12 min

12 min 884

884How Can Someone Send Me Money?

Discover the best ways to send and receive money easily. Explore top methods for hassle-free transfers and find the right option for you

Here’s something that’ll blow your mind: J.P. Morgan’s Kinexys has quietly processed over $1.5 trillion in blockchain transactions over the past four years—yep, trillion with a ‘T’—and they’re now pushing $2 billion daily. While digging into payment innovations for a client piece, I stumbled across these jaw-dropping Kinexys numbers and found a comprehensive whitepaper by Arati Baliga, Subhod I, Pandurang Kamat, and Siddhartha Chatterjee.

Their study, "Performance Evaluation of the Quorum Blockchain Platform," reveals how Quorum’s efficient consensus algorithms and privacy features make it a powerhouse for secure, high-volume transactions. This got me thinking—if massive institutions are embracing blockchain-based payment rails like Quorum, what does that mean for regular folks like us who are still struggling with basic questions like "How can someone send me money?" This disconnect between institutional innovation and everyday payment needs is exactly why understanding your options matters more than ever.

Here's my story: Three weeks ago, a client in Toronto needed to pay me for a DeFi analysis report. Simple enough, except I spent two hours researching the "best" way to receive international payments and still ended up paying $35 in fees. That's when I realized I needed to get serious about understanding every single way someone can send me money in 2025.

So I did what any obsessive finance writer would do—I tested everything. Apps, wire transfers, crypto services, even old-school money orders (don't ask). The result? This comprehensive breakdown of every method is worth knowing about, complete with the real costs, actual speeds, and honest pros and cons.

Adulting 101: Finally Send That Cash to Mom

There's no perfect solution for every situation. Each method has sweet spots and pain points. Some offer lightning-fast transfers but charge fees that'll make you wince. Others are practically free but take forever to process.

The key is understanding what matters most: speed, cost, convenience, or security. Whether you need to receive money from friends and family or handle business transactions, the right choice depends on your specific needs.

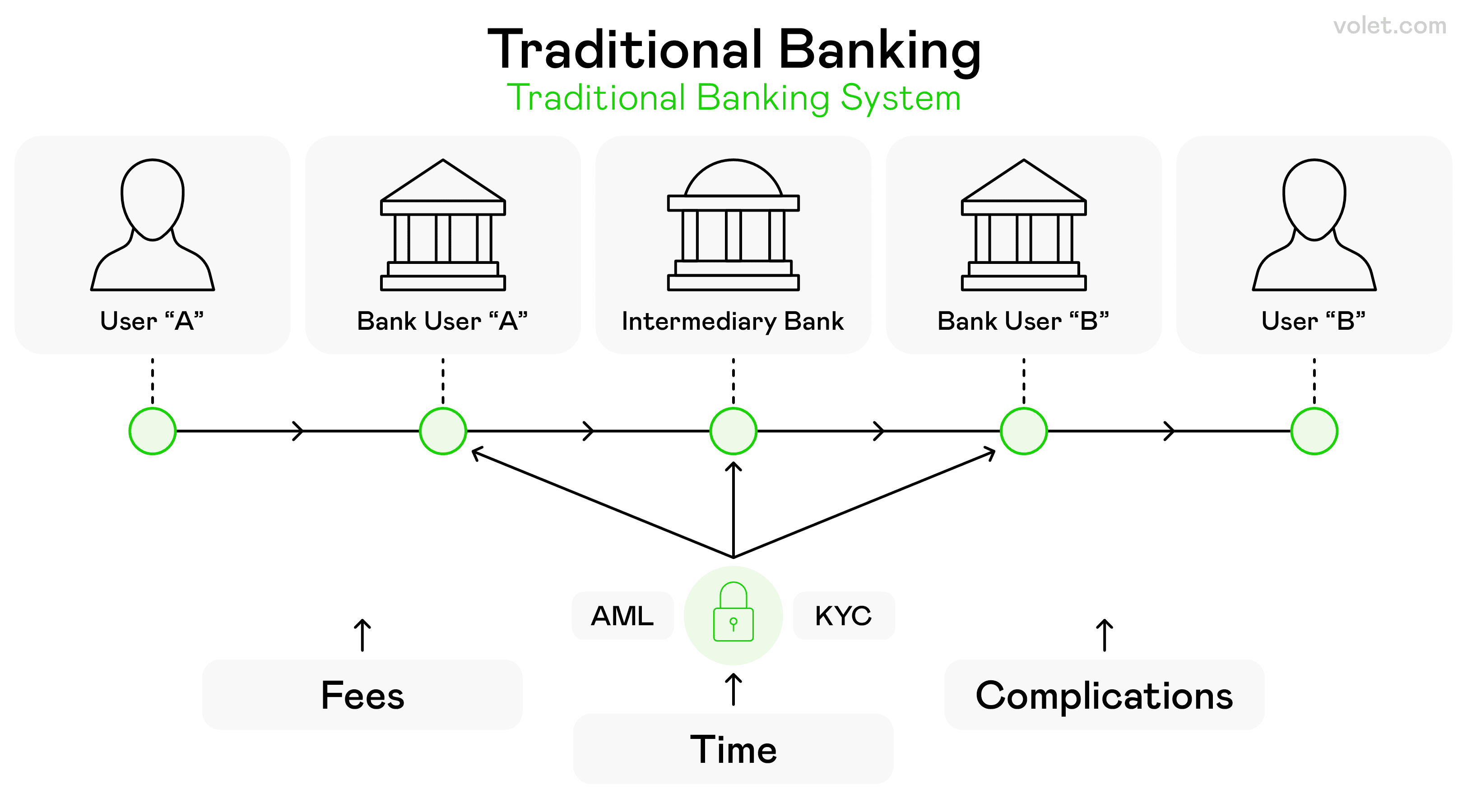

The complexity of traditional banking, involving multiple banks and processes

1. Traditional Banking Methods

Let's start with the backbone of money transfers—traditional banking methods. These remain essential because they offer the highest security and work seamlessly with your existing financial relationships.

Bank Account Transfers

Your bank account is the foundation of most money transfers and for good reason. When someone wants to send money directly to your account they will need your routing numbers and account info. This method allows you to receive money safely and securely through established financial institutions. The process is easy: provide your bank info and funds arrive in 1-3 business days.

Most financial institutions are members of FDIC, so your money's protected up to $250,000. This gives you peace of mind when dealing with larger dollar amounts.

- Free to receive in most cases

- High security through established financial institutions

- Works for large amounts

- Member FDIC protection

- No transaction fees for basic transfers

- Takes 1-3 business days

- Requires sharing of sensitive payment details

- Not ideal for urgent payments

Savings Account Transfers

You can also receive money directly into your savings account, which works similarly to checking account transfers but might take slightly longer to process. The advantage? Your money starts earning interest immediately, making this an attractive option for funds you don't need access to right away.

This method works particularly well for family member support payments or regular transfers where immediate access isn't crucial.

Wire Transfers

Here's where things get serious. Wire transfers are the heavyweights of money movement – they’re fast, secure and perfect for large amounts. I learned about wire transfers when a friend bought his first investment property. The seller needed $50,000 transferred in 24 hours and honestly no other method could handle that kind of speed and security for that large of an amount. Wire transfers are electronic payments that go directly from one bank account to another.

For domestic transfers, the sender needs your name, address, bank account, and routing numbers. Bank wire transfers deliver large amounts from one bank to another within hours or minutes.

The delivery time for wire transfers can vary but is generally one business day or less. However, bank wire transfers generally have a median domestic cost of $25 for sending and $15 for receiving.

Pro tip: Double-check all details before requesting a wire transfer. Wire transfers are irreversible, making them secure but risky if sent to the wrong account.

- Lightning-fast (same day or within hours)

- Extremely secure

- Perfect for large transactions

- Wire transfers are irreversible, making them secure

- Handled by established financial institutions

- Wire transfers may incur higher fees than other transfer methods

- Can't be reversed if sent to the wrong account

- Requires precise recipient details

- Higher transaction fees compared to other methods

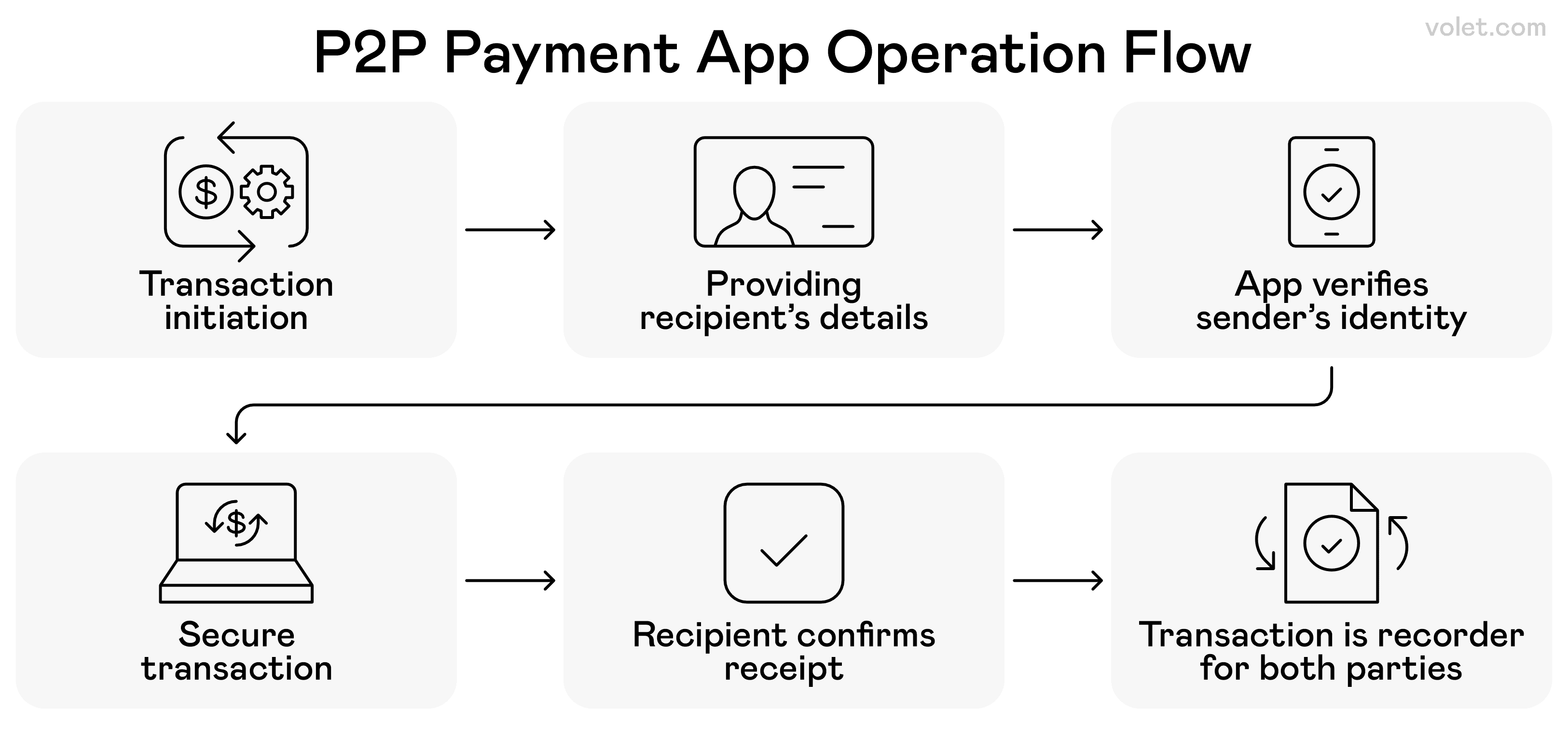

The step-by-step process of how peer-to-peer (P2P) payment apps handle transactions securely between users

2. Peer-to-Peer (P2P) Payment Apps

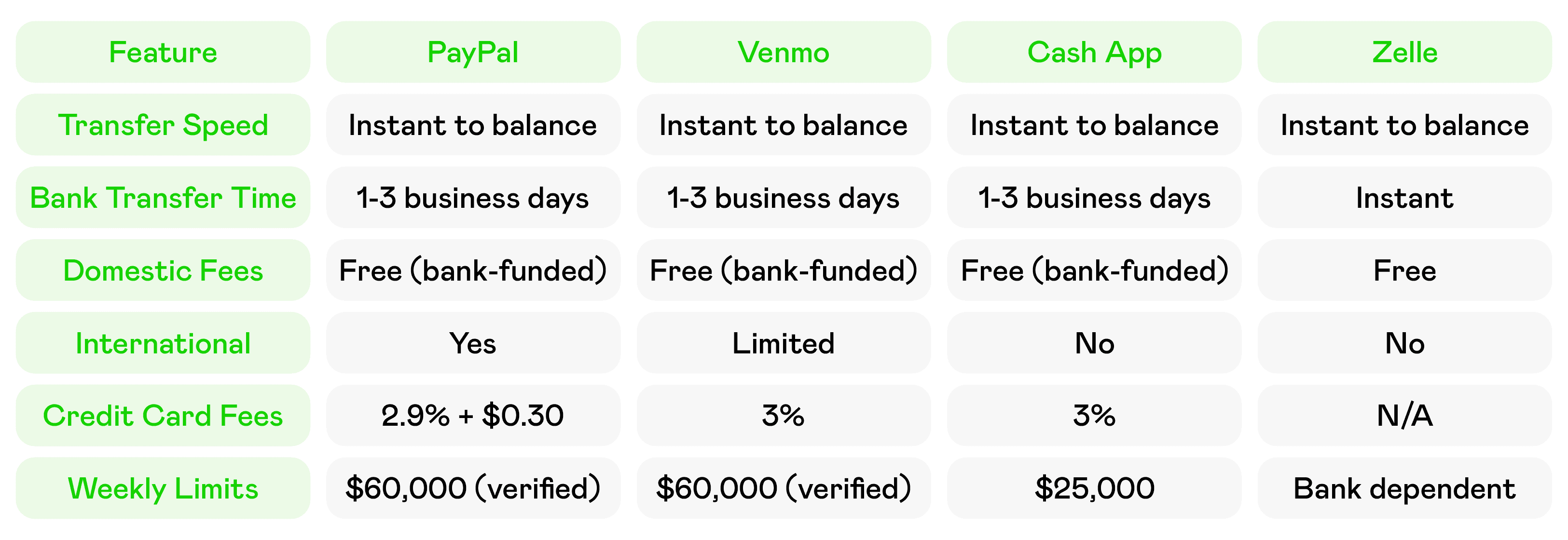

Now we're talking! This is where the money transfer revolution really took off. P2P payment apps have completely changed how we send and receive money making it easier than ever to transfer between friends and family. These apps are great for quick small to medium transfers with minimal hassle.

PayPal

Let me tell you about my PayPal experience. I’ve been using it for years and here’s what I’ve learned: PayPal offers free transfers in the US when you fund with a bank account or PayPal balance. The money goes into your PayPal balance instantly but receiving money through PayPal takes 1-3 business days if you transfer it to your bank account.

PayPal is synonymous with online payments and for good reason. It’s widely accepted, has buyer protection and works internationally making it perfect for personal and business transactions.

- Instant receipt to PayPal balance

- International Capabilities

- Buyer/seller protection

- Widely accepted by merchants

- Free transfers from a linked bank account

- 1-3 business days to transfer to the bank

- Transaction fees for credit card funding

- Account can be frozen for suspicious activity

- Less social than newer apps

Venmo

Venmo's social aspect makes it fun to split bills with friends, and that's exactly where it shines. You can send up to $60,000 per week using Venmo after verifying your identity. The money you receive on Venmo shows up instantly in your Venmo balance, but transferring to your bank takes the usual 1-3 days.

What sets Venmo apart is its social feed feature, which lets you add comments and emojis to payments (though I recommend keeping financial details private). It's become the go-to app for younger users who want to send money to friends easily.

- Instant receipt to Venmo balance

- Social features make it engaging

- Easy bill splitting with friends

- High weekly limits after verification

- Free transfers from a linked bank account

- 1-3 business days to bank transfer

- Social features may compromise privacy

- Limited international capabilities

- Instant cash-out fees apply

Cash App

Cash App became my go-to for quick domestic transfers because of its versatility. Cash App lets you send and receive money for free with cash from your linked bank account or debit card. The platform has evolved beyond simple transfers to include investing, Bitcoin trading, and even a physical card.

The catch? You can cash out to your debit card from the Cash App instantly, but you'll pay a fee of 0.5%-1.75%. Also, if you send money using a credit card on Cash App, you'll be charged a 3% fee.

- Instant transfers to Cash App balance

- Additional features (investing, Bitcoin)

- Physical Cash Card available

- Simple, clean interface

- Free transfers from bank account

- Instant cash-out fees

- Credit card funding charges 3%

- Limited customer support

- Account security concerns

Zelle

Here's something cool—you might already be using Zelle's service through your bank's website or mobile app without realizing it. Most major banks have integrated Zelle, making transfers between enrolled users instant and free, as noted in Zelle’s FAQ. This integration with existing banking relationships makes Zelle incredibly convenient.

The beauty of Zelle is its simplicity. Enrolled users typically occur through their existing bank relationships, so there's no separate app to download in many cases. When someone sends you money through Zelle, it appears directly in your bank account within minutes.

- Instant transfers directly to a bank account

- No separate app is needed (usually)

- Free transfers between enrolled users

- Backed by major banks

- High security through banking partnerships

- Both parties must be enrolled

- Limited to domestic transfers

- No payment protection like PayPal

- Transaction limits vary by bank

Volet.com

For those dealing with international transfers, Volet.com represents the next generation of cross-border payment solutions. This platform specializes in making international money transfers more efficient and cost-effective than traditional methods.

Volet.com leverages modern technology to offer competitive exchange rates and lower fees compared to traditional money transfer services. The service focuses on transparency, showing you exactly what you'll pay upfront without hidden charges, as highlighted in their fee structure.

- Competitive international exchange rates

- Transparent fee structure

- Modern, user-friendly interface

- Faster than traditional international transfers

- Lower costs than banks for international transfers

- A newer platform with a limited track record

- May not be available in all countries

- Smaller networks than established providers

- Limited customer support locations

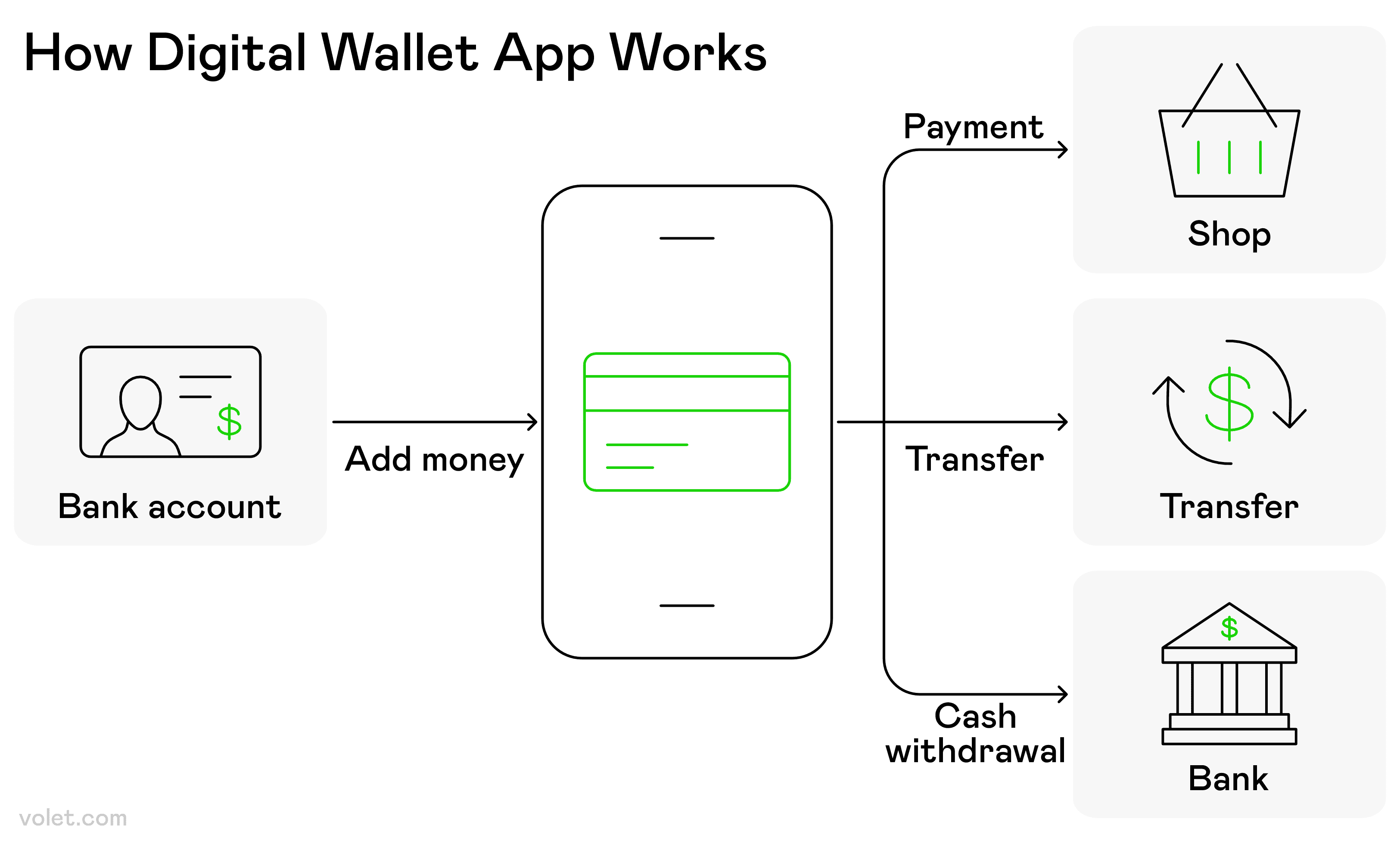

3. Mobile Wallet Solutions

How a mobile wallet app enables users to add money from a bank account and make payments, transfers, or cash withdrawals

Mobile wallets are a must for contactless payments and quick transfers. These digital solutions allow you to store and manage your financial accounts right on your phone.

Mobile wallets let you send and receive money through various apps and have advanced security features like biometric authentication. Using a mobile wallet you can send money by adding your payment and recipient info with just your mobile number.

Many mobile wallet services have minimal transaction fees for sending money, especially domestically. You can send money to someone who also uses a mobile wallet service, creating a seamless digital payment ecosystem.

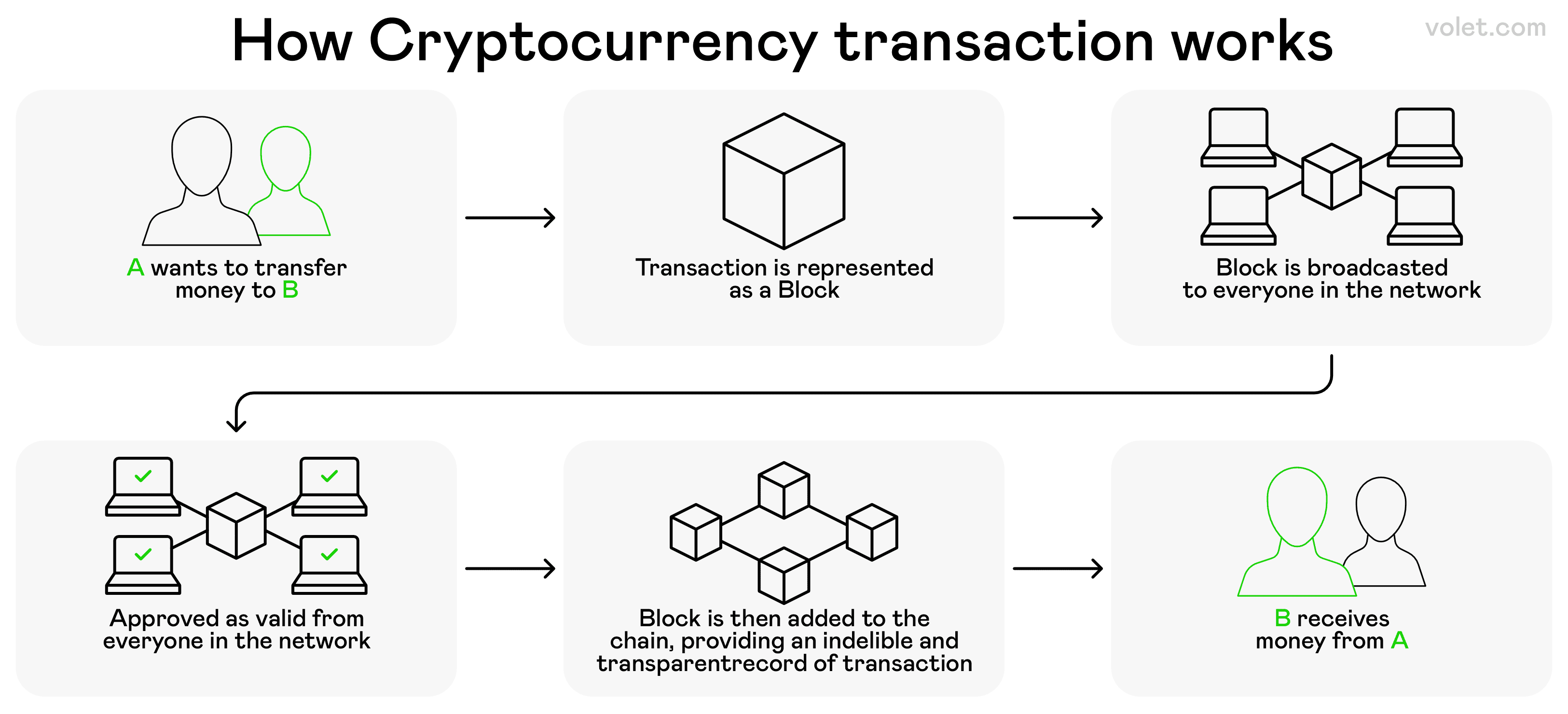

The steps of a crypto transaction from initiation to confirmation on the blockchain

4. Cryptocurrency Transfers

With institutions like J.P. Morgan leveraging Quorum’s blockchain, as detailed in Baliga’s whitepaper, crypto transfers are gaining traction for tech-savvy users. Quorum’s RAFT and IBFT consensus algorithms ensure fast, secure transactions with privacy, ideal for high-value transfers like Kinexys. Here’s what everyday crypto transfers look like:

Direct Cryptocurrency Transfers

You can receive money through direct cryptocurrency transfers using popular coins like Bitcoin, and Ethereum or stablecoins like USDC. The sender needs your wallet address—a long string of characters that’s like your account number.

- Near-instant transfers (minutes vs. days)

- Lower fees for international transfers

- No traditional banking required

- 24/7 availability

- High volatility for non-stablecoin transfers

- Requires technical knowledge

- Limited merchant acceptance

- Irreversible transactions

Crypto-to-Fiat Services

Services like Coinbase, Volet.com, PayPal (crypto feature), and Cash App allow you to receive cryptocurrency and instantly convert it to cash in your account. This bridges the gap between crypto and traditional money transfer.

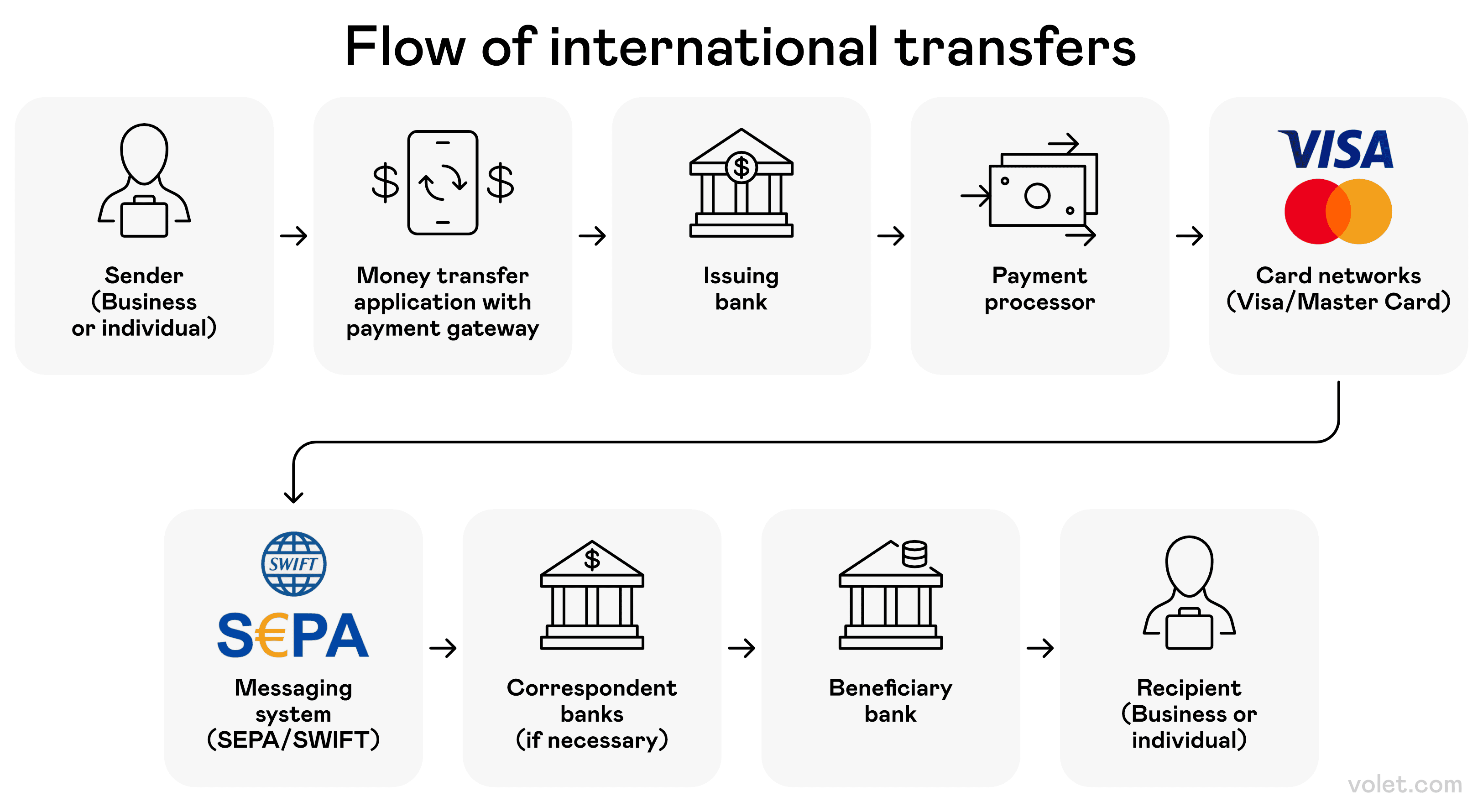

The flow of international money transfers from sender to recipient through banks, processors, card networks, and SWIFT/SEPA systems

5. International Money Transfer Services

When you need to receive money from another country, specialized money transfer services often offer better rates and faster delivery than banks.

Traditional International Services

Western Union: The Global Network Western Union is in over 200 countries, multiple ways to receive money—direct to your bank account, cash pickup at a location or loaded onto a prepaid debit card.

The flexibility is impressive. You can receive cash through their network of agents worldwide, making it accessible even in areas with limited banking infrastructure.

MoneyGram: The Alternative Network MoneyGram offers similar services with a focus on cash pickup locations and direct bank transfers. Their network spans globally, though it's slightly smaller than Western Union's reach.

Modern Digital Services

Online money transfer providers like Wise, Remitly, and others offer better exchange rates and lower fees than traditional banks or Western Union. Their tech-driven approach mirrors Quorum’s efficiency, as highlighted in the whitepaper, making international transfers faster and cheaper.

6 Traditional Cash Methods

Despite the digital revolution, traditional cash methods still have their place, especially when modern methods aren't practical or available.

Personal Checks and Cashier's Checks

Personal checks remain a common method of sending cash to someone, though they're becoming less popular. Cashier's checks are more secure as they're issued by a bank and drawn from the bank's own funds—I used one when buying my car as the dealer required guaranteed funds.

These provide security while maintaining the familiar check format, particularly useful for large transactions where both parties want guaranteed funds.

Money Orders: International-Friendly

Money orders guarantee the recipient a specific amount of money and can be used for international payments. They can be cashed only after the recipient endorses them, providing security against theft.

The beauty of money orders is their wide acceptance and relative security compared to personal checks, particularly useful when dealing with recipients without traditional bank accounts.

Prepaid Debit Card Options

A prepaid debit card can be loaded with money and doesn’t require a traditional bank account to use. They’re perfect for people without traditional banking relationships or for sending money to someone who doesn’t want to share their bank account details.

However, prepaid cards can get lost in transit when mailed. Most prepaid debit cards come with various fees for loading, using, and maintaining the card.

Closing Thoughts

After testing every way to receive money, my take is clear: there’s no one-size-fits-all. Your best option depends on whether you’re handling friend payments, international clients, or business deals.

For quick friend payments, I lean on Venmo or Cash App. For international clients, I compare modern services against wire transfers. For big deals like real estate, wire transfers are king, just as Quorum’s high-throughput design makes it ideal for J.P. Morgan’s massive transactions, per Baliga’s whitepaper.

My advice? Set up accounts with 2-3 different services to cover various scenarios. Have a P2P app for social payments, understand your bank's wire transfer process for large, urgent payments, and always prioritize security when sharing payment details.

Most importantly, always check the total cost before choosing a method. That "free" transfer might cost you more in hidden exchange rate markups than a service with transparent fees. Factor in transaction fees, delivery time, and security features when making your decision.

Disclaimer

This article is provided for informational purposes only and does not constitute legal, financial, or professional advice. Readers are advised to seek professional guidance before making financial decisions.

Frequently Asked Questions

P2P apps like Venmo, Zelle, or Cash App typically offer instant transfers. Zelle through your bank is often the fastest since funds appear immediately in enrolled users' accounts.

Most apps are free to receive money online, but fees apply when cashing out instantly to your debit card or when the sender uses a credit card to fund the transfer.

Wire transfers are the most secure since they go directly between financial institutions and are irreversible once processed.

Online money transfer services offer better exchange rates and lower fees than traditional banks or Western Union.

Only share routing numbers and account details through secure, encrypted channels. Never post this information on social media or send it through unsecured email.