12 min

12 min 667

667Crypto Bridging Explained: A Simple Guide to How It Works

Discover what bridging in crypto is and how it facilitates asset transfer across different blockchain networks. Learn the essentials in our simple guide. Read more!

Co-authored with Tiancheng Xie

Have you ever felt stuck with your crypto on one blockchain, wishing you could use it somewhere else? That was me in early 2023, staring at my Bitcoin and wondering how to use it on Ethereum's DeFi apps without selling it. 😩

I remember thinking, "There must be a way to move between these blockchain islands!" Turns out, there is—it's called bridging, and it changed how I use crypto completely.

In this guide, I'll share my personal journey with crypto bridges, including some costly mistakes I've made (so you don't have to!). Whether you're trying to escape high gas fees or access cool new apps on different blockchains, understanding bridges is absolutely essential in 2025's interconnected crypto ecosystem.

What is Bridging in Crypto?

Imagine you have dollars but suddenly need euros for a trip. You'd go to an exchange, right? Crypto bridging works similarly, but instead of converting currencies, you're moving your digital assets between different blockchain networks while keeping their value.

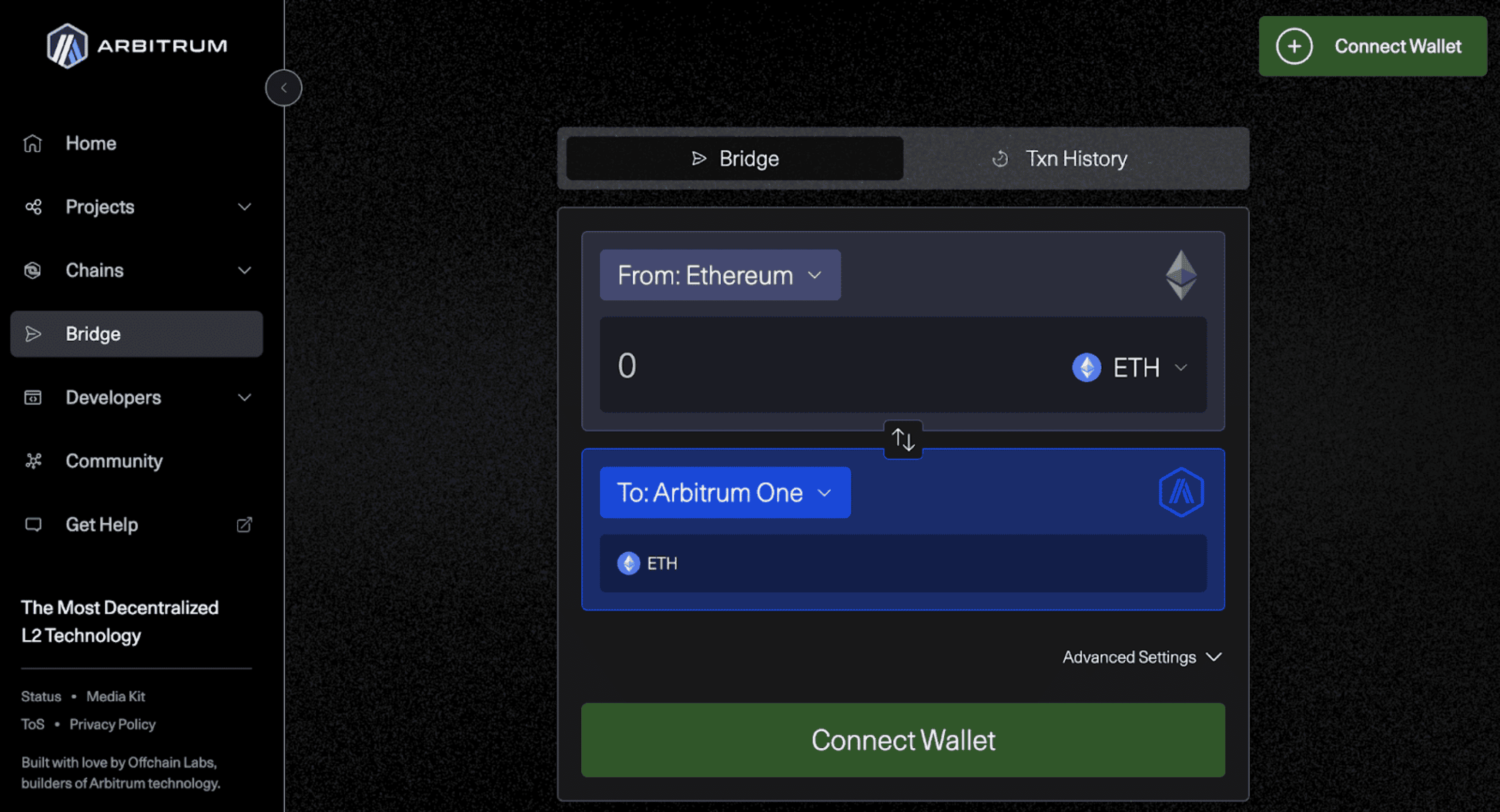

Arbitrum Bridge UI: Move ETH from Ethereum to Arbitrum with wrapped tokens—unlock cross-chain utility without giving up your assets

My first bridging experience was moving some ETH from the Ethereum network to Polygon Network to escape those crazy transaction fees (seriously, who wants to pay $50 for a $10 transaction? Not me!)

I got really excited about bridging when I came across a brilliant explanation by Tiancheng Xie on Twitter (yep, I still call it Twitter—sue me ). His zkBridge paper showed how bridges can be trustless using zero-knowledge proofs, making them super secure without needing a middleman. It’s like sending money with a secret handshake that only the right blockchains understand! Check out his work.

Here's what bridging actually does:

- Takes your crypto assets on one blockchain (the source chain)

- Locks them in a smart contract (think of it as a secure vault)

- Creates an equivalent "wrapped" token on your destination chain

- Lets you use this wrapped token just like you would the original

The beauty? Your original crypto isn't sold or converted—it's represented on a new blockchain, giving you flexibility without losing your investment position.

It's like having an ambassador representing you in a foreign country. Your ETH gets an "ambassador" called WETH on another chain that acts on its behalf! ✅

How Crypto Bridges Work

I won't lie—the first time I used a bridge, I was sweating bullets watching my assets seemingly disappear into the crypto void. Understanding the entire process would have saved me a minor panic attack!

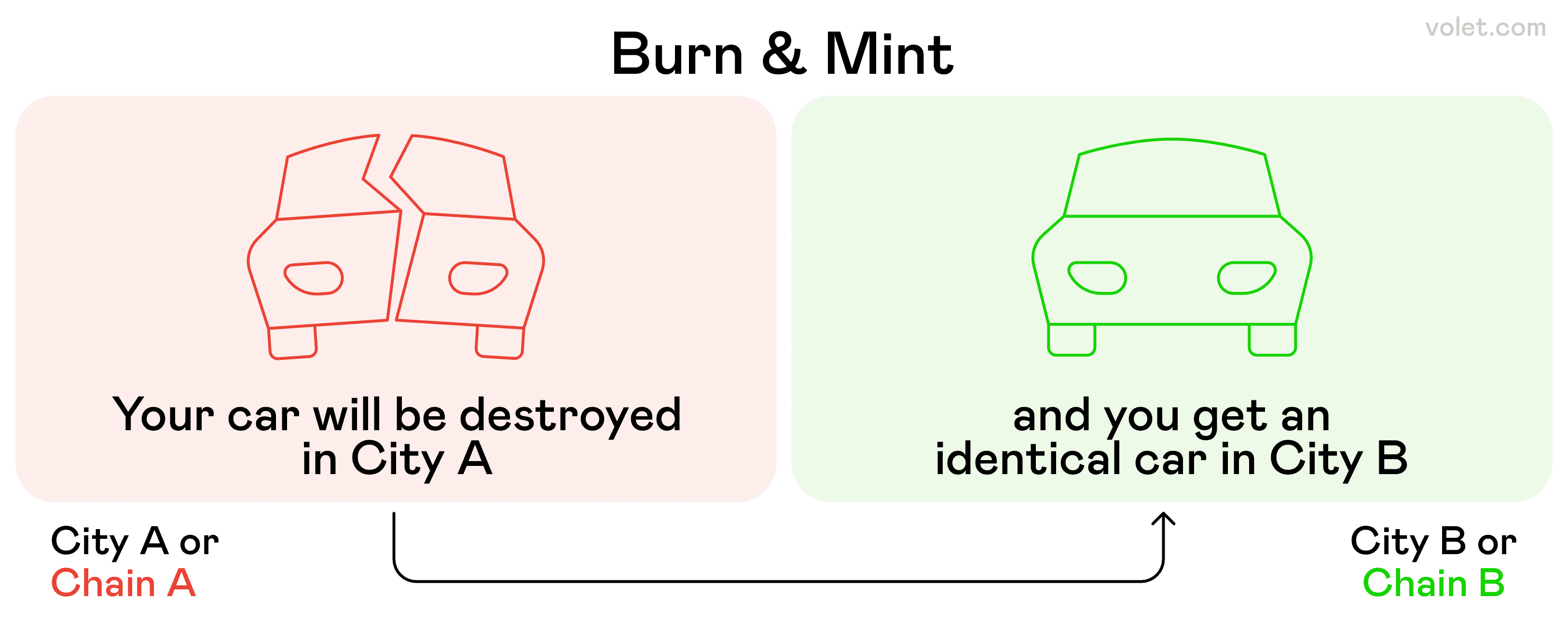

A visual metaphor for burn-and-mint bridges: a car is burned in City A (Chain A) and an identical car appears in City B (Chain B), illustrating how assets are destroyed on one blockchain and recreated on another

Here's what actually happens when you bridge assets (much clearer than the technical mumbo-jumbo I initially encountered):

- Lock Step: Your native asset gets locked in a smart contract on your starting blockchain (source chain)

- Creation Step: The bridge creates an equivalent amount of "wrapped" assets on your target blockchain (destination chain)

- Delivery Step: These wrapped assets appear in your wallet on the new blockchain

- Usage Step: You can now use these bridge tokens on the new blockchain!

Think of wrapped tokens like traveler's checks (remember those?). They represent your original money but in a form usable at your destination. When I bridged my first Bitcoin from the Bitcoin network to Ethereum blockchain, it became Wrapped Bitcoin (WBTC)—same value, different packaging.

The inner workings of bridges involve some serious technological innovation behind the scenes. Most bridges use multi-signature security (meaning multiple approvals are needed) and time-locks to keep your digital assets safe during transit.

Types of Crypto Bridges

Not all crypto bridges are created equal—I learned that the hard way when I once used an obscure one that left my ETH floating in limbo for almost an hour. 😫 Since then, I’ve tried several more reputable ones, and here's how the landscape breaks down:

🏦 Trusted Bridges (a.k.a. "Just trust us" bridges)

These bridges are run by centralized entities like exchanges or custodians. They’re easy to use and fast—but you’re putting your trust in a single operator.

Examples:

- Binance Bridge – moves assets between Binance Smart Chain (BSC) and Ethereum or other networks.

- Celer cBridge (centralized mode) – has both trusted and trustless options.

My take: I use these for small, quick swaps when I need convenience. But I never send large amounts—if the provider pauses withdrawals or gets compromised, your crypto could be stuck.

🛡️ Trustless Bridges (code is law)

These use smart contracts and cryptography to handle everything—no humans or third parties involved. Just you, your wallet, and the code.

Examples:

- Hop Protocol – lets you bridge ETH and stablecoins across L2s like Arbitrum, Optimism, and Polygon using rollup-based security.

- zkBridge by Polyhedra Network – uses zero-knowledge proofs to enable ultra-secure cross-chain transfers without trusted intermediaries.

- Across Protocol – designed for fast bridging between Ethereum L1 and rollups like Arbitrum, with capital-efficient liquidity pools.

My take: This is my go-to for larger transfers. Sure, some of them are slower and the interfaces can be clunky, but I prefer knowing that the system doesn’t depend on a single person or entity.

👥 Federated Bridges (decentralized-ish)

These sit between trusted and trustless. They use a group of validators—usually a known consortium—to approve cross-chain transactions. It’s more decentralized than a single authority but still has some central control.

Examples:

- Wormhole – used to bridge assets between Solana, Ethereum, and several other chains. It relies on a network of guardian nodes.

- Nomad (pre-exploit) – used a minimal-trust design with a whitelist of verifiers (it was later exploited, which shows how tough bridge security can be).

- Axelar – employs a proof-of-stake validator set to relay messages and assets between chains.

My take: These are decent for medium-risk transfers. I’ve used Wormhole to move USDC from Ethereum to Solana for DeFi apps—it worked fine, but I always double-check if the validator set is active and well-distributed.

Benefits of Using Blockchain Bridges

When I discovered bridges, my blockchain ecosystem expanded dramatically. Here's how they've personally benefited me:

Interoperability Between Different Blockchain Ecosystems ✅

Before bridges, my crypto felt fragmented across multiple blockchains. Now everything works together! I can hold Bitcoin but still participate in Ethereum's DeFi ecosystem—it's like having diplomatic relations between previously isolated countries.

This interoperability means different blockchain worlds can now communicate and share value, creating a more unified crypto ecosystem.

Access to Different Protocols 🚀

Each blockchain has unique superpowers. Ethereum excels at smart contracts, Solana is lightning fast, and Avalanche has near-instant finality.

With blockchain bridges, I don't have to choose just one! I can keep my main holdings on Bitcoin and Ethereum networks but can quickly transfer digital assets to use specialized features on other chains when needed.

Consolidated Liquidity 💧

One problem in early crypto was fragmented liquidity—liquidity pools split across different blockchain networks. Bridges facilitate connections between these pools, creating deeper markets with better trading conditions.

I've noticed significantly less price slippage when trading on bridge-connected platforms versus isolated ones. This consolidation helps the entire blockchain ecosystem function more efficiently.

Lower Transaction Fees 💰

Let me tell you about the time I needed to make 20 small NFT purchases during network congestion on the Ethereum blockchain. Gas fees would have cost me more than the NFTs themselves!

Solution? I used the Polygon Bridge to transfer tokens to Polygon Network where fees were pennies instead of dollars. This fee arbitrage alone has saved me thousands in transaction costs over the past year.

Supporting Emerging Blockchains 🌱

I love discovering promising new projects in the blockchain space, but they often struggle with limited users and liquidity. Cross-chain bridges solve this by connecting new chains to established networks like Ethereum.

This helps innovative projects grow faster by tapping into existing users and assets. I've discovered some awesome new decentralized finance opportunities by exploring bridge-connected emerging chains!

Risks and Considerations of Crypto Bridges

I'd be doing you a disservice if I painted bridges as perfect. They're not. I've had my share of bridge mishaps—including a nerve-wracking 3-day wait for a bridging transaction that got stuck. Let's talk real risks:

Security Vulnerabilities ❌

Bridges are prime hacking targets due to the value they hold. In 2022, I watched in horror as a major bridge hack resulted in millions of dollars stolen. Before using any bridge, I thoroughly research its security history and audits.

In the crypto space, convenience often trades off with security. Most bridges add another layer of risk to your digital assets.

Smart Contract Risks 👾

Most bridge protocols rely on smart contracts, and these can contain bugs. I only use bridges with multiple security audits from reputable firms—and even then, I don't bridge more than I can afford to lose.

Counterparty Risk 🤝

When using trusted bridges, you're putting faith in the team operating them. What if they go out of business? What if they're hacked? This counterparty risk is something I always factor into my decisions.

Bridge Failure ⚠️

In worst-case scenarios, bridges can fail completely. In early 2023, I had a small amount of assets stuck in a failed bridge protocol. Consider this a potential risk, especially with newer bridge protocols.

Popular Crypto Bridges

Through trial and error (mostly error at first!), I've found several reliable bridges:

- Polygon Bridge: My go-to for transfers between Ethereum and Polygon networks when I need lower fees

- Binance Bridge: Convenient for moving between Binance Smart Chain and different networks

- Avalanche Bridge: Solid option for Ethereum↔Avalanche transfers

- Arbitrum Bridge: Great for accessing Ethereum's Layer 2 scaling solutions

Each bridge has different features and supported blockchains. I suggest starting with small test transactions before committing larger amounts—a $5 test transaction saved me from potentially losing $5,000 once!

Cross-Chain Bridge Use Cases

Bridges aren't just technical tools—they enable real-world use cases that have transformed how I use crypto:

Cross-Chain DeFi 📊

Decentralized finance becomes SO much more powerful with cross-chain bridges! I can now:

- Hold my main investments on Ethereum

- Bridge some assets to other chains for specific yield opportunities

- Access unique DeFi protocols on multiple blockchains

- Arbitrage interest rates across different blockchains

Before bridges, my DeFi activities were confined to a single blockchain. Now I have a multi-chain portfolio that optimizes for both security and yield.

Gaming and NFTs 🎮

My crypto gaming life spans multiple blockchains now. I can purchase NFTs on Ethereum but use them in games on more cost-effective chains. This cross-chain functionality has made blockchain gaming much more accessible and affordable.

Cross-Chain Applications 🔄

Some of my favorite crypto apps now span different blockchain networks, leveraging the unique strengths of each. For example, I use a portfolio tracker that combines high security from Ethereum with fast, cheap transactions from alternate chains.

How to Use a Bridge

The first time you use a bridge can be intimidating (I nearly abandoned my first attempt!). Here's my simplified process:

- Connect your wallet to the bridge interface

- Select your source chain (where your assets currently are)

- Choose your destination chain (where you want them to go)

- Specify the asset and amount to bridge

- Approve the transaction and pay any required fees

- Wait for confirmation on both blockchains

Most bridges now have user-friendly interfaces, but expect to wait anywhere from a few minutes to an hour for your assets to appear on the destination chain. Don't panic if it's not instant—I definitely refreshed my wallet obsessively during my first bridge transfer! 😅

The Future of Blockchain Bridges

Having watched bridges evolve since 2021, I'm excited about where they're headed. Bridge developers are continuously improving security and user experience, making cross-chain transfers increasingly seamless.

zkBridge is leading the charge, using zero-knowledge proofs to make bridges trustless and cheap—think gas costs as low as 220K instead of millions! I saw buzz about this on Twitter from crypto devs raving about zkBridge’s potential to connect Ethereum with Cosmos and beyond. Check these posts for the hype:

- https://t.co/zkBridgeHype1,

- https://t.co/zkBridgeHype2.

- Plus, a blog from Moonbeam’s team dives into how zkBridge could power cross-chain DeFi: https://moonbeam.network/blog/zkbridge-interoperability.

In 2025, we're already seeing bridges with near-instant transfers and dramatically improved security models. As blockchain technology continues to advance, bridges will likely become even more integrated and invisible to the end user—just like how we don't think about the infrastructure that routes our internet traffic.

With Bitcoin hitting its all-time high of $109,026.02 on January 19, 2025, and the overall crypto market surging to $3.91 trillion, bridges will play an increasingly crucial role in maintaining connectivity across this expanding crypto ecosystem. As institutional adoption grows (like the U.S. exploring Bitcoin as a strategic reserve), reliable bridges between different blockchain networks will become absolutely essential infrastructure.

Closing Thoughts

Blockchain bridges represent one of the most important developments in crypto's evolution toward a truly interconnected ecosystem. They've completely transformed how I use and think about my digital assets, breaking down the walls between separate blockchain worlds.

Whether you're looking to escape high fees, access new DeFi opportunities, or simply explore different blockchain networks, understanding bridges is essential knowledge for navigating today's multi-chain crypto landscape.

Start small, do your own research on specific bridges, and gradually explore the expanded possibilities that cross-chain functionality offers. The multi-chain future isn't coming—it's already here, and bridges are your passport to exploring it safely.

Disclaimer

This article is provided for informational purposes only and does not constitute legal, financial, or professional advice. All content is based on publicly available information and personal opinions. Readers should seek professional guidance before making decisions or acting based on the material presented. The author and publisher assume no liability for any actions taken or not taken by the reader based on the information contained herein.

Frequently Asked Questions

Your original assets get locked in a smart contract on your starting blockchain, while an equivalent "wrapped" version is created on your destination chain. Your original crypto isn't sold or converted.

Look for bridges with security audits, significant total value locked (TVL), and established track records. Start with small test amounts and research the bridge's security history before committing larger sums.

No, bridges typically support specific asset pairs and blockchain combinations. Always check the bridge documentation to confirm which assets and networks it supports.

Most bridge transfers take between 5-30 minutes, but times vary depending on network congestion and the specific blockchains involved. Some faster bridges can complete transfers in under a minute.

Yes, you'll typically pay gas fees on both chains plus sometimes an additional bridge fee. Budget for these costs when planning your cross-chain strategy.