15 min

15 min 584

584Maximizing Your Rewards with DVT Crypto: A Guide to Staking Benefits

Discover how to maximize your rewards with DVT crypto through effective staking strategies. Learn the benefits and start optimizing your investments today!

Co-authored with Matthew Kaufmann

Remember when Bitcoin hit that crazy $109,000 peak back in January? 📈 What a wild ride that was! I nearly spilled my jollof rice (yes, Nigerian jollof is obviously better than Ghana’s—fight me 😤) when I saw the price alerts on Twitter (I still call it Twitter—X sounds like a failed Elon side project. Sue me.😅).

As a crypto writer who’s been in this space since 2020, I’ve seen my fair share of ups and downs—but 2025? This year has been something else entirely.

Here’s a confession: I used to be terrified of staking my ETH. 😱 Like, losing-sleep-over-it terrified. Why? Because running a validator felt like inviting chaos into my digital life. One wrong move and—poof!—slashing penalties would devour my crypto like a midnight snack. 🍽️

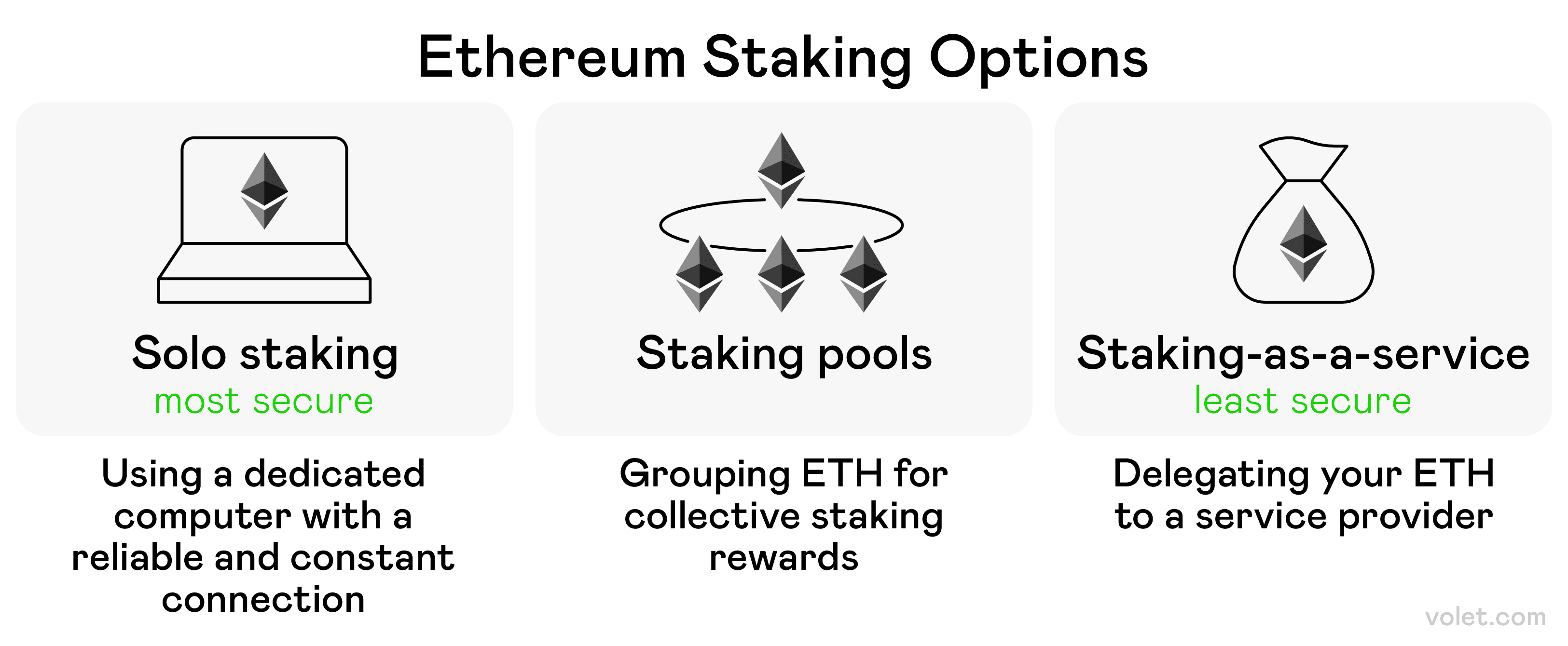

Staking options ranked by control and risk—DVT enhances solo staking by securely splitting validator keys across nodes

Then I discovered Distributed Validator Technology (DVT). Game. Changed. Forever. 🎯

What finally clicked for me was realizing that DVT wasn’t just a tech upgrade—it was a decentralization power move. I came across a fantastic breakdown by Matthew Kaufmann on HackerNoon, where he explained how DVT actually fragments validator duties and key access across multiple nodes. So no single machine holds all the power—or all the risk. That hit home. This isn’t just safer staking—it’s a whole new way of thinking about Ethereum security.

Today, I’m sharing how DVT transformed my Ethereum staking—helping me earn consistent rewards while finally sleeping like a baby 😴💤. No more 3 AM panic checks to see if my validator was still online! (We’ve all been there, right? 😬)

Ready to dive into the world of safer, more reliable staking? Let’s get into it! 👇

What Exactly is DVT Crypto?

So what exactly is DVT crypto? I remember sitting in an airport in Lagos, trying to wrap my head around it while taking my second bottle of Pepsi. Here's how I explain it to my non-crypto friends:

Think of traditional staking as putting all your eggs in one basket—and then balancing that basket on a single stick. If the stick breaks (your node fails), goodbye eggs! 🍳

Distributed Validator Technology (DVT) is like having multiple people hold that basket together. If one person gets tired (node failure), the others keep it steady. Your eggs stay safe, and you keep earning rewards.

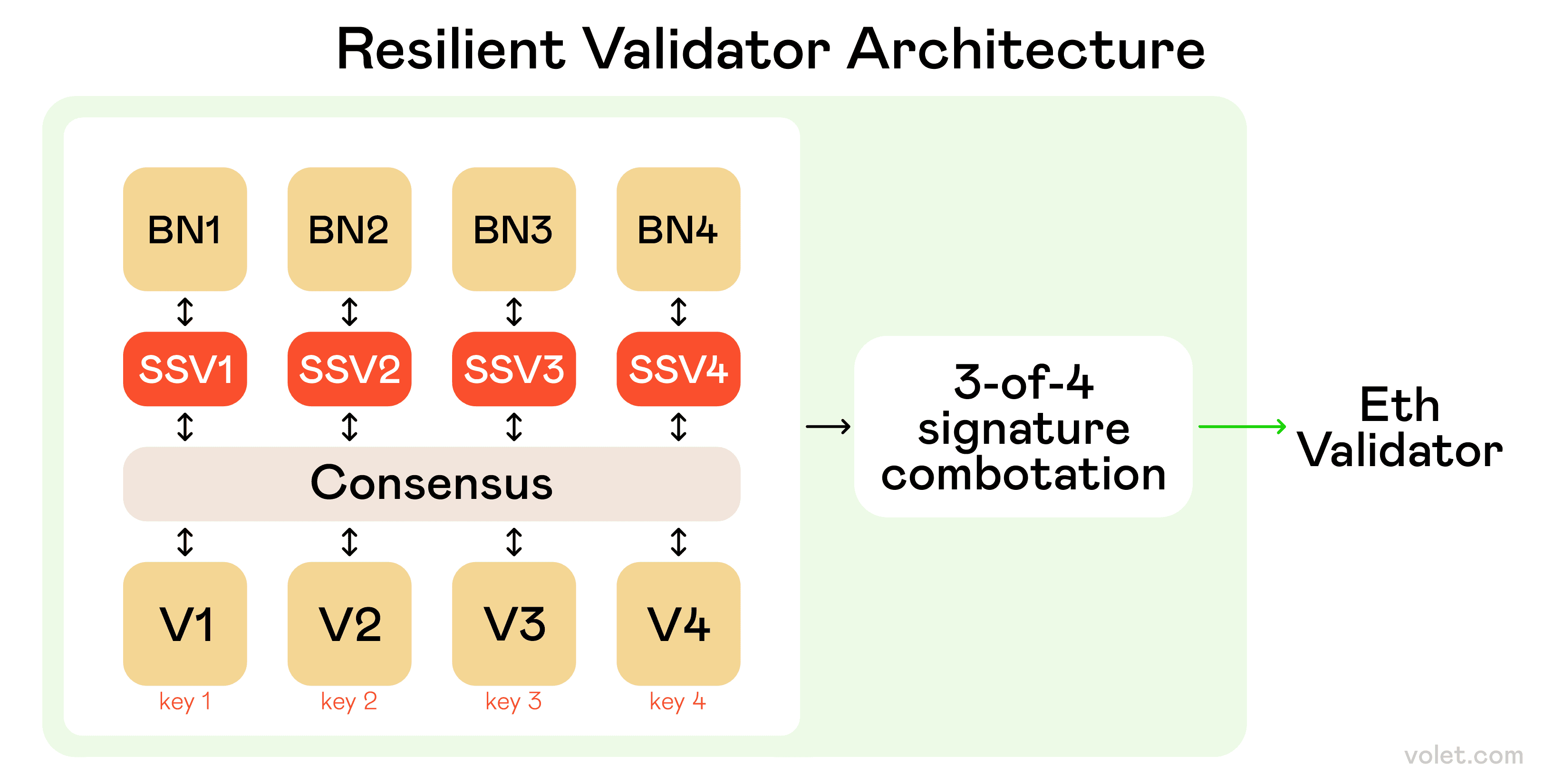

Secret-shared validator infrastructure for Eth2.0

Technically speaking, DVT splits validator duties across multiple nodes, creating a resilient network where responsibilities are distributed. Instead of running a validator on a single machine (hello, single point of failure!), DVT leverages multiple nodes working together as a cluster.

The most mind-blowing part for me? The security boost from threshold cryptography. With traditional setups, your private keys live on one computer—basically a "hack me" invitation. With DVT, key shares are distributed across multiple machines, so no single node ever has the complete key. Genius! 🧠

History & Evolution of DVT Crypto: Why We Needed It

Back in 2022, something massive happened: Ethereum completed The Merge, shifting from power-hungry Proof of Work to more efficient Proof of Stake. Suddenly, anyone with 32 ETH could participate in network consensus as a validator.

But a new problem emerged. Large institutions started accumulating massive amounts of staked ETH, leading to centralization concerns. I remember attending a blockchain conference in Abuja that year where everyone was asking the same question: "How do we keep Ethereum decentralized?"

The Ethereum Foundation and developer community recognized this threat and began exploring solutions. That's when distributed validator technology emerged from theoretical discussions to practical implementation.

I won't pretend I was an early adopter—in fact, I was skeptical at first! My first attempt at running a validator in 2023 ended with me accidentally going offline during a critical attestation period. Lost about 0.15 ETH in penalties. I'm still heart broken. 😅

But watching DVT evolve from an experimental concept to a robust infrastructure solution has been fascinating. The technology has matured significantly to support institutional compliance standards while remaining accessible to individual stakers like you and me.

Benefits of Implementing DVT for Ethereum Validators: What Changed for Me

When I finally took the plunge and implemented DVT for my validator setup, the benefits became clear immediately:

Enhanced Security Through Distributed Key Generation ✅

Remember how I mentioned losing sleep? Gone! Distributed key generation means my validator's private keys aren't sitting vulnerable on a single machine. Instead, shares of these keys are distributed across my cluster of nodes using principles from multi-party computation and Shamir's secret sharing.

No More Single Points of Failure ✅

Before DVT, any issue with my validator node meant immediate downtime and potential penalties. Now, my validator duties are distributed across multiple machines, creating a fault-tolerant environment that keeps running even if one component fails.

Slashing Risk Protection ✅

This was the game-changer for me. By improving coordination between nodes and implementing Byzantine fault tolerance, my risk of double-signing or other slashing-worthy actions dropped dramatically. Given that slashing can result in losing a significant portion of staked assets, this protection alone made DVT worth implementing.

Better Sleep (No, Seriously!) ✅

The peace of mind that comes with knowing your validator is resilient to failures? Priceless. I no longer jump at every notification thinking my validator might be offline.

How DVT Enhances Security in Ethereum Staking: The Technical Stuff Made Simple

Let's talk security—without the jargon overload.

Before implementing DVT, I had this recurring nightmare: waking up to find my validator node compromised and my staked ETH slashed to oblivion. Not fun.

The reality is that running a traditional validator setup means storing your private keys on a single node. It's like keeping all your money under one mattress—convenient until something goes wrong.

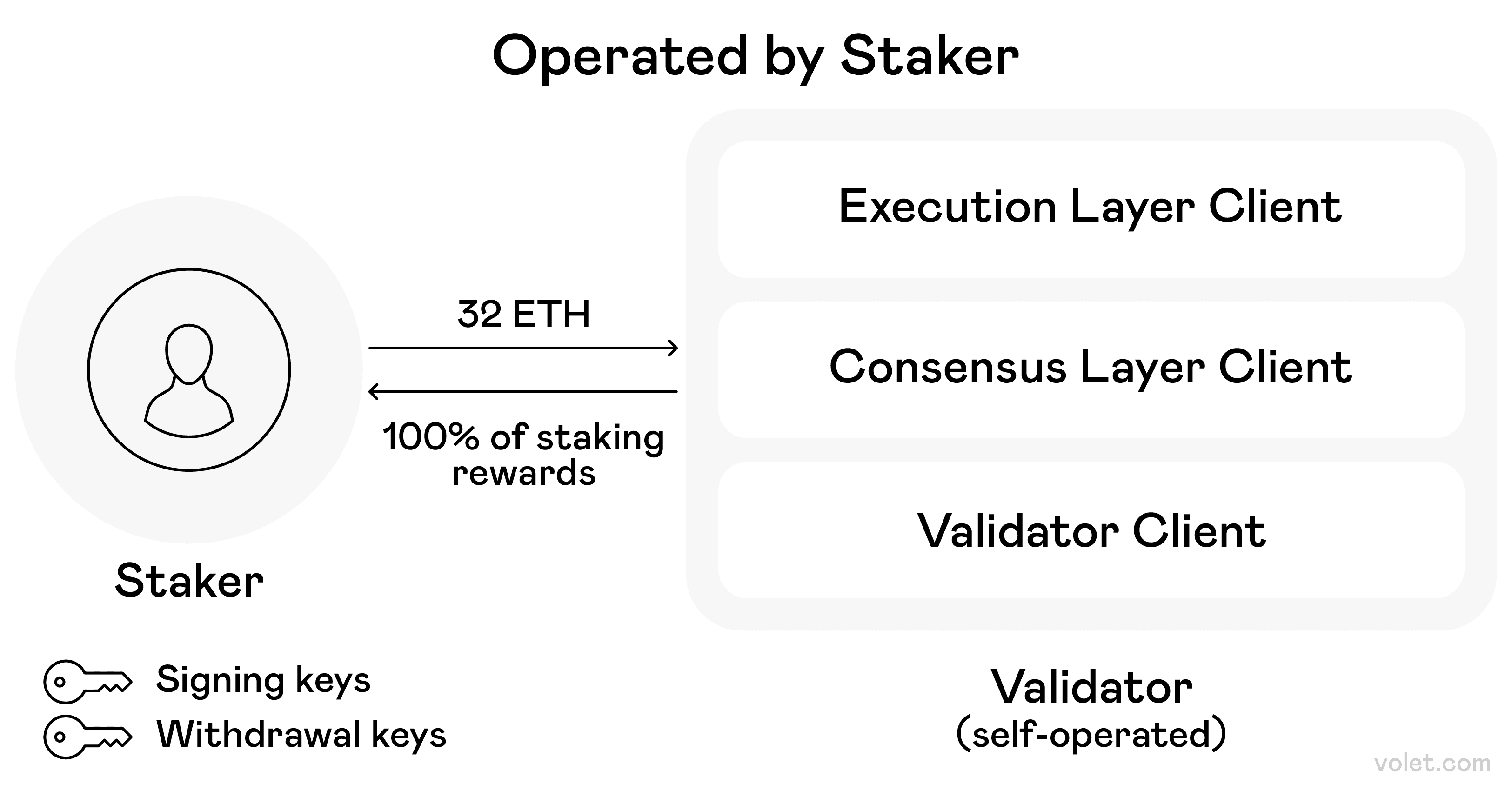

Self-staking setup: the staker runs their own validator with full control over keys and earns 100% of rewards

Distributed validator technology DVT changes this completely by implementing:

Threshold Signing Schemes 🔐

This was a revelation for me! With threshold signing, a predefined number of nodes in your cluster need to agree before signing any transaction. This means a malicious actor would need to compromise multiple nodes simultaneously—exponentially more difficult than hacking a single machine.

Key Management Revolution 🔑

Here's where Shamir's secret sharing comes into play. With DVT, your private keys are never stored in one place. Instead, shares of these keys are distributed across multiple nodes, ensuring no single component has access to the complete key. I like to think of it as splitting a treasure map into pieces—no single piece reveals the location.

Fault-Tolerant Security Infrastructure 🛡️

My validator cluster can now continue performing duties even if certain components fail or are compromised. This resilience ensures consistent participation in network consensus and helps avoid those nasty inactivity penalties that used to keep me up at night.

The beauty of all this? You don't need a computer science degree to implement it (trust me, I definitely don't have one!).

Implementing DVT in Your Staking Process: My Step-by-Step Experience

When I decided to implement DVT into my staking process, I won't lie—I was intimidated. But breaking it down into steps made it manageable:

Step 1: Select Compatible Validator Clients 🔍

First things first, I needed validator clients that supported DVT implementations. These form the foundation of the distributed setup and enable the coordination necessary for distributed operations.

Step 2: Establish Your Node Cluster 🖥️

Next came setting up a cluster of nodes to collectively handle validator duties. I spread mine across different machines with varying hardware and software configurations to maximize resilience against system-wide failures.

Step 3: Generate and Distribute Keys Securely 🔐

This was the most critical step! The implementation process included distributed key generation, where validator keys were securely generated and shared among participating nodes.

Step 4: Configure Network Connectivity 🌐

Ensuring reliable communication channels between all components of the validator cluster was essential. This meant setting up secure, low-latency connections between nodes to maintain consensus and prevent issues that could lead to penalties.

Was it easy? Not entirely. Did I make mistakes? Absolutely (like the time I misconfigured my network settings and had nodes unable to communicate for a nerve-wracking hour).

But the end result—a resilient, distributed validator setup—was worth every frustrating moment of troubleshooting.

Institutional Adoption of DVT Solutions: Not Just for Crypto Geeks

When I first implemented DVT, I felt like I was part of some exclusive tech club. But in 2025, I’ve watched big-money institutions—yep, the suits who once scoffed at crypto—jump on the DVT bandwagon like it’s the hottest jollof spot in Lagos. And honestly? It’s a big deal for all of us staking ETH, not just the geeks.

Let me break it down with some examples that blew my mind when I dug into them:

- Lido Finance: You know Lido, the staking giant that lets anyone stake ETH without running a node? They’re using DVT to make their validator network tougher than a Lagos traffic jam. Through their partnership with Obol Labs, Lido’s Simple DVT Module lets 72 new node operators, including solo stakers, run validators with distributed keys. This means less risk of downtime or slashing, even with over $1 billion in staked ETH. I saw this on X and checked their blog!

- EtherFi: These guys are all about non-custodial staking, and they’re using Obol’s DVT to keep their validators secure and decentralized. It’s like giving their nodes a bulletproof vest—no single key can be stolen, and institutions love that for compliance. I stumbled across this in an X post and thought, “If EtherFi’s doing it, this is legit.” Check their partnership details.

- Bitcoin Suisse: This Swiss crypto firm caters to fancy institutional clients, and they’re tapping into DVT (yep, Obol again!) for their Ethereum staking services. By spreading validator duties across multiple nodes, they’re ensuring their clients’ funds are safe and compliant. I saw whispers of this on X, and it makes sense—big players need big security. Look into Bitcoin Suisse’s announcements or Obol’s site for more.

- SSV Network: SSV is basically DVT central, and they’re powering institutional staking like nobody’s business. Their Secret Shared Validators tech splits keys across multiple parties, and they’re securing nearly 1 in 10 Ethereum validators—100,000 of them! Crypto exchanges and custodians are jumping on this for its slashing protection and compliance perks. I read about their milestone on X and a Medium post that broke it down beautifully.

- Validation Cloud: These folks provide Web3 infrastructure for institutions, and they joined Obol’s Mainnet Alpha in 2023 to run DVT clusters. It’s like giving their clients a VIP pass to secure, decentralized staking. Their Medium post on this had me nodding like, “Okay, institutions are serious!”

Why does this matter? Institutions using DVT means more than just bragging rights. They get complete control of their keys (no trusting shady third parties), multi-operator resilience (no single point of failure), and scalable setups that let them stake millions without breaking a sweat. Plus, it’s a huge vote of confidence in Ethereum’s ecosystem. When the big dogs adopt DVT, it’s like a Hollywood star endorsing your favorite pepper soup spot—everyone trusts it more.

But this isn’t just for the suits. Their adoption makes DVT tech more robust for small stakers like me, too. It’s like getting better roads because the governor’s driving on them—everyone benefits! Still, I double-checked these claims, because X posts can be hype. The sources above confirm it’s real, but always peek at company blogs for the full scoop.

Large financial institutions that once dismissed crypto are now embracing staking—and they're doing it with DVT. Why? Because distributed validator technology DVT solves several critical problems for institutions:

Complete Control of Keys (No Third-Party Risk) ✅

Unlike custodial staking services that require surrendering control of private keys, DVT enables institutions to retain complete control while still benefiting from distributed security. This addresses a major compliance hurdle for many regulated entities.

Multi-Operator Resilience ✅

For institutions running large validator fleets, DVT allows them to allocate validator duties to clusters spread across multiple operators. This prevents reliance on a single hardware/software plane—essentially diversifying their technical risk.

Scalable Implementation Patterns ✅

One thing that surprised me was learning how institutions use DVT to create repeatable and scalable patterns for their staking operations. This streamlines the process as they expand their validator fleets—something I wish I'd known when setting up my own nodes!

The credibility boost from institutional adoption has been significant for the entire Ethereum ecosystem. When major financial players implement a technology, it signals confidence in its security and reliability.

Addressing Centralization Concerns with DVT: The Bigger Picture

Let's talk about something that keeps many Ethereum enthusiasts (myself included) up at night: centralization. As larger entities accumulate more staking power, the risk of centralized control over the network increases—potentially undermining everything that makes blockchain revolutionary.

Fortunately, distributed validator technology DVT offers a compelling solution to these centralization concerns:

Enabling Validator Collaboration 🤝

DVT allows smaller validators (like yours truly) to pool resources and share responsibilities. This means we can compete effectively with larger entities while maintaining decentralized control.

Reducing Barriers to Entry 📉

By mitigating the risks associated with running a validator node, DVT encourages wider participation in staking. More participants mean better distribution of power across the network.

Distributing Control Across Multiple Parties 🌐

Rather than relying on a single entity to maintain validator operations, DVT enables a more collaborative approach where consensus requires agreement among multiple participants.

I've personally joined a small community of Nigerian developers using DVT to run validators collectively. Instead of each person needing the full 32 ETH stake, we collaborate using DVT—contributing to network security while maintaining our independence from larger staking pools.

Future Developments in DVT Technology: What's Coming Next

The future of distributed validator technology looks promising, and I'm genuinely excited about what's on the horizon. As someone who follows this space closely (sometimes too closely—my partner jokes that I check GitHub more than Instagram), here are the developments I'm most excited about:

Smart Contracts Integration 📝

Smart contracts are expected to play an increasingly important role in DVT implementations. This could automate many aspects of the coordination process and enable more sophisticated reward distribution mechanisms. I'm particularly excited about the possibility of programmable slashing protection!

Improved Client Integration 🔄

Developers are working on better integration between DVT and various validator clients, creating a more seamless experience for operators. This could significantly reduce the technical barriers that currently limit adoption among less experienced users (I certainly would have appreciated this when I started!).

Enhanced Coordination Mechanisms 🤖

Ongoing research is focusing on improving coordination between nodes and reducing the network overhead associated with distributed operations. This could make DVT more efficient and accessible to an even broader range of users.

I recently participated in a hackathon where teams were building user-friendly interfaces for DVT management. The progress being made is impressive—what once required extensive technical knowledge is becoming increasingly accessible to average users.

Comparing DVT with Traditional Validator Setups: Why I Made the Switch

When I first started staking ETH, I went the traditional route—running a single validator node on dedicated hardware in my home office. Looking back, I can clearly see the differences between that approach and my current DVT setup:

Reliability: Traditional vs. DVT ⚡

Traditional Setup: ❌ Single point of failure led to downtime whenever my internet connection hiccupped or during power outages (not uncommon in Lagos!)

DVT Setup: ✅ Distributed responsibilities across multiple nodes mean my validator continues operating even during local disruptions

Security: Traditional vs. DVT 🔒

Traditional Setup: ❌ Private keys stored on a single machine created a security vulnerability

DVT Setup: ✅ Distributed key generation and storage ensures no single party has complete access to keys

Peace of Mind: Traditional vs. DVT 😴

Traditional Setup: ❌ Constant anxiety about node performance and potential slashing

DVT Setup: ✅ Confidence in system resilience thanks to Byzantine fault tolerance

The most significant difference? With my traditional setup, I was averaging about 2-3 hours of maintenance and monitoring per week. With DVT, that's down to maybe 30 minutes—and far fewer emergency situations!

Overcoming Challenges in DVT Implementation: Real Talk

I promised honesty, so here it is: implementing DVT isn't all sunshine and passive income. There are real challenges I encountered along the way:

Increased Complexity 🧩

Managing multiple nodes is inherently more complex than a traditional single-node setup. I initially struggled with monitoring and management, especially ensuring all components were functioning correctly. Solution: I found dedicated monitoring tools designed specifically for DVT setups.

Network Requirements 📶

Distributed validator operations require reliable connectivity between all nodes in the cluster. My first implementation had latency issues that occasionally impacted performance. Solution: I upgraded my internet connection and implemented redundancy where possible.

Coordination Complexity 🔄

Ensuring all participants agree on actions and sign messages appropriately was trickier than expected. Solution: The implementation of Byzantine fault tolerance helped address this challenge by enabling the system to reach consensus even when some nodes behaved incorrectly.

Despite these challenges, the benefits of DVT have far outweighed the difficulties. And here's the good news: as the technology matures, many of these pain points are being addressed with more user-friendly implementations.

Closing Thoughts

Looking back at my journey from a nervous single-node validator operator to a confident DVT enthusiast, I can honestly say this technology has transformed my Ethereum staking experience. In a market where Bitcoin is projected to trade between $80,440 and $151,200 this year (According to InvestingHaven), and Ethereum might exceed $6,000, having a secure, resilient staking setup isn't just nice—it's essential.

Distributed validator technology DVT represents a significant evolution in addressing security and decentralization challenges in the Ethereum ecosystem. By enabling more resilient validator operations and reducing staking risks, it's creating a more robust environment for both individual stakers like me and institutional participants.

Whether you're a seasoned validator looking to enhance security or a newcomer interested in participating in Ethereum staking, understanding DVT can help you make more informed decisions about your strategy. As the technology continues to mature and adoption grows, I believe DVT will play an increasingly crucial role in shaping the future of Ethereum staking.

And who knows? Maybe someday we'll look back and wonder how we ever staked without it.

Disclaimer

This article is provided for informational purposes only and does not constitute legal, financial, or professional advice. All content is based on publicly available information and personal opinions. Readers should seek professional guidance before making decisions or acting based on the material presented. The author and publisher assume no liability for any actions taken or not taken by the reader based on the information contained herein.

Frequently Asked Questions

DVT distributes validator duties across multiple nodes, eliminating single points of failure and enhancing security through threshold cryptography, unlike traditional setups that rely on a single node.

Distributed key generation in DVT protects your assets by dividing private keys across multiple nodes, ensuring no single party has complete access to your keys.

Yes, DVT enables smaller validators to collaborate and share resources, reducing barriers to entry and helping maintain a more decentralized network.

DVT enhances security for institutions by creating fault-tolerant clusters, implementing multi-party computation for key management, and allowing full control of private keys while distributing risk.

Shamir's secret sharing in DVT allows for the secure distribution of private key shares among multiple parties, ensuring security even if some nodes are compromised while maintaining operational capability.