12 min

12 min 1.3K

1.3KThe Fastest and Cheapest Crypto to Transfer: Top Options for 2025

Discover the fastest and cheapest cryptocurrencies for transfers in 2025. Maximize your savings and speed with our top recommendations

Last year, I watched my friend Mike pay $47 in gas fees to send $100 worth of Ethereum to his cousin in the Philippines. Forty-seven dollars! That's almost half of what he was trying to send. It got me thinking about how many people are still getting burned by cryptocurrency transaction fees when there are so many better alternatives out there.

To dig deeper, I turned to a fascinating study, "Time-Varying Bidirectional Causal Relationships between Transaction Fees and Economic Activity of Subsystems Utilizing the Ethereum Blockchain Network," co-authored by Lennart Ante and Dr. Aman Saggu, Professor of Finance at Mahidol University (MUIC). Their research on Ethereum’s fee dynamics shows how high costs push users to seek cheaper blockchains, and it invariably inspired me to rethink how we choose cryptos for transfers.

I've been in the crypto space for years now, and I've made my fair share of expensive mistakes (don't even ask me about my early days with Bitcoin fees 😅). But through trial and error, I've discovered some real gems when it comes to finding the fastest and cheapest crypto to transfer.

The truth is, that not all cryptocurrencies are created equal when it comes to transaction costs. While Bitcoin and Ethereum might grab all the headlines based on their market capitalization, they're definitely not your best bet if you're looking to move money around without breaking the bank. Today, I’m sharing my top picks for the fastest and cheapest cryptos to transfer in 2025, backed by insights from Saggu’s research and my own experience.

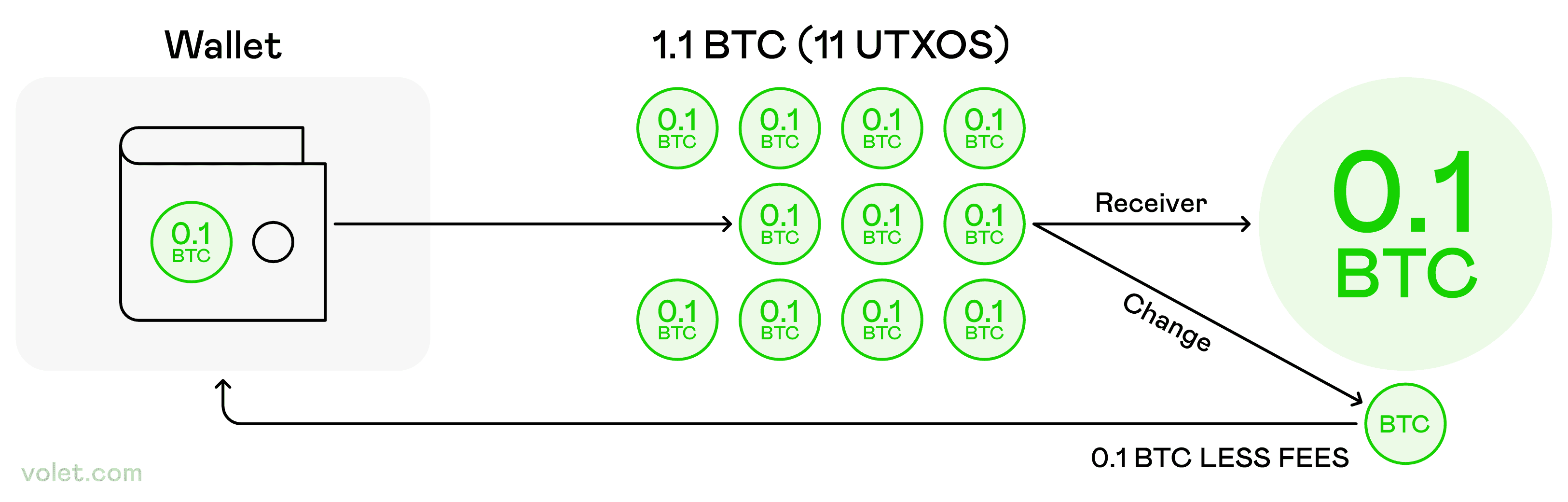

This image shows a Bitcoin transaction where fees are deducted from inputs, rewarding miners for processing the payment.

Why Crypto Transaction Fees Matter More Than You Think

Before we dive into the good stuff, let's talk about why transaction fees should be at the top of your priority list. I learned this the hard way when I was regularly making financial transactions to send money back home to my family.

High transaction fees can eat into your profits faster than you'd imagine. If you're making frequent transfers or dealing with smaller transactions, high fees can completely negate any benefits you might get from using crypto for financial transactions in the first place. And trust me, there's nothing more frustrating than paying $20 in transfer fees to send $50 worth of crypto.

Here's what I've noticed affects crypto transaction fees the most:

- Network Congestion When everyone's trying to use the same blockchain at once, transaction fees skyrocket. It's like rush hour traffic but for your money. I've seen Ethereum gas fees spike to over $100 during busy periods (usually when some new NFT project drops or there's a decentralized finance craze happening).

- Transaction Size and Complexity Simple transfers are cheaper than complex smart contracts. That makes sense, right? The more data your crypto transaction needs to process, the more you'll pay in-network fees.

- Blockchain Design Some cryptocurrencies were built specifically to keep costs low and process transactions efficiently. Others... well, let's just say they prioritize other things over affordable payments.

The Champions of Low-Cost Transactions

After testing dozens of different cryptocurrencies over the years, I've narrowed down my go-to list for when I need to move money without paying ridiculous fees. These are the cryptocurrencies that consistently offer the lowest crypto transaction fees while still being reliable for transferring funds.

Nano: The Zero-Fee Wonder

This one's a bit of a cheat because Nano literally offers zero transaction fees. No joke – you pay absolutely nothing to send Nano from one wallet to another, making it perfect for fee-free transactions.

I first discovered Nano when I was looking for a way to tip content creators without losing half the tip to fees. The technology is pretty clever – instead of using traditional mining consensus mechanisms, Nano uses a unique architecture where each account has its own blockchain (they call it a "block lattice").

Zero fee transactions (seriously, $0.00 in transaction costs)

Instant transfers that confirm transactions in just a few seconds

Environmentally friendly consensus mechanism

Great for micro-payments and smaller transactions

Limited adoption compared to other digital assets

Fewer places to buy and trade

No smart contract platform functionality

Stellar: My Go-To for Cross Border Payments

Stellar has become my favorite for international payments, especially when I'm sending money internationally. Stellar has a minimum average transaction fee of $0.00001 so you’re looking at essentially free transactions for cross-border and everyday transactions.

I sent $500 to a friend in Kenya and the total cost was less than a cent. Stellar can process transactions in seconds, with much lower fees and my friend had access to the money in seconds. Compare that to traditional international transfers that can take days and cost $25-50 in fees.

Stellar was designed to make cross-border payments easier and more cost-effective and it shows. Financial institutions are partnering with Stellar for international payments because of the huge advantage in speed and cost.

Transactions are confirmed in 3-5 seconds with faster transaction speeds

Minimum fee of $0.00001 for all blockchain transactions

Designed specifically for international transfers

Partnerships with major financial institutions

Price can be volatile

Still building mainstream adoption

Solana: Speed Meets Affordability

Solana caught my attention during the 2021 bull run, but not for the reasons you think. Everyone was talking about the price, I was fascinated by the $0.00025 average transaction fee and 2.5-second transaction time.

As someone who’s dealt with slow transaction times and high fees on other networks, Solana felt like a breath of fresh air. The network can handle high volume and fast transactions, great for everyday transactions and larger transfers.

The smart contract platform also means you can do more than just simple transfers – though remember, more complex operations will cost slightly more in network fees.

Average transaction of $0.00025 with reasonable fees

Transaction speeds of 2.5 seconds

Full smart contracts functionality

High transaction volume capacity

The network has experienced some outages

Still relatively new compared to Bitcoin or Ethereum

Validator centralization concerns

Ripple (XRP): The Bank-Friendly Option

Ripple often gets overlooked in crypto circles, but it's actually one of the most cost-efficient options for transfers. Ripple charges a $0.0002 average transaction fee with 4 4-second settlement time, built for moving money efficiently through secure transactions.

What’s interesting about Ripple is it was designed to work with traditional financial institutions. This means it often has better integration with existing banking systems which can be helpful if you’re moving between crypto and traditional accounts for international payments.

I've used XRP for several cross-border transactions, and the combination of low costs and fast transaction speeds makes it a solid choice, especially for larger amounts.

Bitcoin Cash: Bitcoin's Cheaper Cousin

Bitcoin Cash emerged from Bitcoin specifically to address the high transaction costs and slower transaction speed issues. With average transaction fees around $0.0024, it's significantly cheaper than regular Bitcoin while maintaining similar security features for blockchain transactions.

I'll be honest – Bitcoin Cash doesn't get much love in crypto communities, but for pure utility as a transfer mechanism, it works really well. Bitcoin Cash has an average fee of around $0.0024 with confirmation times of about 10 minutes, making it reliable for transferring funds when you don't need instant settlement.

Much lower transaction fees than Bitcoin at just $0.0024 average

Widely accepted among crypto exchanges

Familiar technology and consensus mechanism

Good for larger financial transactions

Confirmations in about 10 minutes provide reasonable speed

Slower than some newer alternatives with faster transaction speeds

Less exciting than newer tech

Ongoing debates about its future

Other Notable Mentions

Algorand deserves a mention with crypto transaction fees averaging $0.001 and the ability to confirm transactions in about 4 seconds. It's got solid technology and reasonable fees, though it hasn't quite hit mainstream adoption yet.

Litecoin sits in the middle ground with transaction fees ranging between $0.03 and $0.04 with confirmations in about 2.5 minutes. Not the cheapest crypto on our list, but still way better than Bitcoin or Ethereum for everyday transactions, and it's widely accepted with decent transaction speeds.

Dash offers secure transactions at around $0.0043 per average transaction, with the bonus of some privacy features if that's important for your financial transactions. Dash has transactions confirmed in seconds with $0.0043 fees, both fast and cheap.

Zilliqa is another option worth considering – transactions are confirmed in seconds with $0.01 fees, making it competitive for users who need both speed and reasonable costs.

Understanding What Drives Transaction Costs

Transaction fees are necessary to maintain the security and functionality of the blockchain. These fees compensate miners or validators for processing your transactions and securing the network. Without these incentives, the blockchain wouldn’t be able to operate.

The amount you pay depends on several factors including network demand, transaction complexity, and the specific blockchain’s design. Ripple charges $0.0002 average transaction fee because it was designed for efficiency, Bitcoin’s fees can be much higher because of its different approach to security and decentralization.

Privacy-Focused Digital Assets for Secure Transactions

Sometimes you need more than low fees – you want privacy too. While most cryptocurrencies offer some level of anonymity, some digital assets are designed with privacy as a core feature.

Nano stands out here too because it has zero transaction fees and instant transfers, making it not just cost-effective but also quick for private transactions when you need complete fee-free transactions. The combination of zero costs and instant settlement makes Nano particularly attractive for users who value both privacy and efficiency.

Monero is probably the most well-known privacy coin. It uses ring signatures and stealth addresses to enhance privacy, making blockchain transactions much harder to trace. While fees aren’t the lowest, Monero has low fees considering its strong privacy features.

Zcash offers encrypted transactions while maintaining relatively low costs. You can make transactions either transparent (like Bitcoin) or completely private depending on your needs for secure transactions.

For those who want a balance of privacy and cost efficiency Dash’s PrivateSend feature adds an extra layer of privacy to transactions. With Dash’s $0.0043 transaction fees, you get secure transfers at a low cost and some anonymity. Not as private as Monero but a good middle ground if you want some anonymity without sacrificing too much on fees or transaction speed.

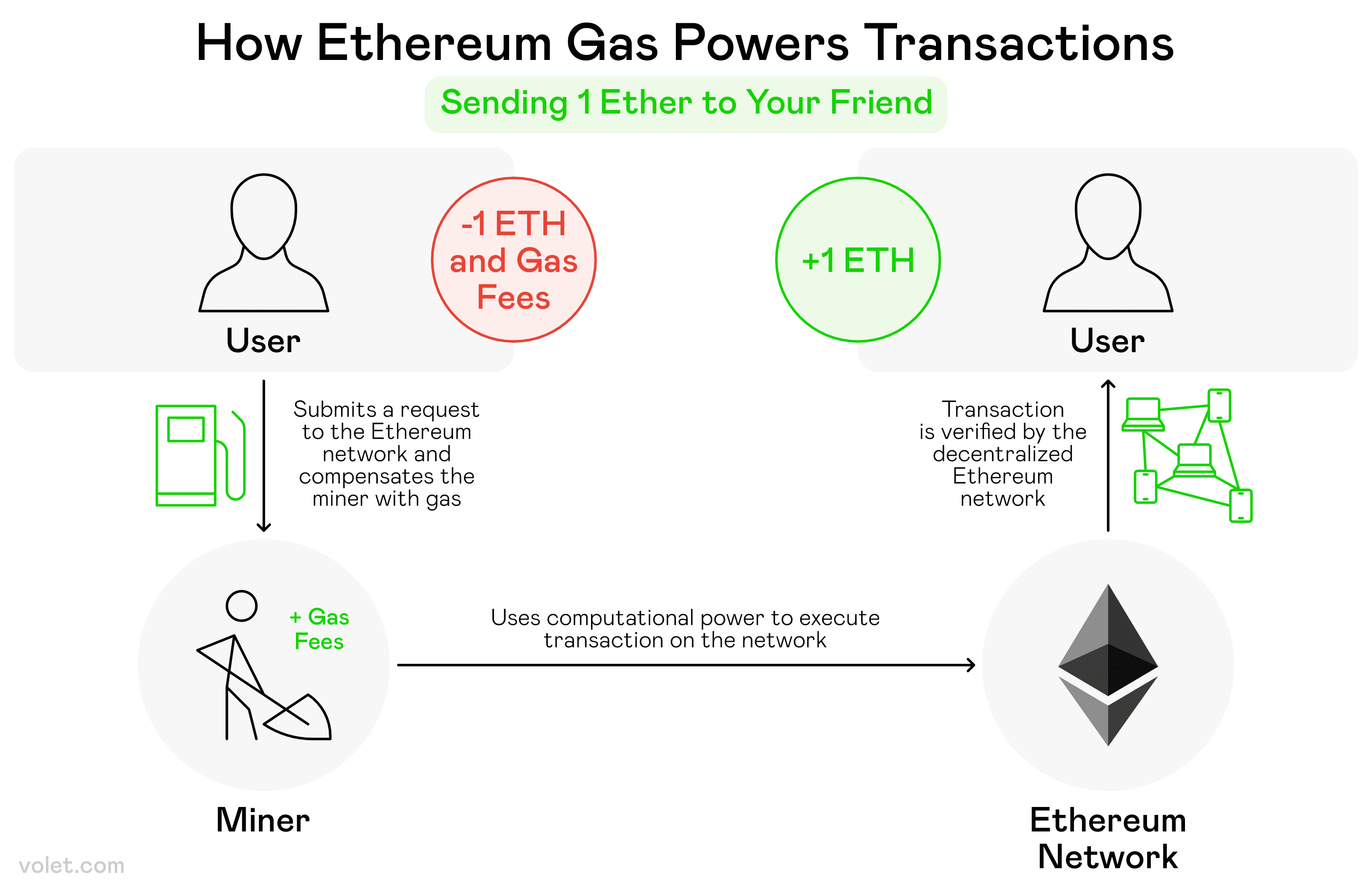

How Ethereum gas fees are paid to miners when sending ETH, covering the computational cost of processing and verifying transactions.

The Ethereum Gas Fee Problem

Let’s talk about the elephant in the room – Ethereum’s gas fees. Don’t get me wrong, Ethereum is amazing for smart contracts and decentralized finance, but it’s not the cheapest crypto to transfer funds.

During network congestion I’ve seen gas fees go through the roof. We’re talking $50-100+ just to move some tokens around. That’s fine if you’re moving thousands of dollars, but if you’re trying to send $100 to a friend? The high transaction costs make it impractical.

The gas fees on Ethereum are determined by network demand and the complexity of your crypto transaction. When lots of people are using the network (like during popular NFT drops or decentralized finance farming crazes), transaction fees go through the roof.

Some ways to reduce Ethereum costs:

- Use Layer-2 solutions like Polygon or Arbitrum for cheaper transactions

- Consider the Lightning Network and other Layer-2 solutions that can lower transaction costs and improve transaction speed

- Time your transactions during low-activity periods to avoid high fees

- Batch multiple transactions together

- Use wallets with SegWit support for Bitcoin transactions

Highlights of the key factors to consider when choosing a cryptocurrency exchange.

Choosing the Right Crypto Exchanges

Where you buy and sell your crypto can make a big difference in your overall costs. Different crypto exchanges have different fee structures and some are more friendly to frequent transfers than others.

I’ve found that choosing decentralized exchanges usually results in lower trading fees compared to centralized platforms, but they can be a bit more complicated to use. It’s usually worth it if you’re making regular transfers.

Things to look for in exchanges:

- Low withdrawal fees that don't eat into your savings

- Reasonable trading fees for buying and selling

- Support for the cheapest crypto options we've discussed

- Fee discounts for higher volume users

- Good liquidity for the coins you want to trade

The key is finding crypto exchanges that don't eat up your savings with excessive withdrawal fees, especially if you're working with smaller transactions.

Smart Strategies for Minimal/Low Fees

Here are some practical tips I've picked up for keeping crypto transaction fees as low as possible:

Batch Your Transactions

Instead of making multiple smaller transactions, try to batch them together when possible. This can significantly reduce your overall transaction costs, especially for frequent transfers.

Time Your Transfers

Network activity tends to fluctuate throughout the day and week. I've noticed that transaction fees are often lower during off-peak hours (usually early morning or late evening in major time zones).

Use the Right Tool for the Job

Don't use Ethereum for simple transfers when you could use Stellar or Nano. Save the high-fee networks for when you actually need their smart contract platform features.

Consider Layer-2 Solutions

For Ethereum-based transactions, Layer-2 solutions like Polygon can offer much lower costs while still giving you access to the Ethereum ecosystem for decentralized finance.

Closing Thoughts

After years of experimenting with different cryptocurrencies and watching the market evolve, I'm more convinced than ever that transaction costs will be a deciding factor in which cryptocurrencies succeed long-term.

The projects that prioritize affordable payments and fast transactions are the ones that will actually get used for everyday transactions. While Bitcoin and Ethereum might get all the attention as digital assets with high market capitalization, the real winners for practical money transfers will be the ones that offer low transaction fees and can process transactions quickly.

My advice? Don't get caught up in the hype around expensive cryptocurrencies when you just need to move money around. Start with the cheapest crypto options I've outlined here, test them out with smaller transactions, and find what works best for your specific needs. Your wallet will thank you.

Frequently Asked Questions

Nano has zero transaction fees, so it’s the cheapest crypto out there. Stellar comes in second with a minimum fee of $0.00001 per transaction.

Stellar and Ripple are both great for cross-border payments, with Stellar charging $0.00001 and Ripple charging around $0.0002 per transaction. Stellar transactions typically confirm in 3-5 seconds with fees as low as $0.00001 while Ripple charges an average transaction fee of $0.0002.

Gas fees on networks like Ethereum can range from a few dollars to over $100 during high congestion periods, making them expensive for smaller transactions.

Yes, Nano is the only cryptocurrency with completely fee-free transactions. Nano has zero transaction fees and instant transfers.

Consider transaction fees, transfer speeds, network reliability, exchange availability, and whether the recipient can easily access and convert the cryptocurrency.

Disclaimer

This article is provided for informational purposes only and does not constitute legal, financial, or professional advice. All content is based on publicly available information and personal opinions. Readers should seek professional guidance before making decisions or acting based on the material presented. The author and publisher assume no liability for any actions taken or not taken by the reader based on the information contained herein.