11 min

11 min 507

507Exploring What Types of Digital Tools and Products Can Be Created Using DeFi Applications

Discover the diverse digital tools and products you can create with DeFi applications. Learn how to leverage these innovations for your projects.

Ever found yourself staring at your bank statement, wondering why that transfer took three days and cost you $30? Yeah, me too. That was before I tumbled down the rabbit hole of decentralized finance (DeFi) and discovered a whole new world of possibilities.

I'm not going to pretend I'm some crypto genius (I once lost my private keys for a week—they were in my other jeans pocket 🤦♂️), but I've spent the last few years exploring this space, building applications, and making plenty of mistakes so you don't have to.

Today, I'm breaking down what types of digital tools and products can be created using DeFi applications—from lending platforms to experimental protocols I probably shouldn't have trusted with my money (but did anyway... for research purposes, obviously).

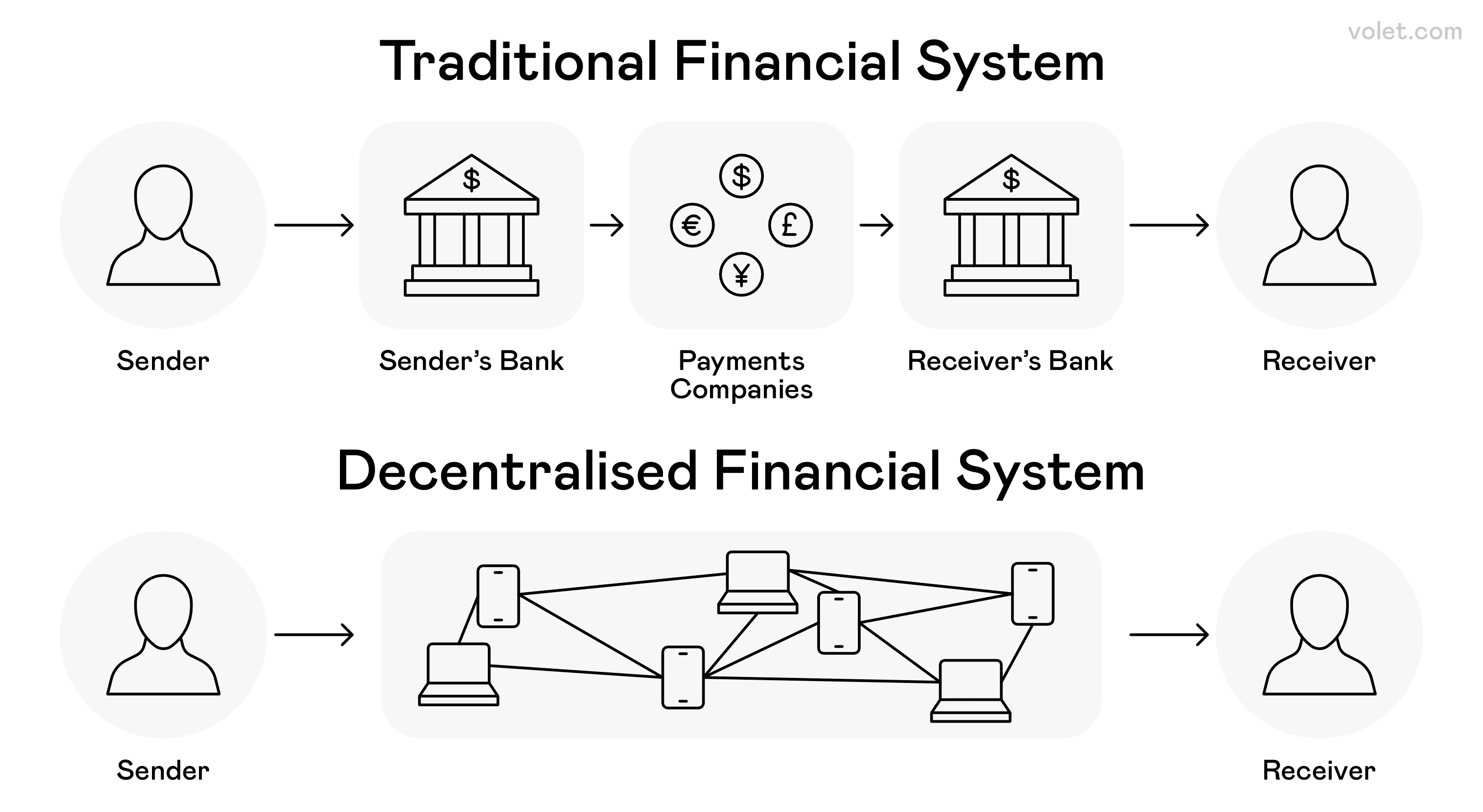

How a decentralized financial system enables direct value transfer between individuals using blockchain technology.

What Is Decentralized Finance DeFi and Why Should You Care?

I still remember my first encounter with traditional banking. I was fresh out of college, excited to start adulting with my new bank account. Then came the endless fees, the three-day waits for transfers, and the customer service calls that had me listening to elevator music for hours. "There has to be a better way," I thought while staring at yet another $35 overdraft fee on my account with exactly $0.47 in it. That frustration is what initially drew me to explore alternatives in the financial system.

Decentralized finance (or DeFi) uses blockchain technology and cryptocurrencies to let people conduct financial transactions directly with each other without intermediaries like banks. It's finance, but make it peer-to-peer.

Here's why DeFi matters:

✅ No intermediaries: Cuts out banks and other centralized institutions, reducing costs and transaction times

✅ Global access: Available to anyone with an internet connection

✅ Transparency: All transactions are recorded on blockchain networks

✅ Programmable money: Smart contracts automatically execute agreements without human intervention

✅ Higher interest rates: Generally offers better returns than traditional financial services (though with more risk—as I learned the hard way)

The traditional financial system relies on centralized authorities and financial institutions that act as gatekeepers. DeFi aims to create a blockchain-based financial system that democratizes access to financial services and provides options for unbanked populations worldwide.

What Types of Digital Tools and Products Can Be Created Using DeFi Applications

When people ask me what types of digital tools and products can be created using DeFi applications, I usually smile, knowing I'm about to blow their minds. The possibilities are incredible and expanding daily.

Last year, I tried explaining these DeFi tools to my mom, and she thought I was talking about science fiction. Fast forward to today, and she's regularly asking me which DeFi platforms offer the best interest rates! That's how quickly this technology is evolving and becoming accessible.

Let me walk you through the most innovative digital products you can build in this space—each representing a revolution in how we think about financial tools:

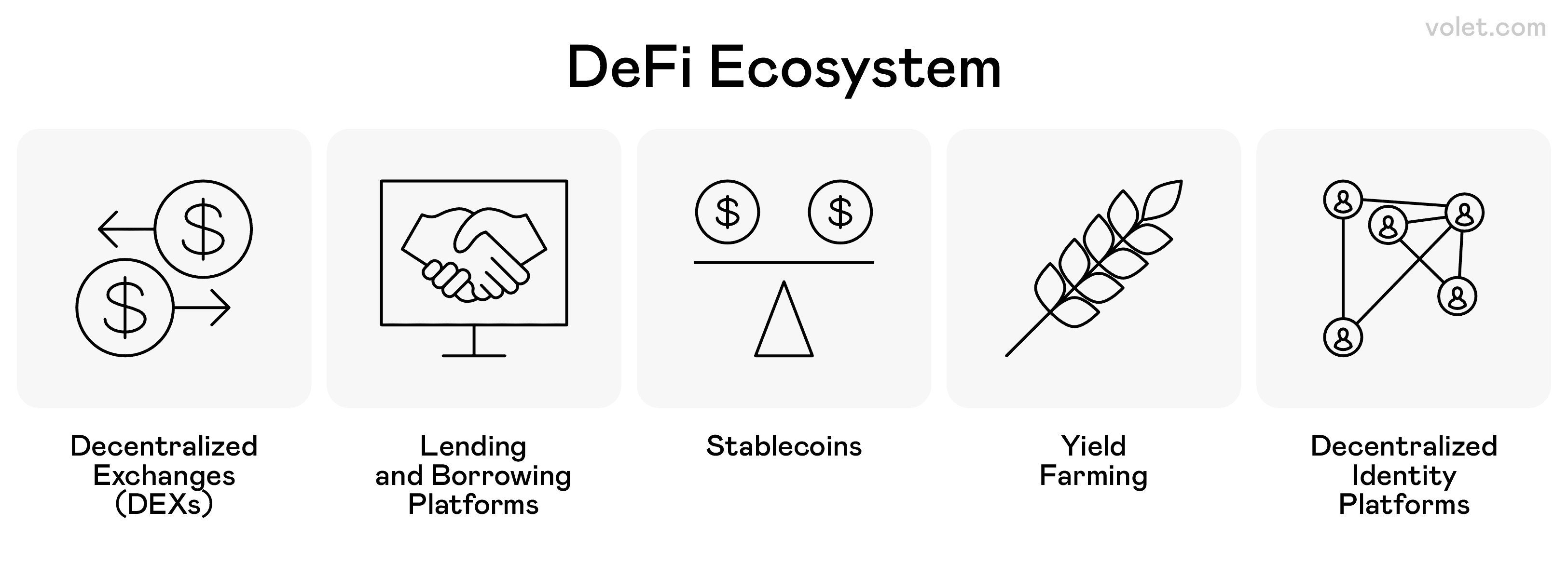

Decentralized Exchanges (DEXs)

Remember trying to open a brokerage account? The paperwork, the waiting, the minimum deposits… Decentralized exchanges flip that model on its head.

I built my first mini-DEX as a side project last year (it only supported two tokens and looked terrible, but it worked!). These DeFi tools allow users to trade digital assets directly from their crypto wallets without a central authority in the middle.

Popular examples include:

- Uniswap

- SushiSwap

- dYdX

The core technology behind these DeFi platforms uses liquidity pools rather than traditional order books. Instead of matching buyers with sellers, users trade against a pool of tokens locked in smart contracts.

Lending and Borrowing Platforms

One Friday night, while my friends were out partying, I was experimenting with flash loans (don't judge—we all have different hobbies). These are loans that are borrowed and repaid within a single transaction on the Ethereum blockchain. If they're not repaid, the transaction simply reverts like it never happened.

This is just one exotic lending mechanism that DeFi enables. More conventional lending platforms allow:

- Depositing assets to earn interest

- Borrowing assets by providing collateral

- Leveraging positions for higher returns (and higher risks—trust me, I've sweated through some close liquidation calls)

The best part? No credit checks. The blockchain doesn't care about your FICO score; it cares about your collateral. This democratizes financial access by allowing anyone with collateral to access loans without going through traditional financial services.

Stablecoins and Payment Solutions

"But isn't crypto super volatile?" That's usually the first question I get when talking about using DeFi for everyday transactions. It's a fair point—I wouldn't want my grocery money-losing 20% of its value overnight either.

Enter stablecoins: cryptocurrencies pegged to stable assets like the US dollar or other fiat currency. These tokens bridge the volatility gap while retaining the benefits of blockchain technology.

You can build:

- Stablecoin payment processors

- Cross-border payment applications (I used Stellar to send money internationally in seconds with low fees—try doing that with a bank wire!)

- Programmable money flows (like automatically splitting incoming payments between savings, investments, and expenses)

Yield Aggregators and Farming Tools

I once spent three hours manually moving funds between different DeFi protocols to maximize my returns. Then I discovered yield farming tools and felt pretty silly.

These DeFi services:

- Automatically move users' assets between different protocols to maximize returns

- Compound interest earnings

- Minimize transaction costs through smart contract optimization

Building a yield aggregator requires a deep understanding of various DeFi protocols, but the concept is straightforward: help users earn interest on their crypto assets with the least amount of effort.

Innovative DeFi Tools Transforming the Financial System

The most exciting aspect of DeFi is how it's spawning entirely new financial products that never existed before. Let's explore some of the more innovative tools you can create:

Automated Portfolio Management

I used to spend hours rebalancing my crypto assets. Then I built a simple tool that automatically maintained my desired asset allocations. This concept can be expanded into sophisticated portfolio management systems that:

- Rebalance assets based on user-defined parameters

- Implement custom investment strategies

- Provide risk management features

- Track performance against benchmarks

Platforms like Kubera now track DeFi, crypto, and traditional assets in one dashboard, giving users a holistic view of their financial landscape.

Prediction Markets and Insurance Services

Decentralized prediction markets allow token holders to bet on the outcome of events, from election results to sports matches. Similarly, DeFi insurance protocols like Nexus Mutual provide coverage against smart contract failures.

These platforms use financial incentives to create markets that can:

- Forecast events with remarkable accuracy

- Provide coverage for previously uninsurable risks

- Create entirely new economic incentive models

I experimented with building a micro prediction market for my local sports league, and while adoption was limited, the technology worked flawlessly.

Tokenization Platforms for Real Assets

One of the most promising frontiers in DeFi is the tokenization of real-world assets. I'm currently working on a platform that tokenizes rental properties, allowing fractional ownership and automated revenue distribution.

Tokenization enables:

- Breaking expensive real assets into affordable, tradable fractions

- Programming automated dividend distributions

- Creating liquid markets for traditionally illiquid assets

- Reducing the administrative overhead of asset management

The possibilities extend far beyond real estate to art, commodities, intellectual property, and virtually any asset class you can imagine.

Illustration of the key components of the DeFi ecosystem.

DeFi Ecosystem: Essential Infrastructure and Services

Building in the DeFi ecosystem doesn't mean starting from scratch. There's a robust umbrella term of tools and services that developers can leverage:

Crypto Wallets and Key Management

Crypto wallets are the gateway to DeFi for most users. MetaMask, a browser extension wallet compatible with Ethereum, has become the de facto standard for DeFi interactions.

When building DeFi applications, consider:

- Wallet integration options (MetaMask, WalletConnect, Coinbase Wallet)

- Key management solutions (users losing private keys is still a major issue)

- Multi-chain support

- Security features like multi-sig requirements

Data Analytics and Visualization

Tools like DeFi Llama track total value locked and changes in value for various protocols, while DeFi Pulse provides rankings and metrics for different DeFi services. Dune Analytics offers powerful tools for visualizing blockchain data.

For my projects, I've found that integrating analytics dashboards directly into the application significantly improves user confidence and engagement.

Development Frameworks and Libraries

The development ecosystem for DeFi has matured significantly. Frameworks like:

- Hardhat for the Ethereum development environment

- The Graph for indexing blockchain data

- Moralis for backend infrastructure

- Chainlink for Oracle services

These tools dramatically reduce development time and improve reliability.

Practical Use Cases of DeFi Applications in Daily Life

It's easy to get lost in the technical aspects of DeFi, but what matters most is how these tools can improve people's financial lives. Here are some practical applications I've found valuable:

Earning Better Interest on Savings

My savings accounts at traditional banks were earning 0.01% interest. My DeFi investments? Anywhere from 3-15% APY (though with more risk). DeFi platforms offer significantly higher interest rates than those offered by banks because they eliminate overhead costs and operate 24/7.

Cross-Border Payments Without the Hassle

When I needed to send money to a freelancer in Asia, traditional financial services wanted to charge me $45 and take 3-5 business days. Using a DeFi app, I completed the same transaction for less than $1 in under a minute.

Asset Management for Businesses

Traditional financial institutions often require substantial minimum investments. With DeFi, businesses have been able to:

- Build diversified portfolios starting with modest amounts

- Access sophisticated financial strategies previously reserved for the wealthy

- Maintain complete control over their assets at all times

- Automate investment strategies based on risk tolerance

Creating Passive Income Through Providing Liquidity

By providing liquidity to liquidity pools on decentralized exchanges, I've created passive income streams that require minimal maintenance. Liquidity providers earn fees from trades executed against their pooled assets, creating a steady stream of revenue.

For businesses looking to optimize their treasury operations, DeFi tools offer new ways to earn interest on idle capital while maintaining liquidity for operational needs.

Highlights of the key challenges in DeFi development.

Challenges and Considerations in DeFi Development

I'd be doing you a disservice if I painted DeFi as all rainbows and unicorns. There are significant challenges to consider:

Security Risks and Vulnerabilities

Smart contract vulnerabilities have led to billions in stolen funds. Any development in the DeFi space must prioritize security above all else, especially when dealing with Maker vaults and other complex DeFi services that handle large amounts of value.

Regulatory Uncertainty

The regulatory landscape for DeFi is still evolving, with significant differences between jurisdictions. Government agencies worldwide are still determining how to approach this new financial paradigm, creating uncertainty that can impact the design and functionality of your applications.

User Experience Hurdles

Despite improvements, DeFi still has a steep learning curve. Creating intuitive, user-friendly interfaces remains a major challenge for widespread adoption, especially for users coming from traditional finance or centralized finance (CeFi) platforms.

Scalability and Gas Fees

Network congestion and high transaction costs on blockchains like Ethereum can make certain DeFi applications impractical for everyday use, though Layer 2 solutions are helping address these issues.

Closing Thoughts

When I reflect on my journey through the world of DeFi applications, I'm amazed by how quickly this space has evolved. From clunky interfaces and frequent exploits to sophisticated financial tools challenging traditional financial institutions, the progress has been remarkable.

The beauty of DeFi lies in its openness. You don't need permission from gatekeepers to build innovative financial products. With coding skills, determination, and a healthy respect for the risks involved, anyone can contribute to this financial revolution.

As you explore what types of digital tools and products can be created using DeFi applications, remember that the most successful projects solve real problems for real people. Beyond the hype and technical fascination, DeFi's ultimate promise is democratizing finance and creating a more inclusive, efficient financial system.

I still check my traditional bank account occasionally, but increasingly, my financial life exists within the DeFi ecosystem. Despite its challenges, I believe we're just scratching the surface of what's possible with these new technologies.

Disclaimer

This article is provided for informational purposes only and does not constitute legal, financial, or professional advice. All content is based on publicly available information and personal opinions. Readers should seek professional guidance before making decisions or acting based on the material presented. The author and publisher assume no liability for any actions taken or not taken by the reader based on the information contained herein.

Frequently Asked Questions

To start building DeFi applications, you need a development environment like Hardhat or Truffle, knowledge of Solidity for smart contract development, and frameworks like React.js with Web3.js or ethers.js for frontend integration. Familiarity with tools like MetaMask for testing is also essential.

Decentralized exchanges operate without intermediaries, allowing direct peer-to-peer trading through smart contracts instead of order books. They typically offer non-custodial trading (meaning you maintain control of your assets), greater privacy, and access to a wider range of tokens than traditional exchanges.

The most important security considerations include thorough smart contract auditing, implementing emergency pause mechanisms, following established security patterns, using battle-tested code libraries, conducting extensive testing, and starting with limited funds until security is proven.

DeFi applications can implement KYC/AML procedures where required, geofencing to restrict access from certain jurisdictions, maintain transparent documentation, engage with regulatory bodies proactively, and design flexible systems that can adapt to regulatory changes.

User-friendly DeFi applications feature intuitive interfaces that abstract away technical complexity, clear explanations of risks and rewards, robust error handling with helpful messages, responsive design for all devices, and step-by-step guidance for complex operations like providing liquidity or yield farming.