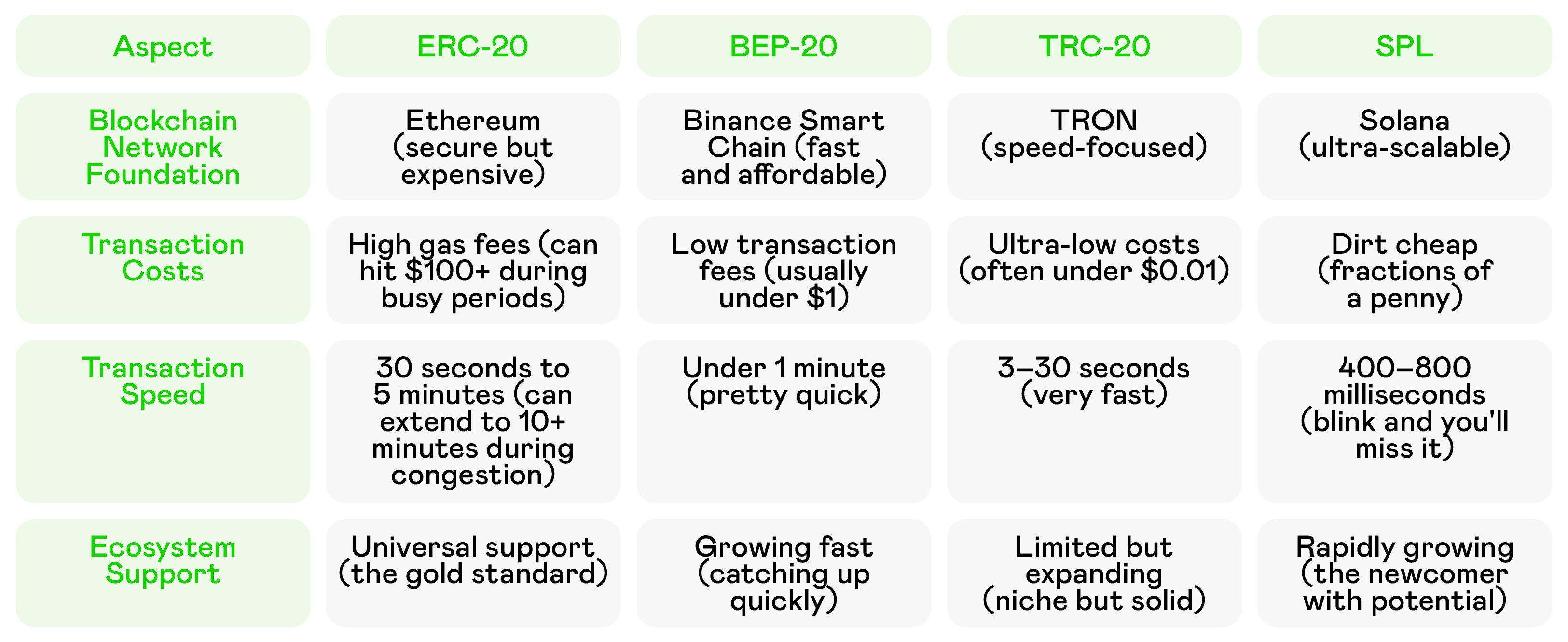

Remember that $80 gas fee I mentioned? That's ERC-20's biggest weakness. High gas fees can turn a simple token transfer into an expensive nightmare, especially during network congestion

Transaction costs can skyrocket during busy periods

ERC-20 tokens typically confirm in 30 seconds to 5 minutes under normal conditions, though delays can extend to 10+ minutes during network congestion

Ethereum's gas fees make small transactions uneconomical

Network congestion makes everything slower and pricier

Layer-2 solutions (e.g., Optimism, Arbitrum) mitigate high fees and congestion, with transactions often costing <$0.50 and confirming in seconds but might be more challenging to use

Real Talk: I once spent $150 in gas fees to move $200 worth of tokens. Not my finest moment. Since 2022, Ethereum’s Layer-2 solutions like Arbitrum and Optimism have drastically reduced transaction costs and confirmation times, making ERC-20 tokens more practical for cost-sensitive applications. For example, a new token transfer on Arbitrum can cost less than $0.50 and complete in seconds, compared to mainnet fees that could exceed $100 during peak congestion. The WDApp team noted this too—their solution integrates with Ethereum, and I bet Layer 2 could make their tokenization even cheaper and faster.

When to Choose ERC-20

Despite the high costs, ERC-20 still makes sense when:

- You need maximum compatibility across platforms

- Security is your top priority

- You're building complex decentralized applications

- You don't mind paying premium fees for premium service

Interestingly, ERC-20 tokens can function on the BSC and TRON networks through cross-chain bridges, which wrap them into BEP-20 or TRC-20 formats, expanding their utility beyond the Ethereum blockchain network. And that’s how transaction fees can go down.

BEP-20

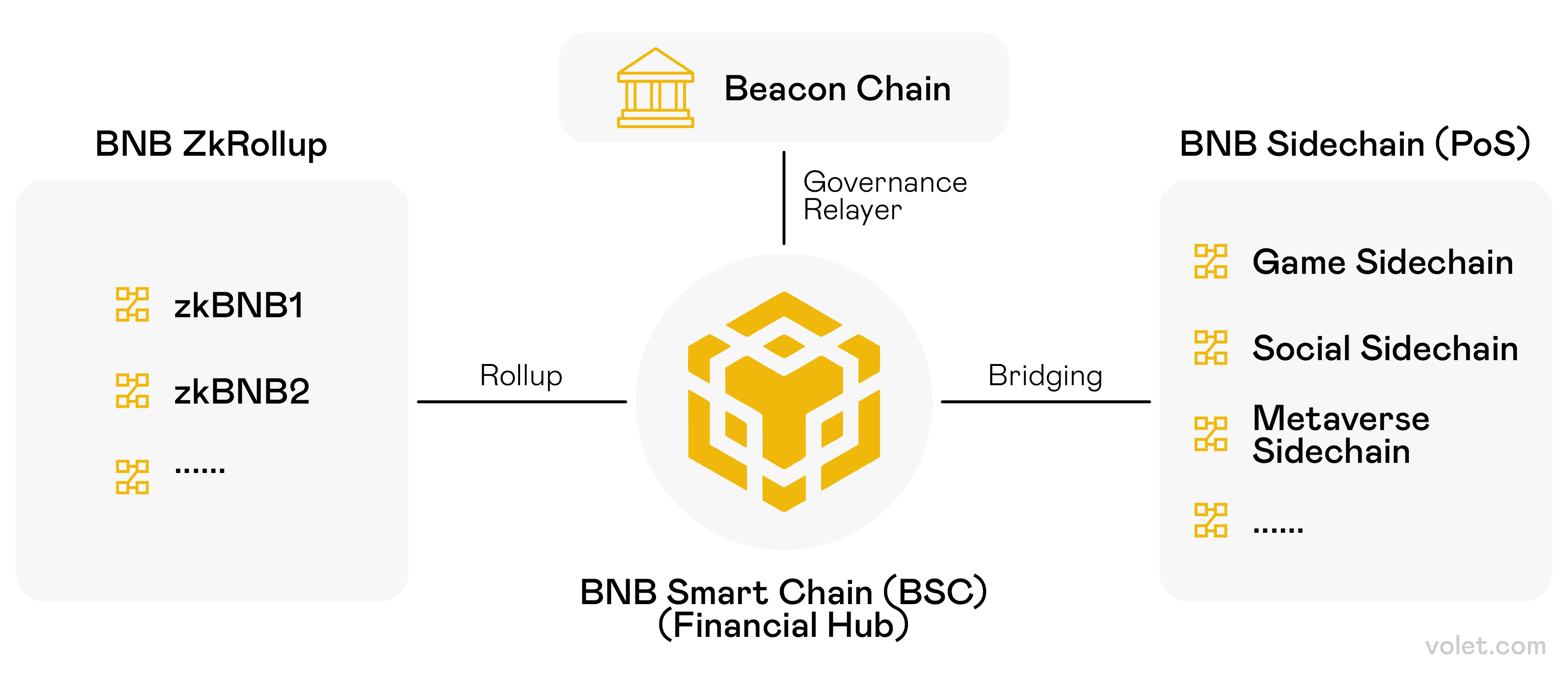

BEP-20 is a token standard introduced on Binance Smart Chain (BSC), inheriting all functionalities of the ERC-20 protocol. It's basically ERC-20's budget-friendly cousin that runs on BSC instead of Ethereum.

How BNB Smart Chain connects with ZkRollups, Sidechains, and the Beacon Chain for scaling and governance

What makes BEP-20 special:

- EVM compatibility: Works with Ethereum Virtual Machine tools and infrastructure

- Low transaction fees: We're talking cents, not dollars

- Faster transaction speeds: Usually under a minute

- Smart contract compatibility: All the functionality of ERC-20, minus the hefty price tag

My BEP-20 Success Story

After getting burned by Ethereum's gas fees, I decided to try BEP-20 for a client's token launch. The difference was night and day. Transaction fees that would've cost $50 on Ethereum? Less than $1 on BSC.

The project involved creating governance tokens for a small community, and the low fees meant we could actually afford to distribute tokens to users without breaking the bank.

BEP-20's Trade-offs

Nothing's perfect, and BEP-20 has its own challenges:

More centralized than Ethereum (Binance has significant control)

Smaller ecosystem compared to Ethereum

Less battle-tested than ERC-20

But for many use cases, these trade-offs are worth it for the massive cost savings.

TRC-20

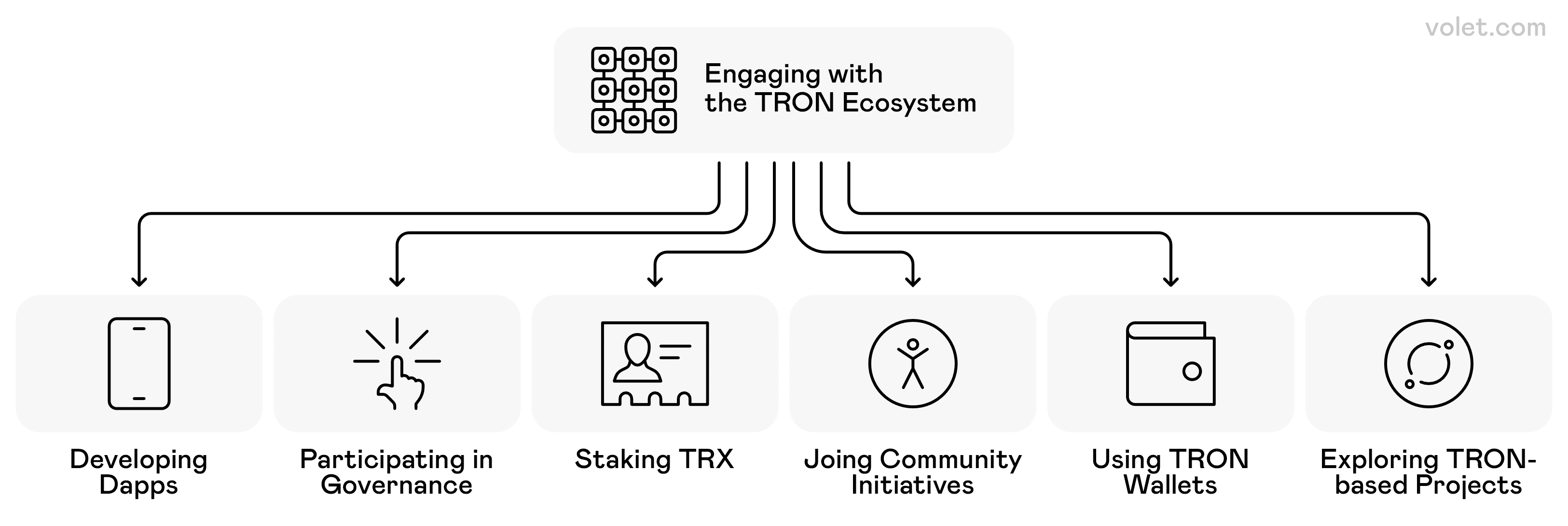

TRC-20 is a standard for tokens on the TRON blockchain, defining their token issuance, transfer, and other rules. TRC 20 tokens run on the TRON network, and they're all about speed and efficiency. TRC-20 tokens utilize a Delegated Proof-of-Stake (DPoS) consensus mechanism, which makes transactions lightning-fast.

TRC-20's superpowers:

- Low transaction costs: Often under $0.01 per transaction

- High transaction speed: Typically confirms in 3–30 seconds.

- Growing ecosystem: TRC-20 tokens offer a growing ecosystem of decentralized applications (dApps)

- Efficient consensus: DPoS mechanism ensures faster processing

Outlines of the six key ways to interact with the TRON ecosystem

But there are certain disadvantages:

Smaller ecosystem than Ethereum or BSC

Less decentralized due to DPoS

Cross-chain compatibility can be tricky

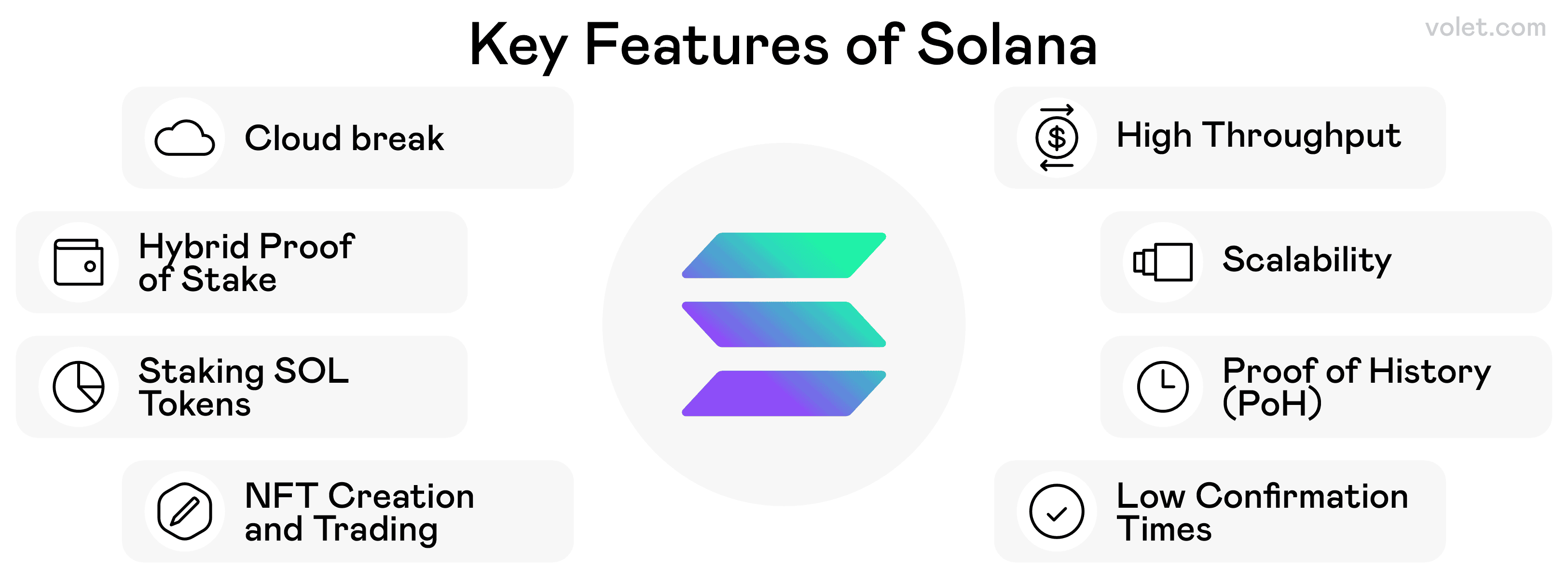

SPL Tokens: Solana's High-Speed Contender

SPL tokens are designed for the Solana blockchain to support decentralized apps and projects at scale. They're Solana's equivalent of Ethereum's ERC standards, and they're making waves in the crypto space. What sets SPL apart? They can handle both fungible and non-fungible tokens within the same contract.

SPL's advantages:

- Lightning-fast speeds: Transactions finalize in approximately 400–800 milliseconds under optimal conditions

- Ultra-low fees: Even complex transactions cost pennies

- Flexible architecture: One standard for all token types

- High scalability: Built for mass adoption

Why SPL Tokens Are Gaining Traction

I recently worked with a gaming platform that needed to handle thousands of microtransactions per second. Ethereum would've collapsed under the load, BSC would've been too slow, and even TRON struggled with the volume.

SPL tokens handled everything effortlessly. The combination of speed, low fees, and flexibility made it the perfect choice for their use case.

Outlines of Solana’s key features like speed, scalability, proof of history, and staking

Key Differences: ERC-20 vs BEP-20 vs TRC-20 vs SPL

Let me break down TRC-20, ERC-20, BEP-20 token standards in a way that actually makes sense:

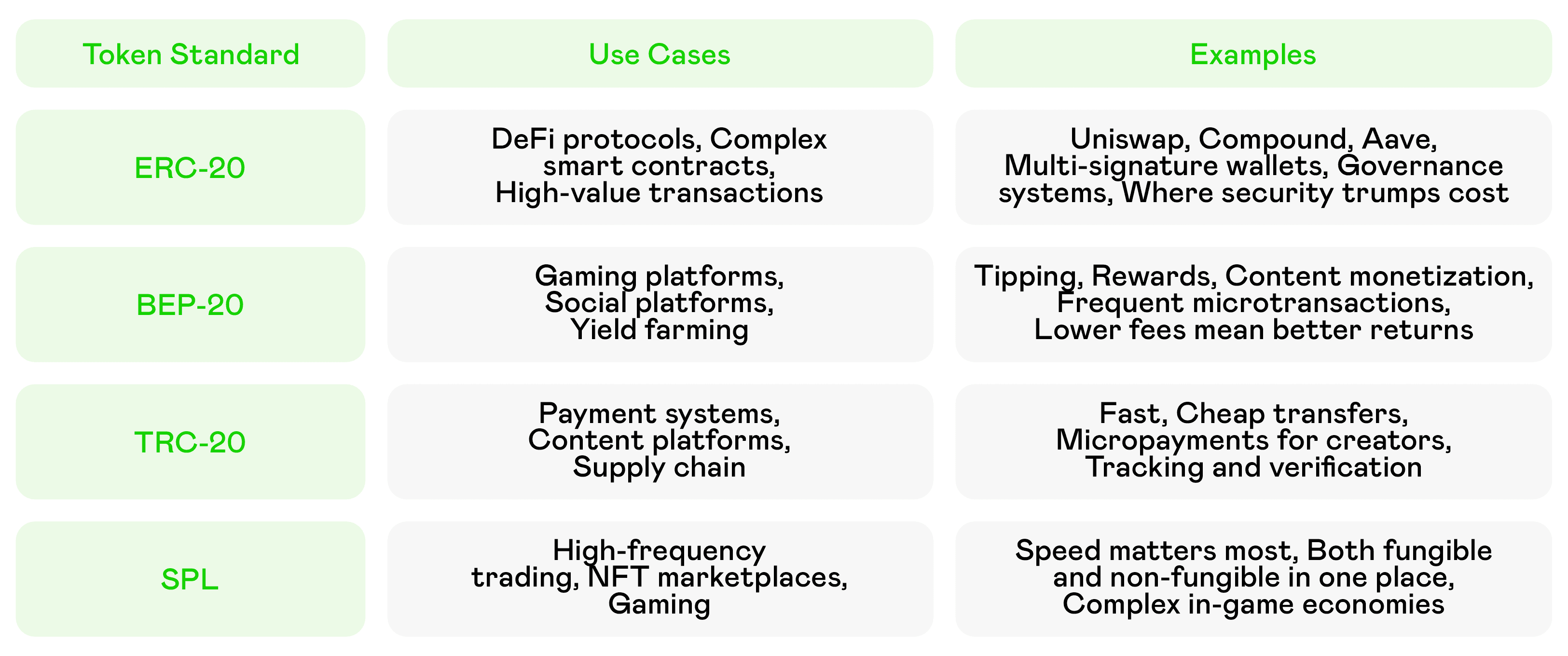

Loyalty Programs: Token Standards in the Real World

One of the coolest uses of token standards isn't even in traditional crypto—it's loyalty programs. Imagine earning tokens for shopping, then trading them across different platforms or converting them to other digital assets.

ERC-20 Loyalty Programs:

- High-value rewards: Premium brands with expensive products

- Complex redemption: Multiple partners, intricate rules

- Long-term holding: Tokens that appreciate over time

BEP-20 Loyalty Programs:

- Retail chains: Frequent, small purchases

- Online platforms: E-commerce, streaming services

- Community rewards: Social media engagement

TRC-20 Loyalty Programs:

- Micro-rewards: Reading articles, watching ads

- Gaming achievements: In-game progress, daily logins

- Content creation: Rewarding user-generated content

SPL (Solana) Loyalty Programs:

Micro-transactions: Instant rewards for small purchases (e.g., coffee, snacks)

High-frequency engagement: App usage, social media interactions

NFT integrations: VIP perks tied to token-gated collectibles

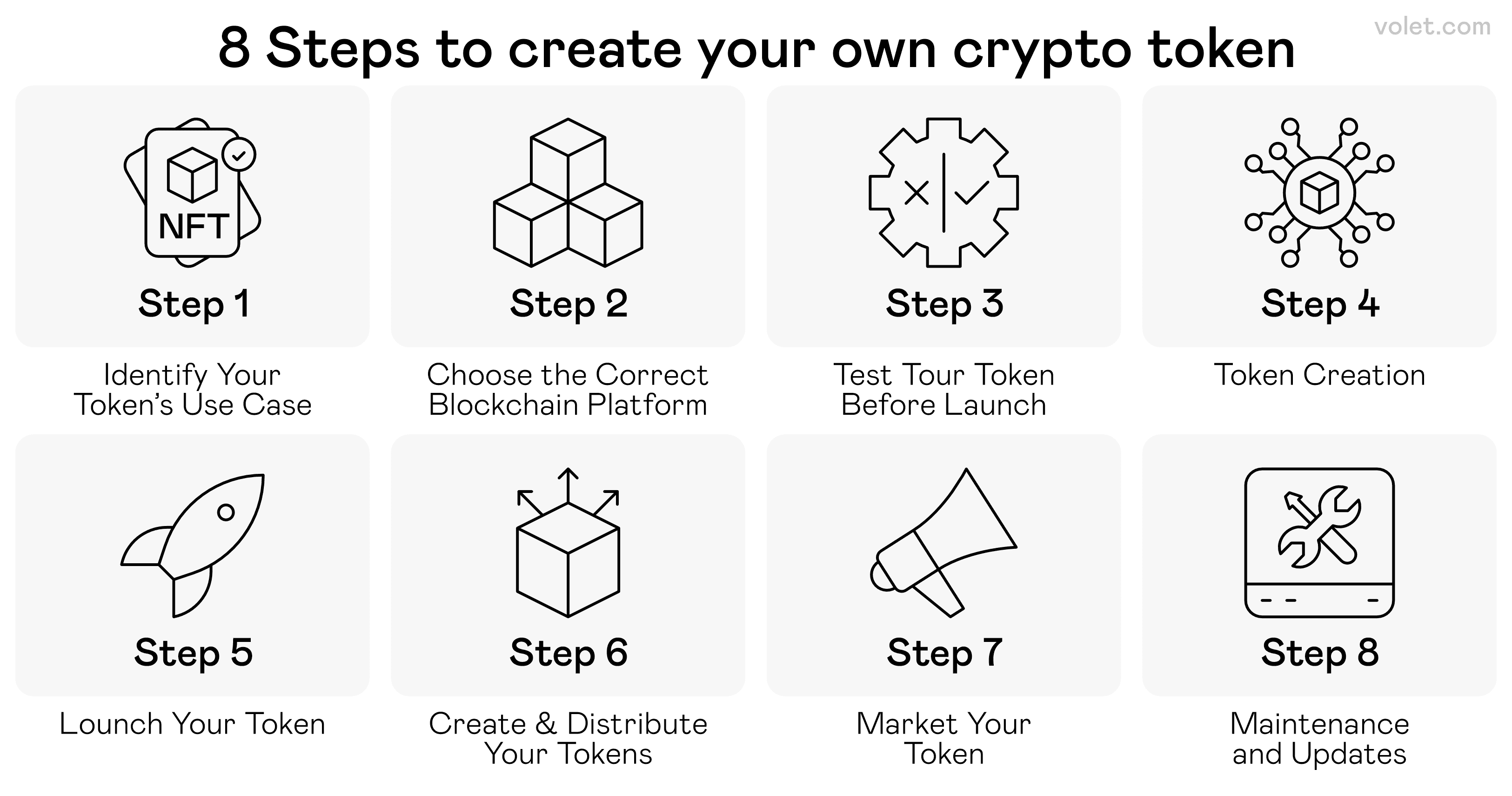

Outlines of the 8 key steps to create a crypto token and maintaining it

Token Development

Token development isn't rocket science, but choosing the right standard makes all the difference. Here's my approach:

1. Define Your Purpose

- Utility tokens: In-app currency, access rights

- Governance tokens: Voting, community decisions

- Reward tokens: Loyalty programs, incentives

- Asset tokens: Real-world asset representation

2. Choose Your Bitcoin Blockchain

- High security needed: Ethereum (ERC-20)

- Balanced approach: Binance Smart Chain (BEP-20)

- Speed priority: TRON (TRC-20)

- Ultimate scalability: Solana (SPL)

3. Smart Contract Development

- Use established frameworks: OpenZeppelin for security

- Test extensively: Testnet first, always

- Audit thoroughly: Third-party security reviews

- Deploy carefully: Double-check everything

4. Integration and Distribution

- Exchange listings: Research requirements early

- Wallet compatibility: Ensure broad support

- dApp integration: Plan for future use cases

- Community Building: Marketing and Adoption

Common Mistakes

Mistake #1: Choosing the wrong Bitcoin blockchain for your use case

Lesson: I picked Ethereum for a high-frequency trading token. The gas fees made it unusable.

Mistake #2: Ignoring cross-chain compatibility

Lesson: Built a beautiful token that couldn't interact with major platforms.

Mistake #3: Underestimating ongoing costs

Lesson: Forgot about the costs of contract upgrades and maintenance.

Understanding Bitcoin Network Token Standards

The BRC-20 Revolution

The BRC-20 Revolution The BRC-20 token standard allows for fungible tokens on the Bitcoin blockchain, but beyond that it’s limited. BRC-20 tokens don’t support smart contracts, and BRC-20 tokens on the Bitcoin ecosystem inherit its scalability issues, so they’re not suitable for high-frequency use despite the security of the Bitcoin network.

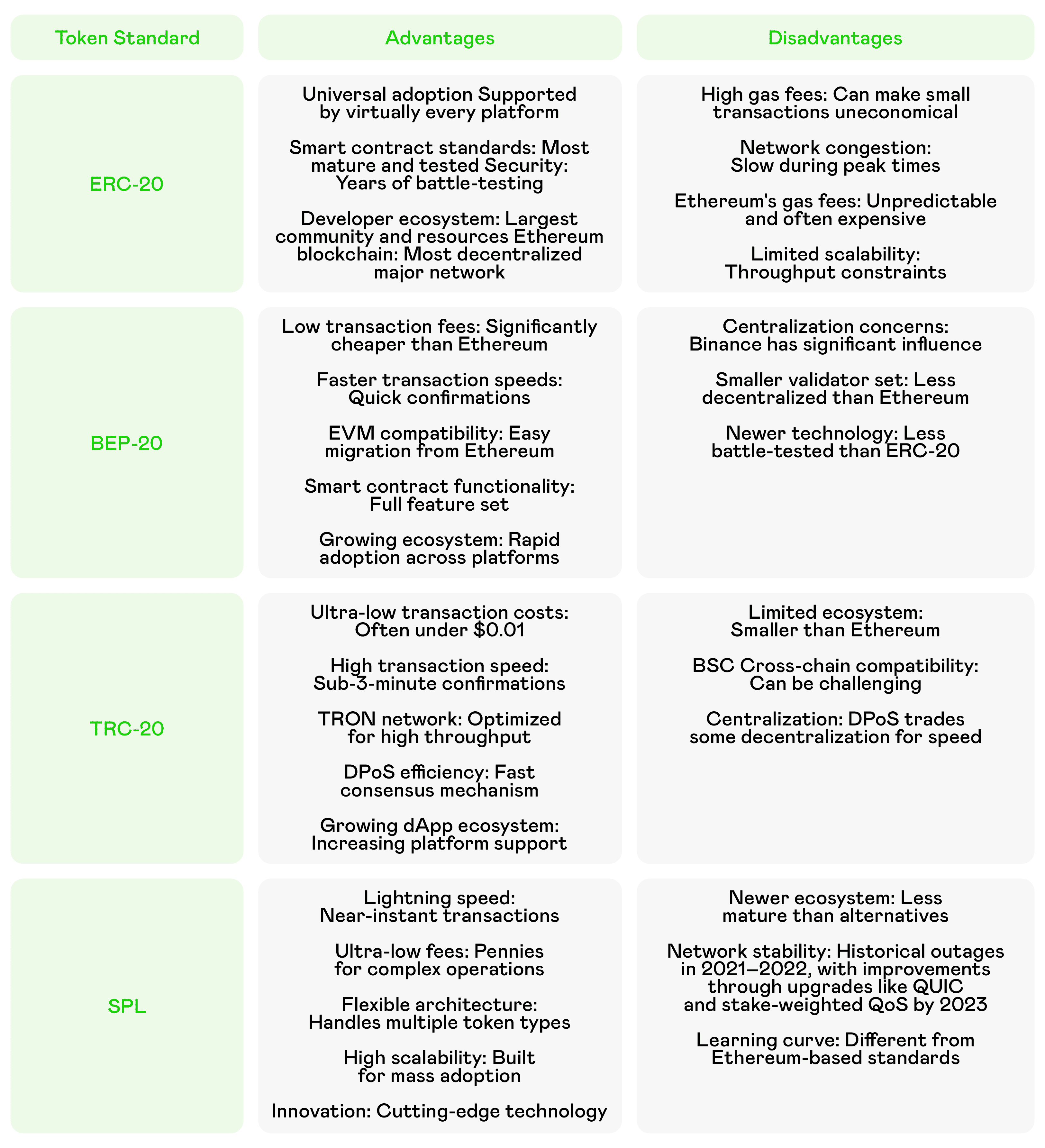

TRC-20, ERC-20, BEP-20 Token Standards: Advantages and Disadvantages in 2025

ERC 20 Tokens: The Veteran's Choice

Universal adoption: Supported by virtually every platform

Smart contract standards: Most mature and tested

Security: Years of battle-testing

Developer ecosystem: Largest community and resources

Ethereum blockchain: Most decentralized major network

High gas fees: Can make small transactions uneconomical

Network congestion: Slow during peak times

Ethereum's gas fees: Unpredictable and often expensive

Limited scalability: Throughput constraints

BEP 20 Tokens: The Balanced Approach

Low transaction fees: Significantly cheaper than Ethereum

Faster transaction speeds: Quick confirmations

EVM compatibility: Easy migration from Ethereum

Smart contract functionality: Full feature set

Growing ecosystem: Rapid adoption across platforms

Centralization concerns: Binance has a significant influence

Smaller validator set: Less decentralized than Ethereum

Newer technology: Less battle-tested than ERC-20

TRC-20 Tokens: The Speed Champion

Ultra-low transaction costs: Often under $0.01

High transaction speed: Sub-3-minute confirmations

TRON network: Optimized for high throughput

DPoS efficiency: Fast consensus mechanism

Growing dApp ecosystem: Increasing platform support

Limited ecosystem: Smaller than Ethereum or BSC

Cross-chain compatibility: Can be challenging

Centralization: DPoS trades some decentralization for speed

SPL Tokens: The Future-Forward Choice

Lightning speed: Near-instant transactions

Ultra-low fees: Pennies for complex operations

Flexible architecture: Handles multiple token types

High scalability: Built for mass adoption

Innovation: Cutting-edge technology

Newer ecosystem: Less mature than alternatives

Network stability: Historical outages in 2021–2022, with improvements through upgrades like QUIC and stake-weighted QoS by 2023; ongoing efforts aim to enhance reliability

Learning curve: Different from Ethereum-based standards

Managing Tokens Across Multiple Standards

As the ecosystem grows, you'll likely need to work with various tokens. Here's how I manage multiple token types:

Portfolio Strategy:

- Core holdings: ERC-20 for stability

- Growth positions: SPL for innovation

- Utility tokens: BEP-20 for daily use

- Microtransactions: TRC-20 for efficiency

Risk Management:

- Diversify across standards: Don't put all eggs in one basket

- Understand each ecosystem: Know the rules and limitations

- Keep up with updates: Standards evolve constantly

- Plan for interoperability: Cross-chain solutions are crucial

The Future of Token Standards

What's Coming Next?

The comparison of TRC-20, ERC-20, BEP-20 token standards isn't static. All four standards—ERC-20, BEP-20, TRC-20, and SPL—continue driving blockchain's progress and the digital economy forward. Each ecosystem continues evolving:

Layer 2 solutions:

Reducing gas fees via Arbitrum and Optimism, with fees often below $1.

Sharding: Still in development (e.g., Danksharding) to enhance scalability, not yet implemented by 2025.

Proof of Stake: Completed in 2022, significantly reducing energy consumption but not substantially lowering gas fees, which rely on Layer 2 solutions like Arbitrum and Optimism for cost reductions.

Decentralization efforts:

Ongoing plans to add validators, though still centralized with 21 validators; Security enhancements: Improved auditing tools since 2020; Ecosystem expansion: Growing dApp and service adoption, though smaller than Ethereum’s.

Smart contract development:

Ongoing improvements to enhance functionality; Ecosystem growth: Expanding developer tools and dApp support, particularly for content platforms; Partnerships: Increasing real-world integrations in gaming and media.

Network stability:

Improved since 2021–2022 outages via upgrades like QUIC and stake-weighted QoS; Developer tools: Enhanced documentation for Rust-based development; Cross-chain bridges: Growing interoperability with Ethereum and others.

Closing Thoughts

After years of working with various token standards, I’ve learned there’s no one-size-fits-all solution. The comparison of TRC-20, ERC-20 and BEP-20 token standards shows each has its sweet spot in the evolving landscape of digital assets. ERC 20 is the gold standard for projects that need maximum compatibility and don’t mind paying premium fees. BEP 20 is the best balance of features and costs for most projects.

TRC-20 is best when speed and ultra-low costs are paramount. And SPL tokens are the cutting edge of scalability and innovation. The key is matching your specific needs with the right standard. Don’t follow the crowd—analyze your needs, think about your users and choose strategically. Whether you’re building the next big decentralized finance protocol or a simple loyalty program, the right token standard can make or break your project.

Remember: the crypto space moves fast and what’s true today might change tomorrow. Stay informed, keep experimenting and always be ready to adapt. The future of digital assets is bright and understanding these foundational token standards puts you ahead of the game.

Disclaimer

This article is for informational purposes only and not for legal, financial or professional advice. All content is based on publicly available information and personal opinions. Readers should seek professional guidance before making decisions or acting based on the content of this article. The author and publisher assume no responsibility for actions taken or not taken by the reader based on the information contained herein.

Frequently Asked Questions

ERC 20 tokens run on the Ethereum blockchain with higher fees and broader compatibility, BEP 20 tokens run on the Binance Smart Chain with lower transaction fees and faster transaction speeds but with a smaller ecosystem.

Yes, TRC-20 tokens are best for high volume low-value transaction scenarios due to ultra-low fees and high speed transactions, perfect for microtransactions and payment systems.

Not directly, but you can use cross-chain bridges and decentralized exchanges to swap native tokens between different bitcoin blockchain networks, fees and time requirements vary.

SPL tokens offer the most flexibility by supporting both fungible tokens and non-fungible tokens in the same contract, while ERC-20 (specifically ERC-721 for NFTs) provides the broadest marketplace compatibility.

Consider your priorities: ERC-20 for maximum compatibility, BEP-20 for balanced features and costs, TRC-20 for ultra-low fees and speed, or SPL for cutting-edge scalability and innovation in decentralized finance applications.