29 min

29 min 703

703Cryptocurrency Tax Guide 2025: What Investors Need to Know

Stay informed with our Cryptocurrency Tax Guide 2025. Learn what investors need to know for filing and ensure compliance this tax season

Let me guess—you're probably here because crypto taxes feel like trying to solve a Rubik's cube while blindfolded, right? Trust me, I've been there. Back in 2021, I thought I was being smart by diversifying into different cryptocurrencies. Little did I know I was creating a tax headache that would haunt me for years.

Here's the thing: crypto taxes aren't going anywhere, and the IRS is getting smarter about tracking digital assets. In fact, they've made it crystal clear that cryptocurrency is treated as property for tax purposes, which means every trade, sale, or even that random airdrop you forgot about could trigger a taxable event.

But don't panic! 🙋♂️ I've learned these lessons the hard way so you don't have to. This crypto tax guide will walk you through everything you need to know about crypto taxes in 2025, from understanding capital gains tax to navigating the new IRS rules that are coming this year.

A brief visual summary showing how crypto is taxed, mainly through capital gains and income tax.

Why Crypto Taxes Feel Like a Nightmare (And Why You Can't Ignore Them)

Let's be brutally honest—crypto taxes are confusing as hell. When I first got into Bitcoin back in 2020, nobody told me that every single transaction would need to be tracked for tax purposes. I was just excited about potentially making some gains (spoiler alert: the market had other plans).

Here's what I wish someone had told me from the start: in the United States, cryptocurrency is subject to capital gains tax when you dispose of it and income tax when you earn it. Sounds simple, right? Wrong. The devil's in the details, and those details can cost you big time if you're not careful.

The IRS treats digital assets just like stocks or real estate. Every time you sell, trade, or spend crypto, you're potentially creating a taxable event. And yes, that includes trading Bitcoin for Ethereum—something I learned the expensive way when I got a notice about unreported gains.

What Makes 2025 Different?

This year brings some major changes that will affect how you handle crypto taxes. Trust me, you want to get ahead of these:

✅ Mandatory 1099 Reporting: Here's where things get interesting—centralized exchanges must issue Form 1099-DA starting in 2025 for gross proceeds and certain cost basis information, but here's the kicker: decentralized exchanges (DEXs) and non-custodial wallets are not currently classified as brokers under IRS proposed regulations (REG-122793-19). This means DEXs like Uniswap or non-custodial wallets won't provide tax forms, so you must meticulously track all transactions—including dates, amounts, fair market values, and fees—to calculate capital gains and losses accurately. Let me be real with you: future IRS guidance may include some DeFi platforms, so stay updated and consult a tax professional.

✅ Per-Transaction Cost Basis Tracking: Now here's where most people are going to mess up—starting in 2025, you must track the cost basis for all crypto transactions using a consistent method like FIFO (First In, First Out), LIFO (Last In, First Out), HIFO (Highest In, First Out), or specific identification, as permitted by IRS regulations (26 CFR § 1.1012-1). The IRS requires detailed records for each transaction, including date, amount, fair market value, and fees, regardless of the wallet used. Here's a tip from my experience: organizing records by wallet can help manage transactions across multiple platforms, but you must report cost basis on a per-transaction basis to comply with IRS rules. Trust me, maintain detailed records across all exchanges and wallets to ensure accurate reporting.

Note: Keep an eye on IRS updates for any future changes to cost basis rules, as proposed regulations could evolve.

✅ Enhanced IRS Enforcement: Look, I'll be honest—the IRS has expressed its intent to crack down on cryptocurrency tax compliance issues and has updated the main US income tax form 1040 to include reporting questions on digital assets.

I learned about these changes when my accountant (yes, I finally got one after my 2021 disaster) sent me a frantic email about preparing for the new requirements. Don't be like past me—get ahead of this stuff now.

Understanding Fair Market Value

Okay, let's talk about fair market value because this concept is absolutely crucial for calculating your crypto taxes correctly. Fair market value is essentially what your crypto is worth at the exact moment of any transaction.

I remember when I got paid in Ethereum for a motion graphics project in 2022 (yeah, I dabble in design work sometimes). The client sent me 0.5 ETH when it was trading at $2,800. That means I had to report $1,400 as ordinary income on my tax return, even though I didn't sell the ETH right away.

Here's where it gets tricky: when I finally sold that Ethereum six months later for $2,200, I had to calculate capital gains based on my cost basis of $2,800. So actually, I had a capital loss of $600 that I could use to offset other gains. See how this works?

How to Nail Fair Market Value Every Time

- Use Exchange Prices: I always check the price on the exchange where the transaction happened. Coinbase and Binance are my go-to sources for consistency.

- Document Everything: Screenshot prices or use crypto tax software that automatically pulls historical data.

- Stay Consistent: The IRS wants you to use the same method across all your transactions. Pick one and stick with it.

❌ Don't Wing It: Never guess at prices. The IRS can easily verify crypto prices on any given day.

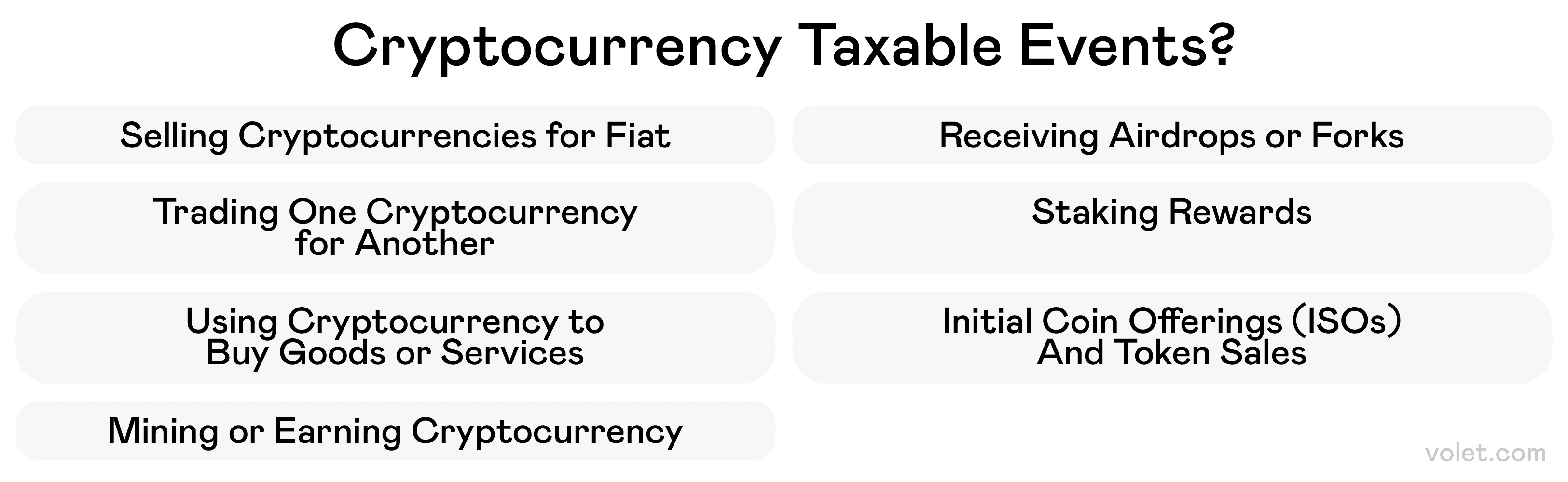

The image highlights common crypto activities that trigger taxes, like trading, selling, or earning rewards.

Taxable Events: When the IRS Says "Pay Up"

This is where things get real. A taxable event happens when you earn or dispose of cryptocurrency. "Dispose" sounds fancy, but it just means selling, trading, or spending your crypto.

Let me share a painful example: In 2021, I swapped some Bitcoin for Cardano because I thought I was being clever and diversifying. What I didn't realize is that crypto-to-crypto swaps are taxable events. I had to calculate capital gains based on Bitcoin's fair market value at the time of the swap, not when I eventually sold the Cardano.

What's Taxable And What's Not

Taxable Events:

- Selling crypto for fiat currency: This triggers capital gains tax on any profit you made

- Trading crypto for another crypto: Every swap counts as a taxable event based on fair market value

- Spending crypto on goods or services: Yes, buying that coffee with Bitcoin creates a taxable event

- Earning crypto through mining, staking, or airdrops: All taxed as ordinary income at fair market value when received

- Using cryptocurrency to buy goods and services: The IRS treats this as a taxable event

Non-Taxable Events:

- Buying crypto with fiat currency: Tax-free until you sell or use it

- Transferring crypto between your own wallets: This is tax-free moving crypto

- Simply holding cryptocurrency: Just HODLing doesn't trigger taxes

- Gifting crypto: Here's something that surprised me—transferring crypto to someone else as a gift is generally not a taxable event for capital gains, but if the value exceeds the 2025 annual gift tax exclusion ($18,000 per recipient), you may need to file a gift tax return (Form 709). The recipient inherits your cost basis for future tax calculations. Trust me, consult a tax professional for guidance on gift tax rules.

The Tricky Stuff That Caught Me Off Guard

Airdrops: Let me tell you about a mistake that cost me—airdropped cryptocurrencies are taxed as ordinary income at their fair market value (FMV) when received, per IRS Revenue Ruling 2019-24. The FMV becomes your cost basis for calculating capital gains or losses when you later sell or trade the airdropped tokens. For example, if you receive a $200 airdrop, report $200 as income, and use $200 as the cost basis for future sales. I had to report $200 in income from a Uniswap airdrop I completely forgot about.

Staking Rewards: Here's where things get interesting—staking rewards from cryptocurrencies like Cardano or Ethereum are taxed as ordinary income at their FMV when received, per IRS guidance. The FMV serves as the cost basis for calculating capital gains or losses when you sell or trade the rewards.

Here's my advice: track the FMV at receipt to avoid errors in future tax calculations. Note that legal challenges, like Jarrett v. United States, question whether staking rewards should be taxed upon receipt, but current IRS rules stand. I track all my staking rewards monthly now to avoid end-of-year scrambling.

Mining Rewards: If you're mining crypto, those rewards are considered income based on the fair market value of the crypto at the time of receipt. My brief Bitcoin mining experiment in 2022 taught me this lesson quickly.

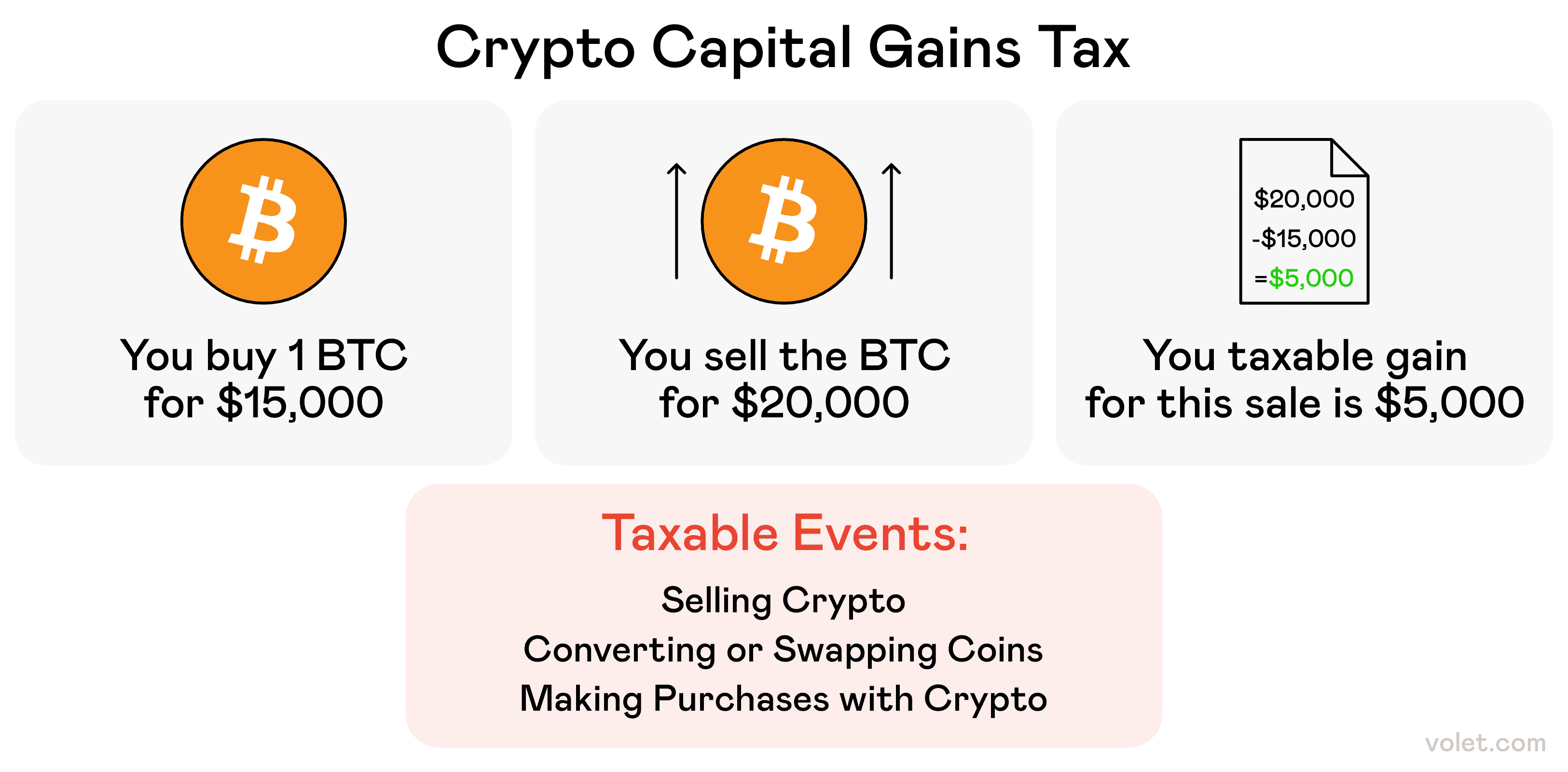

Illustration of how crypto capital gains tax is calculated, using an example of buying and selling Bitcoin.

Capital Gains Tax Rates: Short vs. Long-Term Drama

Here's where timing becomes everything. The tax rate for cryptocurrency varies based on how long you held the asset and your total taxable income for the year.

I learned this lesson with Dogecoin (don't judge me—it was 2021, and everyone was doing it). I bought some DOGE and sold it three weeks later for a nice profit. Since I held it for less than a year, I paid short-term capital gains tax, which is taxed at your ordinary income tax rate. For me, that was 24% at the time. Ouch.

Short-Term Capital Gains Tax

Short-term capital gains tax rates on cryptocurrency range from 10% to 37% if held for less than a year. These rates match your ordinary income tax brackets for 2025 (per IRS Revenue Procedure 2024-40, single filers):

- 10% for taxable income up to $11,600

- 12% for income $11,601–$47,150

- 22% for income $47,151–$100,525

- 24% for income $100,526–$191,950

- 32% for income $191,951–$243,725

- 35% for income $243,726–$609,350

- 37% for income over $609,350

Long-Term Capital Gains Tax

Long-term capital gains tax rates for cryptocurrency in 2025 (per IRS Revenue Procedure 2024-40, single filers):

- 0% for taxable income up to $48,350

- 15% for taxable income between $48,351 and $533,400

- 20% for taxable income over $533,400

Note: Tax brackets are for single filers. Check IRS publications for married filing jointly or other filing statuses.

My Bitcoin holdings from 2020? Those qualify for long-term capital gains rates now, which saves me a ton compared to my Dogecoin mistake.

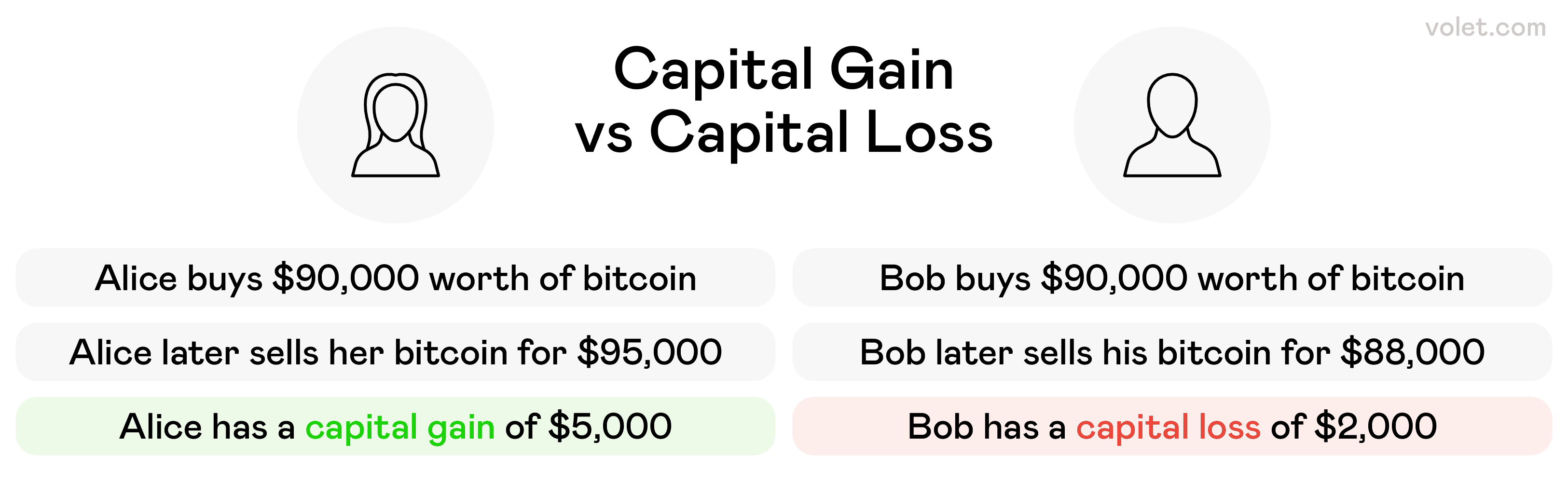

Comparison between capital gain and capital loss, and how it works.

Capital Gains and Losses: The Math That Matters

Every time you dispose of cryptocurrency, you need to calculate capital gains or losses. This is where having good records becomes absolutely critical.

Let me walk you through my first big Bitcoin sale in 2021. I sold 0.2 BTC for $10,000. Sounds great, right? But I needed to figure out my cost basis (what I originally paid for it).

Step-by-Step: How to Calculate Crypto Capital Gains

Step 1: Find your cost basis (purchase price + fees)

- I bought 0.2 BTC for $6,000 + $100 in fees = $6,100 cost basis

Step 2: Determine the sale price

- Sold for $10,000 - $50 in fees = $9,950 sale price

Step 3: Calculate gains or losses

- $9,950 - $6,100 = $3,850 in capital gains

Step 4: Determine if it's short-term or long-term

- Since I held it for over a year, it qualified for long-term capital gains rates

Cost Basis Methods: Choose Your Adventure

Here's where things get tricky—starting in 2025, you'll need to pick a cost-basis method and stick with it. Here are your options:

FIFO (First In, First Out):

- Assumes you sell your oldest crypto first

- Easy to understand and calculate

- Often results in lower gains if crypto prices have been rising

LIFO (Last In, First Out):

- Assumes you sell your newest crypto first

- Can be better when prices are falling

- More complex to track

HIFO (Highest In, First Out):

- Sells the crypto with the highest cost basis first

- Minimizes taxable gains

- Requires detailed record-keeping

I use HIFO because it helps minimize my tax liability, but it requires meticulous tracking. Whatever method you choose, be consistent—the IRS doesn't like it when you switch methods to minimize taxes.

Understanding Long-Term Capital Gains Tax Strategy

The difference between short-term and long-term capital gains tax can literally save you thousands. Let me show you with real numbers from my own experience.

In 2022, I had two similar Ethereum positions:

- Position A: Bought for $2,000, sold after 8 months for $3,000 (short-term gain of $1,000)

- Position B: Bought for $2,000, sold after 14 months for $3,000 (long-term gain of $1,000)

With my income putting me in the 24% tax bracket:

- Short-term gain: $1,000 × 24% = $240 in taxes

- Long-term gain: $1,000 × 15% = $150 in taxes

That extra six months of holding saved me $90 in taxes. Now imagine that across larger positions—the savings add up fast.

When Long-Term Capital Gains Tax Matters Most

Large Positions: The bigger your gains, the more you save with long-term rates

High-Income Brackets: If you're in higher tax brackets, the difference becomes even more significant

Portfolio Planning: I now plan my sales around the one-year mark when possible

Digital Assets and IRS Treatment

Here's something that tripped me up early on: for tax purposes, cryptocurrency is treated as property according to IRS guidelines. This means the same rules that apply to selling stocks or real estate also apply to your Bitcoin and Ethereum.

What does this mean practically? Every transaction creates a potential taxable event. When I first started trading altcoins in 2021, I was making dozens of trades per week. Each one created a taxable event that I needed to track and report.

Why the Property Classification Matters

Capital Gains Treatment: Your crypto profits are treated as capital gains, not regular income (unless you're a professional trader)

Like-Kind Exchanges Don't Apply: Unlike real estate, you can't do 1031 exchanges with crypto. Every trade is taxable.

Holding Period Rules: The same one-year rule for long-term vs. short-term applies to digital assets

Crypto to Crypto Swaps: The Hidden Tax Trap

This is probably the biggest "gotcha" in crypto taxes. When I started DeFi trading in 2021, I thought swapping tokens was just... swapping. Boy, was I wrong.

Every crypto-to-crypto swap is considered a disposal event subject to capital gains tax. When I traded my Litecoin for Solana, the IRS treated it as if I sold the Litecoin for cash and then bought Solana with that cash.

How to Handle Crypto to Crypto Swaps Correctly

Step 1: Determine the fair market value of what you're trading away

- Trading 10 LTC when each LTC is worth $150 = $1,500 fair market value

Step 2: Calculate your gains or losses

- If I originally bought those 10 LTC for $1,200, my gain is $300

Step 3: Report it properly

- This $300 gain gets reported on Form 8949 and Schedule D

The key thing to remember: you're not just moving crypto around—you're creating taxable events that need to be tracked and reported.

Crypto Tax Rate Breakdown by Income Level

Your crypto tax rate depends heavily on your total taxable income and how long you held your assets. Let me break this down with some real examples from different income levels.

Lower Income Brackets (Under $47,025)

If your taxable income is under $47,025, you qualify for the 0% long-term capital gains rate. This is huge! I have a friend who kept his day job income low and timed his crypto sales to take advantage of this.

Example: Sarah makes $40,000 at her day job and has $15,000 in long-term crypto capital gains. Her total taxable income is $55,025, so part of her gains qualify for 0% tax and part for 15%.

Middle Income Brackets ($47,026 - $518,900)

Most crypto investors fall into this range and pay 15% on long-term capital gains. Short-term gains still get taxed at your ordinary income tax rate.

Example: My situation in 2023—$80,000 in regular income, $20,000 in long-term crypto capital gains. I paid 15% on the crypto gains ($3,000) instead of my regular 22% rate.

High Income Brackets (Over $518,900)

High earners pay the maximum 20% rate on long-term capital gains, plus a potential 3.8% Net Investment Income Tax.

Net Investment Income Tax (NIIT) for High Earners

Here's something that caught me off guard when I had a really good crypto year—if your modified adjusted gross income (MAGI) exceeds $200,000 (single filers) or $250,000 (married filing jointly), you may owe an additional 3.8% Net Investment Income Tax on your cryptocurrency capital gains and other investment income. For example, if you're a single filer with $300,000 in MAGI, including $50,000 in long-term crypto gains, you'll pay the 15% long-term capital gains tax ($7,500) plus 3.8% NIIT ($1,900) on those gains. Trust me, always factor in the NIIT when planning high-value crypto sales, and consult a tax professional to calculate your MAGI accurately.

Tax Benefits of Long-Term Holding

Holding your cryptocurrency for the long term comes with significant tax benefits. The difference between short-term and long-term capital gains rates can be massive.

Let me share a real example from my portfolio. I bought Ethereum in early 2021 for $1,800 and had two choices in late 2021 when it hit $4,000:

Option 1 (What I almost did): Sell after 10 months

- Gain: $2,200

- Tax rate: 24% (my ordinary income rate)

- Taxes owed: $528

Option 2 (What I actually did): Wait 3 more months for long-term status

- Gain: $2,400 (price went up a bit more)

- Tax rate: 15% (long-term capital gains)

- Taxes owed: $360

By waiting those extra few months, I saved $168 in taxes and actually made $200 more in gains. That's a $368 difference for being patient.

Strategies for Maximizing Tax Benefits 📈

Calendar Management: I keep a spreadsheet tracking purchase dates to know when positions become long-term

Layered Selling: When I need to take profits, I sell my long-term positions first

Tax Planning: I coordinate with my accountant to time sales for optimal tax treatment

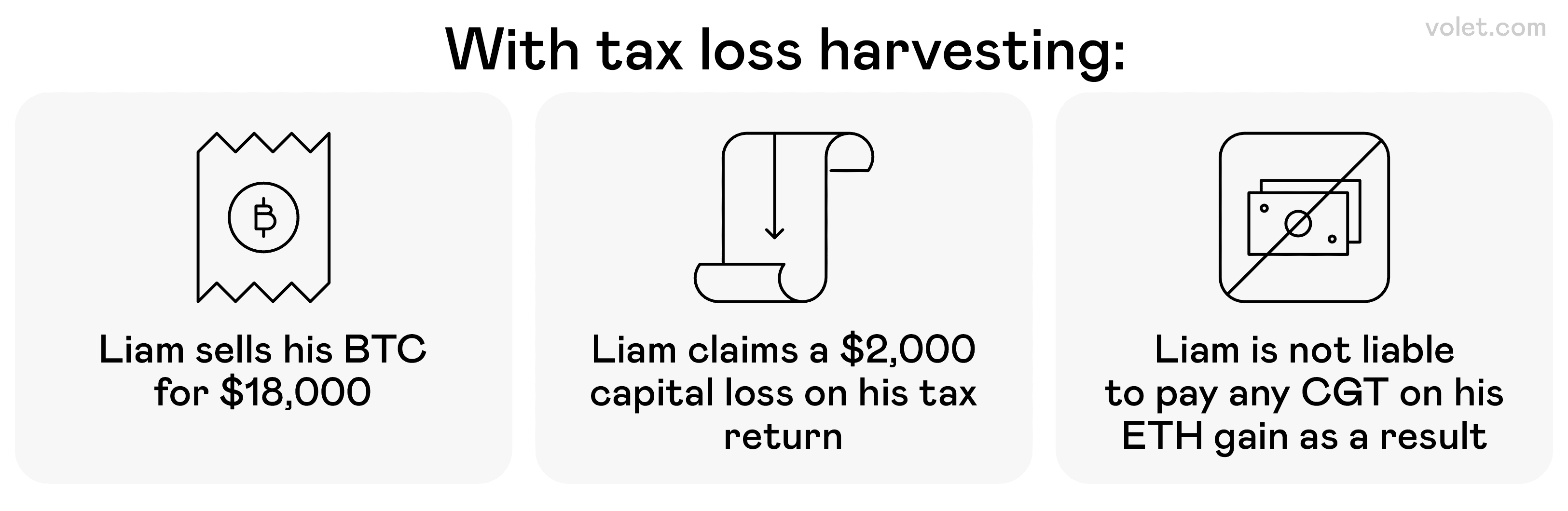

Illustration of how tax loss harvesting works in crypto.

Tax Loss Harvesting: Making Losses Work for You

Tax loss harvesting is honestly one of my favorite strategies because it turns crypto losses into tax advantages. The basic idea is simple: sell losing positions to offset your gains and reduce your tax liability.

In 2022, during the crypto winter, I had some positions that were down significantly. Instead of just holding and hoping, I strategically sold some losers to harvest the losses.

How Tax Loss Harvesting Works

Step 1: Identify losing positions

- I had Polkadot that I bought for $35 but was trading at $20

Step 2: Sell to realize the loss

- Sold my DOT position for a $1,500 capital loss

Step 3: Use the loss to offset gains

- Used that $1,500 loss to offset gains from other crypto sales

Step 4: Follow the rules

- Here's where it gets interesting—when tax loss harvesting, you can sell cryptocurrency at a loss to offset gains and repurchase the same crypto immediately, as wash sale rules don't currently apply to cryptocurrencies, which are treated as property (not securities) under IRS rules (26 U.S.C. § 1091). However, let me be real with you: proposed legislation, such as H.R. 7022 in 2024, could extend wash sale rules to digital assets in 2025 or later, potentially disallowing losses if you repurchase within 30 days. Monitor IRS.gov for updates, ensure accurate reporting, and consult a tax professional, as immediate repurchasing may draw scrutiny if misreported.

Tax Loss Harvesting Benefits

Offset Unlimited Capital Gains: Capital losses can offset any amount of capital gains

Reduce Ordinary Income: Can offset up to $3,000 of ordinary income per year

Carry Forward Losses: Unused losses carry forward to future tax years

I saved over $800 in taxes in 2022 using this strategy, turning my crypto losses into a tax advantage.

Crypto Mining Tax Implications

Crypto mining creates some unique tax challenges that caught me off guard when I tried mining Ethereum in 2021 (before the merge to proof-of-stake).

When you mine cryptocurrency, you incur income tax on the fair market value of the cryptocurrency at the time it's received. This means you owe taxes even if you don't sell the crypto right away.

My Mining Tax Experience

I set up a small mining rig and mined about $2,000 worth of Ethereum over six months. Here's what I learned:

Income Tax: Had to report $2,000 as ordinary income at my regular tax rate (24% at the time = $480 in taxes)

Deductible Expenses: Could deduct business expenses like:

- Electricity costs ($600)

- Equipment depreciation ($300)

- Internet and cooling costs ($100)

Future Sales: When I eventually sold the mined ETH, I calculated capital gains based on the fair market value when I received it (my new cost basis)

Tax Strategies for Miners

Track Everything: Document all mining rewards and their fair market value when received

Deduct Business Expenses: Keep receipts for electricity, equipment, and other mining costs

Consider Business Structure: Some miners benefit from forming an LLC for tax purposes

❌ Don't Forget Self-Employment Tax: Here's something that blindsided me—if crypto mining is your trade or business (e.g., regular and continuous activity with profit intent), you may owe self-employment tax (15.3%) on net earnings, in addition to income tax on the fair market value of mined crypto.

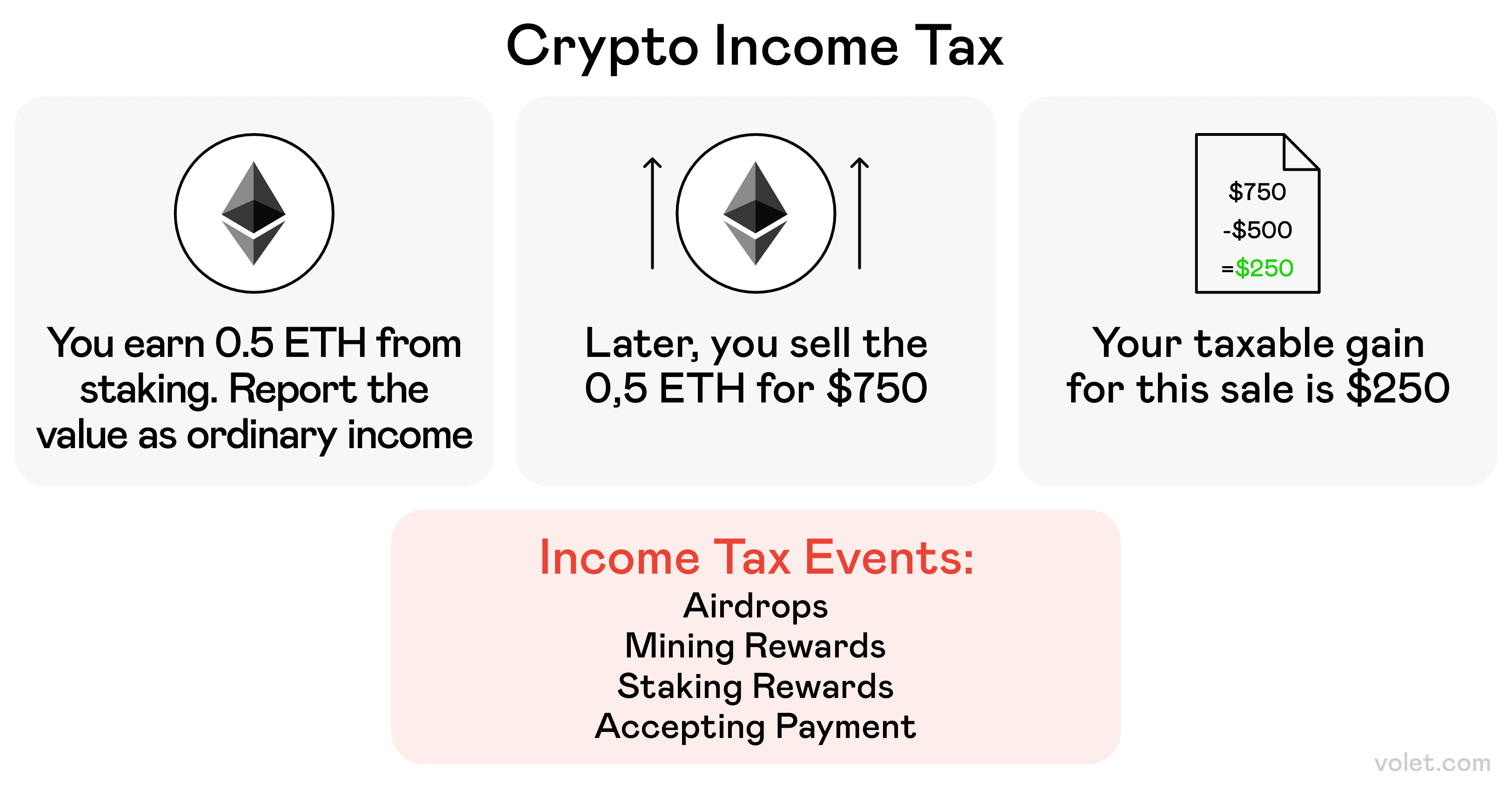

Illustration of how crypto income tax works, showing how earnings from staking are reported as income and later taxed on any gains when sold

Income Tax on Crypto Activities

Beyond capital gains, there are several ways crypto activities can generate ordinary income that you need to report on your tax return.

Different Types of Crypto Income

Staking Rewards: Cryptocurrency received as staking rewards is taxable as ordinary income at its fair market value when received. I stake Cardano and have to report those monthly rewards as income.

Airdrops: Those free tokens that randomly appear in your wallet? Here's the thing—income from airdrops is considered taxable income based on the fair market value of the cryptocurrency at the time of receipt.

Interest from Lending: If you lend crypto on platforms like BlockFi or Celsius, the interest you earn is ordinary income.

Payment for Services: Getting paid in crypto for work (like my freelance design projects) creates ordinary income at the fair market value when received.

How to Report Crypto Income

Schedule 1: For personal crypto income like staking rewards or occasional freelance payments

Schedule C: If crypto activities constitute a business (frequent trading, mining operation, etc.)

The key thing to remember: crypto income gets taxed at your ordinary income tax rate, not the favorable capital gains rates.

Reporting Requirements and Tax Forms

Let's talk about the paperwork—because that's where a lot of people mess up. Taxpayers must report capital gains and losses from cryptocurrency transactions on Form 8949 and Schedule D.

Essential Tax Forms for Crypto 📄

Form 8949: This is where you list every single crypto transaction that resulted in capital gains or losses. Every sale, every trade, every purchase with crypto—it all goes here.

Schedule D: This summarizes your total capital gains and losses from Form 8949. It's like the executive summary of your crypto trading activity.

Schedule 1: Use this for crypto income that isn't from capital gains—things like staking rewards, airdrops, or getting paid in crypto.

Schedule C: If you're treating crypto as a business (like professional trading or mining), you'll need this form.

My Form 8949 Nightmare (And How to Avoid It)

In 2021, I had over 200 crypto transactions to report. Each one needed its own line on Form 8949 with:

- Description of the asset

- Date acquired and sold

- Cost basis

- Sale proceeds

- Gain or loss

I tried doing it manually. Big mistake. After three sleepless nights, I finally bought crypto tax software. Best $100 I ever spent.

Accurate Crypto Tax Reports: Tools and Strategies

Speaking of crypto tax software, let me share what I've learned about getting accurate crypto tax reports without losing your sanity.

Crypto Tax Software Options

CoinLedger

- Connects to most major exchanges

- Handles complex transactions well

- Great customer support (I've used it)

Koinly

- Good for DeFi transactions

- Clean interface

- Sometimes struggles with complex swaps

TaxBit

- Professional-grade features

- More expensive but very thorough

- Used by many crypto businesses

Setting Up Accurate Tracking

Connect All Exchanges: Link every platform you've used—Coinbase, Binance, Kraken, etc.

Upload Wallet Transactions: Don't forget DeFi transactions and wallet-to-wallet transfers

Review Everything: Software isn't perfect—always review the generated reports

Keep Backup Records: Save CSV exports and transaction histories

❌ Don't Trust Blindly: I always spot-check a few transactions to make sure the software got them right

Working with a Tax Professional

After my 2021 tax disaster, I finally hired a tax professional who understands crypto. Best decision I made for my financial sanity.

When You Need Professional Help

Complex Portfolio: If you're dealing with DeFi, NFTs, multiple exchanges, and business activities, get help.

High-Value Transactions: When significant money is at stake, professional guidance pays for itself.

IRS Issues: If you've received notices or are being audited, don't go it alone.

Business Activities: If crypto is part of your business, you need professional tax planning.

Finding the Right Tax Professional

Crypto Experience: Make sure they actually understand digital assets, not just traditional investing

Recent Training: Tax laws change—ensure they're up to date on 2025 requirements

References: Ask for references from other crypto investors

❌ Avoid Generic Preparers: The person at the strip mall tax place probably won't cut it for complex crypto portfolios

Strategies to Minimize Your Tax Burden

Let me share some legitimate strategies I use to keep more of my crypto gains.

Legal Tax Reduction Strategies

Long-Term Holding: Holding cryptocurrency for more than a year can reduce your capital gains tax rate significantly. I plan major sales around the one-year mark when possible.

Tax Loss Harvesting: Strategically selling losing positions to offset gains. I do this quarterly to optimize my portfolio.

Charitable Donations: Here's something that surprised me—donating cryptocurrency to registered charity is not subject to capital gains tax and may result in tax deductions. I donated Bitcoin to my local food bank in 2023.

IRA Investments: You can hold cryptocurrency in a self-directed IRA to avoid taxes until retirement age. I'm considering this for part of my long-term holdings.

Advanced Strategies for Larger Portfolios

Geographic Diversification: Some crypto investors relocate to lower-tax jurisdictions (though this requires careful planning and professional advice)

Business Structure Optimization: Depending on your activities, different business structures might offer tax advantages

Estate Planning: For significant crypto holdings, proper estate planning can minimize taxes for your heirs

Common Mistakes That Cost You Money

Let me share the expensive mistakes I've made so you don't have to repeat them.

Mistake #1: Not Tracking Every Transaction

In 2021, I forgot to track several small altcoin trades. When I got an IRS notice, I spent weeks reconstructing transactions from email confirmations and browser history. Total nightmare.

Solution: Use crypto tax software from day one and sync it regularly.

Mistake #2: Ignoring Small Transactions

I used to ignore transactions under $50, thinking they wouldn't matter. Wrong. The IRS expects every transaction to be reported, regardless of size.

Solution: Track everything. Even that $5 coffee purchase with Bitcoin counts.

Mistake #3: Mixing Personal and Business Crypto

When I started freelancing for crypto payments, I made the mistake of mixing business and personal transactions in the same wallets.

Solution: Keep separate wallets for business activities and maintain clear records.

Mistake #4: Panic Selling Without Tax Planning

During the 2022 crash, I panic-sold several positions without considering the tax implications. I missed opportunities for tax loss harvesting and optimal timing.

Solution: Make a plan and stick to it. Emotional decisions rarely optimize for taxes.

Record Keeping: Your Tax Return's Best Friend

Good record-keeping is absolutely essential for accurate crypto tax reporting. Here's the system I use after learning from my mistakes.

Essential Records to Keep

Transaction Records:

- Date and time of each transaction

- Type of transaction (buy, sell, trade, etc.)

- Amount of crypto involved

- Fair market value in USD

- Exchange or platform used

- Transaction fees

Supporting Documentation:

- Exchange statements and confirmations

- Wallet addresses and transaction IDs

- Screenshots of important transactions

- Email confirmations from exchanges

My Record-Keeping System

Let me tell you, developing this system took me way too many painful tax seasons to figure out. But now that I've got it down, tax time is actually manageable (who am I kidding—it's still stressful, but at least I'm not pulling all-nighters anymore).

Digital Organization:

- One folder per tax year

- Subfolders for each exchange/platform

- Monthly exports from all platforms

- Backup everything to cloud storage

Here's where I learned the hard way—don't wait until December to export your data. I do it monthly now because some exchanges have limits on how far back you can pull transaction histories. Trust me, you don't want to be that person emailing customer support in March asking for records from two years ago.

Crypto Tax Software:

- Connected to all exchanges for automatic importing

- Regular reconciliation and review

- Annual backup of all data

The reconciliation part is crucial. I learned this when my tax software showed I had a $50,000 gain that I definitely didn't have. Turns out there was a duplicate transaction that got imported twice. Always, always double-check the numbers.

Physical Backup:

- Print important transaction summaries

- Keep hardware wallet recovery phrases secure

- Maintain a master list of all wallets and accounts

I know, I know—who prints stuff anymore? But when the IRS comes knocking, having paper backups has saved my butt more than once. Plus, if your computer crashes or gets hacked, you're not scrambling to recreate everything from memory.

Understanding Tax Liability Across Different Activities

Now, here's where things get interesting—your tax situation changes dramatically depending on how you're involved with crypto. I've been through most of these scenarios, and let me tell you, each one comes with its own headaches.

Casual Investor Tax Liability

If you're buying and holding crypto as an investment:

- Capital gains treatment on sales

- No self-employment tax

- Relatively simple reporting

My early crypto investing fell into this category, and honestly, taxes were pretty straightforward. Buy Bitcoin, hold Bitcoin, sell Bitcoin—easy to track, easy to report. Those were the days!

Active Trader Tax Liability

If you're making frequent trades:

- Potentially ordinary income treatment if you're a professional trader

- Possible self-employment tax

- Complex record-keeping requirements

When I went through my day-trading phase in 2021 (yeah, I thought I was the next crypto Warren Buffett), my tax situation became a nightmare. Hundreds of transactions, complex wash sale considerations, and way too many late nights trying to figure out my cost basis. Learn from my mistakes—if you're going to trade actively, set up proper tracking from day one.

Business-Related Tax Liability

If crypto is part of your business:

- Ordinary income on receipts

- Business expense deductions

- Self-employment tax considerations

- Quarterly estimated payments

My freelance design work paid in crypto falls into this category, and here's what caught me off guard—I had to start making quarterly estimated tax payments because crypto income isn't subject to withholding like regular paychecks. Missing those payments? Hello, underpayment penalties.

State Taxes on Crypto

Okay, here's something that completely blindsided me as far back as 2023—state taxes on crypto gains can be a real killer. Let's be real here, federal taxes are just the beginning of your crypto tax story.

Most states tax cryptocurrency gains as capital gains or income, aligning with IRS treatment. But here's where it gets painful—states like California hit you with up to 13.3% on top of federal taxes, while New York can add up to 10.9%. Compare that to states like Texas, Florida, and Wyoming that have no state income tax, and you're talking about potentially massive savings just based on where you live.

Now, here's where things get tricky with everyday purchases. When using crypto to buy goods or services, most states treat it as a barter transaction, taxing the capital gain (the difference between the crypto's fair market value and its cost basis) rather than imposing sales tax. But—and this is a big but—some states may apply sales tax to specific crypto transactions, depending on their guidelines.

Here's my advice from someone who learned this the expensive way: check your state's revenue department (like California FTB or NY DTF) for specific guidance, and seriously consider consulting a tax professional if you're dealing with significant amounts. The rules vary wildly from state to state, and what works in one place might get you in trouble somewhere else.

The Future of Crypto Taxation

Based on what I'm seeing from recent IRS guidance and proposed legislation, here's what has me both excited and worried for the coming years. Honestly, some of these changes are overdue, but others are making me nervous about increased complexity.

Anticipated Changes

Increased Reporting Requirements: Expect more detailed reporting similar to traditional securities. The days of crypto being the "Wild West" are numbered.

Enhanced Exchange Compliance: Crypto exchanges will provide more comprehensive tax documents. This is actually good news for most of us—less manual tracking!

Stricter Enforcement: The IRS is investing heavily in crypto compliance technology, and they're getting scarily good at matching up transactions across platforms.

Here's what has me worried for 2026 and beyond—the IRS is clearly building infrastructure to catch crypto tax evaders, and they're not messing around. The agency has been hiring cryptocurrency specialists and investing in blockchain analysis tools. If you've been playing fast and loose with crypto taxes, now's the time to get compliant before they come knocking.

Stay Informed on Tax Rate Changes: Capital gains and ordinary income tax rates for 2025 are set by current IRS guidelines (Revenue Procedure 2024-40). But here's the thing—future legislation could adjust these rates, so regularly check IRS updates or consult a tax professional to stay prepared for potential changes.

Staying Ahead of Changes

Regular Education: I follow crypto tax news and attend webinars when possible. Yeah, I know it sounds boring, but staying informed has saved me thousands in penalties and interest.

Professional Relationships: Maintaining relationships with knowledgeable tax professionals. Having a good crypto-savvy CPA on speed dial is worth every penny.

Flexible Systems: Using tools and processes that can adapt to changing requirements. The crypto tax software you choose today needs to handle whatever curveballs the IRS throws next year.

Conservative Approach: When in doubt, I err on the side of over-reporting rather than under-reporting. Trust me, it's better to be safe than sorry when dealing with the IRS.

Closing Thoughts

Look, I'll be brutally honest with you—crypto taxes are still a massive pain in the ass, even after everything I've learned over the years. But here's the reality check: they're not going anywhere, and the IRS is only getting better at tracking digital assets. Like, scary good at it.

The key is getting organized now before you're in the middle of tax season frantically trying to piece together transactions from three years ago. And trust me, I've been there—it's not fun, and it's definitely not cheap when you have to hire someone to clean up the mess.

Start tracking everything from your next transaction forward. Use good crypto tax software (seriously, don't be cheap here—it'll save you way more than it costs). Keep detailed records like your financial life depends on it because honestly, it kind of does. And when things get complicated—which they will—don't be too proud to get professional help.

I've made plenty of expensive mistakes along the way. From forgetting to track airdrops to panic-selling without considering tax implications, each screwup taught me something valuable. Hopefully, sharing these hard-learned lessons saves you from learning them the expensive way like I did.

Here's the bottom line: the crypto space is evolving rapidly, and so are the tax rules around it. What worked last year might not work this year. Stay informed, stay compliant, and remember—paying taxes on crypto gains means you actually made gains. That's still a win in my book! 🚀

But seriously, don't wing it. The stakes are getting higher every year, and the IRS is watching. Get your act together now, while you still have time to do it right.

Disclaimer

This article is provided for informational purposes only and does not constitute legal, financial, or professional advice. All content is based on publicly available information and personal opinions. Readers are advised to seek professional guidance before making decisions or acting based on the material presented. The author and publisher assume no liability for any actions taken or not taken. Tax information is based on IRS guidance as of May 2025. Rules may change, so verify with IRS.gov or a tax professional before filing.

Frequently Asked Questions

A taxable event occurs when you sell, trade, spend, or earn cryptocurrency. This includes converting crypto to fiat currency, trading one cryptocurrency for another, purchasing goods or services with crypto, and receiving crypto through mining, staking, or airdrops.

Cryptocurrency gains are subject to the same capital gains tax rates as other investments. Short-term gains (assets held less than one year) are taxed at ordinary income rates of 10-37%, while long-term gains (held over one year) are taxed at preferential rates of 0%, 15%, or 20% depending on your income level.

You should maintain detailed records of all cryptocurrency transactions, including dates, amounts, fair market values in USD, transaction fees, and the platforms used. Keep exchange statements, wallet addresses, transaction IDs, and any supporting documentation for at least seven years.

Yes, several strategies can help minimize taxes legally: holding crypto for over one year to qualify for long-term capital gains rates, using tax-loss harvesting to offset gains with losses, donating appreciated crypto to charity, and considering crypto investments within tax-advantaged retirement accounts.

Starting in 2025, crypto exchanges must provide Form 1099-DA detailing gross proceeds and, for certain transactions, cost basis. Taxpayers must track cost basis for all transactions using a consistent method (e.g., FIFO, LIFO, HIFO). The IRS is implementing enhanced enforcement measures, so maintain detailed records of all cryptocurrency transactions.