17 min

17 min 1.4K

1.4KTop 10 Cryptocurrency Price Prediction 2025: Key Insights and Trends

Explore the top 10 cryptocurrency price predictions for 2025, highlighting key insights and trends. Stay informed and make smart investment decisions!

I've been in this crypto space long enough to see Bitcoin hit $69k and then watch it crash down faster than my hopes of buying a Lambo. But here's the thing: I'm still here, still hodling, and still excited about what the latter part of 2025 might bring.

You know that feeling when you first heard about Bitcoin back in 2009 (when Satoshi Nakamoto created it) and thought "Digital money? That's just play money"? Yeah, me too. Now look where we are – Bitcoin's maximum supply is limited to 21 million coins, and that scarcity is one of the main reasons it's worth... well, all the money people are throwing at it.

I remember my first crypto purchase like it was yesterday. Sweating bullets, triple-checking wallet addresses, convinced I'd somehow send my hard-earned cash into the digital void. Fast forward to today, and I'm here sharing what I've learned about the top 10 cryptocurrency price predictions in 2025 backed by specific analysts and firms, plus lessons I’ve learned to help you avoid my mistakes.

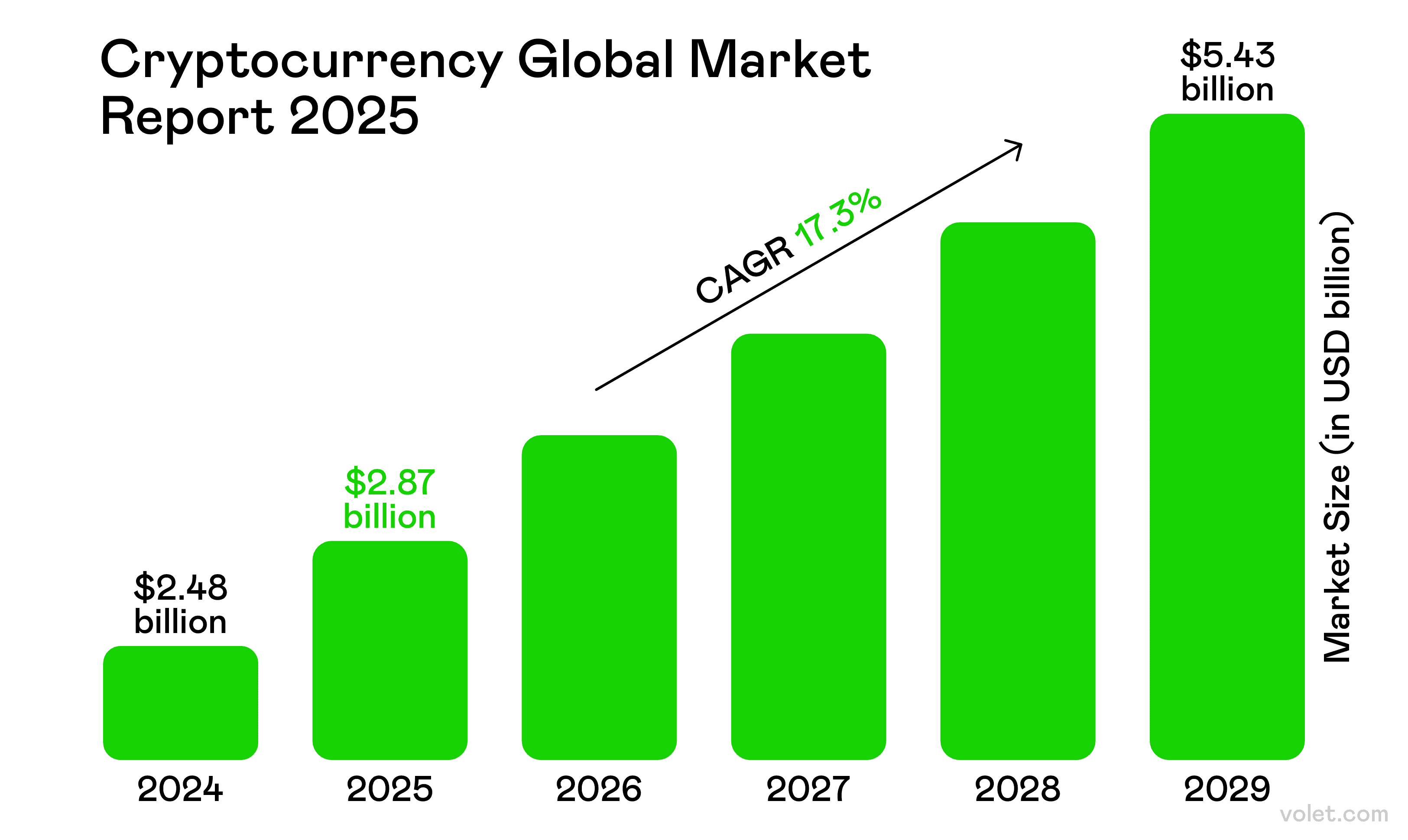

The image shows a projected growth in the global cryptocurrency market, with a compound annual growth rate (CAGR) of 17.3%, reaching $5.43 billion by 2029.

What's Really Driving the Crypto Market in 2025? 📈

The crypto market isn't just about hype anymore (though let's be honest, meme coins still have their moments). We're seeing real institutional adoption, better blockchain technology, and – dare I say it – actual regulation that doesn't make us all panic.

Here's what I'm seeing shape cryptocurrency prices in the broader crypto markets:

✅ Institutional Money: Major companies aren't just dipping their toes anymore

✅ Regulatory Clarity: Improving in key regions like the U.S. and EU, but global regulations remain inconsistent, creating both opportunities and challenges for crypto adoption.

✅ Technical Innovation: The underlying technology keeps getting better

✅ Real-World Use Cases: People are actually using this stuff now

❌ Still Volatile AF: Don't mortgage your house for crypto

❌ Scams Everywhere: Do your own research (seriously)

❌ FOMO Traps: That "next Bitcoin" probably isn't

The cryptocurrency market continues to evolve, and market sentiment plays a huge role in driving these changes. When investor sentiment is positive, we see massive pumps. When it's negative? Well, let's just say I've lived through a few of those too.

My Top 10 Cryptocurrency Price Prediction 2025 💰

Let me walk you through what crypto experts and analysts are saying about 2025. These crypto price predictions aren't crystal ball readings – they're based on market conditions, fundamentals, and extensive analysis from experts who've been studying this space longer than I've been losing sleep over charts.

1. Bitcoin (BTC) - The Digital Gold Standard

Analyst Predictions for 2025: $80,000 to $200,000.

Bitcoin was created in 2009 by Satoshi Nakamoto, and it's still the king. Crypto experts predicted that by 2025, Bitcoin's market capitalization will be worth more than $1 trillion, and honestly? The math checks out as Bitcoin's market capitalization has already surpassed $1.5 trillion as of May 2025.

Bitcoin commands approximately 50–55% of the total cryptocurrency market, reinforcing its position as the market leader. The halving cycles, institutional adoption, and the fact that only 21 million will ever exist? That's a recipe for sustained growth according to most cryptocurrency investments analysis.

Why Analysts Are Bullish:

- Limited supply (hello, scarcity economics)

- Corporate treasuries are buying

- It's basically digital gold now

- Significant upside potential from institutional adoption

Real Talk: Bitcoin might not make you rich overnight, but it's probably the safest bet in this high-risk investment world we call crypto. Most crypto experts I follow consider it the foundation of any solid portfolio.

2. Ethereum (ETH) - The Smart Contract King

Market Predictions for 2025: 2,500 to $6,000.

Ethereum is the world's biggest blockchain for NFTs and defi protocols as of 2025, and let me tell you – I've made and lost money on both. The Ethereum blockchain processes more smart contracts than I can count, and analysts expect Ethereum’s market capitalization to exceed $330 billion in 2025, driven by its dominance in DeFi, NFTs, and smart contract innovation.

Here's the kicker: Ethereum's supply could decrease over time due to burning a portion of transaction fees. Deflationary crypto? Industry experts are excited about this.

What Makes ETH Special According to Analysts:

- Smart contracts that actually work

- Massive ecosystem of decentralized applications

- The foundation for most defi protocols

- Ethereum supports a robust ecosystem of decentralized applications, including some meme coins, though platforms like Solana are increasingly popular for meme coin projects.

Ethereum is the biggest blockchain for decentralized applications and NFTs as of 2025, and crypto analysts don't see that changing anytime soon. The Ethereum blockchain continues to be the go-to blockchain platform for developers.

3. Solana (SOL) - The Speed Demon

Expert Predictions for 2025: $120 to $600

Solana offers high transaction speeds of ~2,000–3,000 TPS, with a theoretical maximum of 65,000. The upcoming Firedancer upgrade could potentially scale to 1 million TPS, enhancing its appeal for developers, though deployment timelines remain uncertain. That's unmatched scalability right there, according to blockchain technology experts.

I've used Solana for trading, and the speed difference is night and day compared to Ethereum. Lower fees, faster transactions – it's a developer's dream and analysts are taking notice.

Why Crypto Experts Like Solana:

- Incredible transaction throughput

- The growing ecosystem of decentralized apps

- Strong community support from developers

- Real-world utility that's actually being used

4. XRP - The Banking Favorite

Analyst Consensus for 2025: $1.80 to $5

XRP was designed to enable faster, cross-border transactions, and they're actually doing it. XRP facilitates fast cross-border transactions through RippleNet, with partnerships like Santander and other financial institutions, boosting its real-world utility. This real-world utility has crypto experts bullish on its prospects.

XRP has gained regulatory clarity in the U.S. following the 2023 SEC case resolution, but global regulatory challenges persist, influencing its adoption trajectory.

5. Binance Coin (BNB) - The Exchange Token

Market Expert Predictions for 2025: $580 to $1,200

Industry analysts point out that BNB isn't just about trading fees anymore. It's become the backbone of one of the largest crypto ecosystems, with tons of projects building on Binance Smart Chain. The crypto exchange giant continues to innovate, and that's reflected in expert price predictions.

6. Cardano (ADA) - The Academic Approach

Crypto Analyst Predictions for 2025: $0.60 to $2

Cardano utilizes a Proof-of-Stake consensus mechanism which is more efficient than Proof-of-work. No more energy consumption debates here. You can earn staking rewards just by holding cardano ada in your crypto wallet, and experts see this as a major advantage.

Why Analysts Like Cardano ADA:

- Energy-efficient consensus mechanism

- A strong academic approach to development

- Cardano is building an ecosystem with initiatives in developing countries, such as education projects in Africa, though its adoption pace trails some competitors.

- Solid staking rewards program

The Cardano Ada project has been methodical in its approach, and crypto experts appreciate the steady development progress.

7. Chainlink (LINK) - The Oracle Master

Expert Analysis for 2025: $12 to $40

Chainlink is a decentralized oracle that allows users to create smart contracts based on real-world events. Think sports betting, insurance, and pretty much anything that needs real-world data on the blockchain platform. Crypto analysts see huge potential in Oracle networks.

8. Dogecoin (DOGE) - The Meme That Wouldn't Die

Market Predictions for 2025: $0.15 to $1

Look, I get it. Dogecoin started as a joke. But meme culture and community support have kept this thing alive longer than most "serious" projects, according to crypto market analysts. Sometimes the crypto community just wants to have fun, and that community support translates to real value.

Why Meme Coins Matter (According to Experts):

- Strong community engagement

- Cultural impact beyond just finance

- Gateway drug for new crypto enthusiasts

- Surprising staying power in bear markets

9. Polkadot (DOT) - The Blockchain Connector

Industry Expert Predictions for 2025: $8 to $30

Industry experts love Polkadot's architecture which allows it to connect unrelated blockchains and create new blockchains. It's like the internet of blockchains, and interoperability is huge for the decentralized internet we're building according to blockchain technology specialists.

Polkadot's parachain auctions and cross-chain functionality make it a favorite among developers building decentralized applications. The platform's ability to process multiple transactions simultaneously across different chains gives it significant upside potential in the evolving crypto space.

What Makes DOT Special:

- Revolutionary parachain technology

- Cross-chain interoperability solutions

- A growing ecosystem of specialized blockchains

- Strong governance model with community participation

The demand for cross-chain solutions continues to grow, and Polkadot's unique approach positions it well for sustained growth as the cryptocurrency space matures.

10. Avalanche (AVAX) - The Ethereum Competitor

Crypto Expert Predictions for 2025: $25 to $100

Crypto analysts see Avalanche as fast, cheap, and packed with features. It's giving Ethereum a run for its money in the smart contract space, with robust security features that appeal to developers and institutions alike.

Avalanche's three-blockchain architecture provides exponential growth potential while maintaining compatibility with Ethereum-based applications. The platform's subnet technology allows for custom blockchain creation, attracting significant institutional investor interest.

Key Avalanche Advantages:

- Sub-second transaction finality

- Lower fees than Ethereum for smart contracts

- Custom subnet creation capabilities

- Growing defi protocols ecosystem

Top ten cryptocurrency wallets, offering users trusted options for secure and efficient digital asset storage.

The Best Crypto Exchange and Crypto Wallet Setup 🔒

Here's where I made my biggest rookie mistakes. Let me save you some headaches based on what I've learned and what crypto experts recommend.

Choosing the Right Crypto Exchange

I've been on practically every major crypto exchange, and here's my honest take based on experience and expert recommendations:

For Beginners:

- Coinbase (user-friendly but higher fees)

- Binance (more features, steeper learning curve)

For Advanced Traders:

- KuCoin (tons of altcoins and penny cryptos)

- Kraken (solid security track record)

Things to Watch Out For (Learned the Hard Way):

- Withdrawal fees (they add up fast)

- Security features (2FA is non-negotiable)

- Available trading pairs for your favorite crypto coin

- Customer support quality (you'll need it eventually)

Most crypto experts recommend using multiple exchanges to diversify risk and access different crypto assets.

Your Crypto Wallet Strategy

I learned this the hard way: not your keys, not your crypto. Here's my wallet setup based on expert recommendations:

Hardware Wallets (for long-term holding):

- Ledger Nano S/X with robust security features

- Trezor (crypto experts love these)

Software Wallets (for active trading):

- MetaMask (for Ethereum stuff and Ethereum-based meme coins)

- Phantom (for Solana and its ecosystem)

Pro Tip from Crypto Experts: Never keep all the money on a crypto exchange. I don't care how trustworthy they seem – exchanges get hacked, governments freeze accounts, stuff happens.

Cryptocurrency Investments: My Hard-Learned Lessons 📚

The "Penny Cryptos" Trap

Oh boy, penny cryptos. Those sub-$1 coins that promise 1000x returns? I've been there. Some actually deliver, but most are just expensive lessons in humility according to seasoned crypto experts.

The demand for cryptocurrencies with small market caps often spikes due to their potential for extreme growth, but remember – a small market cap also means less investor interest sometimes. It's a classic high-risk investment scenario.

Current Market Reality:

- Over 10,000 crypto projects exist as of 2025, but most lack real-world utility, emphasizing the need for thorough research.

- Most penny cryptos lack real-world utility

- Community engagement matters more than the price

- Upcoming tokens in token presales can offer early access opportunities

Community Support Matters More Than You Think

I used to ignore community support and just look at charts. Big mistake. The crypto community can make or break a crypto project faster than any technical analysis. Active development, engaged communities, regular updates – these things matter according to every crypto expert I follow.

What Strong Communities Look Like:

- Regular developer updates

- Active social media presence

- Real users, not just bots

- Clear roadmap execution

- Response to community feedback

The Meme Coin Phenomenon

Let's talk about meme coins for a second. These Ethereum-based meme coins and others have made people millionaires overnight. I've seen Fantasy Pepe and other meme culture projects explode, but I've also seen them crash harder than my first attempt at day trading.

Emerging projects like Fantasy Pepe aim to integrate AI with crypto, such as combining fantasy football with predictive systems, but these remain highly speculative. More established AI blockchain projects, like Fetch.ai, are gaining traction for trading and dApp automation.

Meme Coin Reality Check:

- Fantasy Pepe represents the evolution of meme culture in crypto

- Most meme coins have zero real-world utility

- Community support can be fickle

- Significant upside potential comes with massive downside risk

- Only invest money you can afford to lose completely

AI Agent and the Future of Crypto 🤖

Here's something that's got me excited: AI agent integration. Projects like Mind of Pepe represent an integration of AI with crypto, allowing for autonomous engagement with blockchain communities.

What Crypto Experts Are Saying About AI Integration:

- Mind tokens and AI agent projects are experimental

- The influencer economy is merging with AI

- Real-world applications are still being developed

- High potential but also high speculation

Current AI agent projects I'm watching:

- Mind tokens for AI-powered trading

- Prediction systems like Fantasy Pepe

- Automated community management tools

- AI-driven decentralized applications

But as always, do your in-depth research before jumping into anything AI-related. The hype is real, but so are the risks according to crypto experts.

The Best Crypto to Buy Strategy (That Actually Works) 💡

After years of wins and losses, here's my approach to finding the best crypto, informed by expert analysis and hard experience:

1. Start With the Core Holdings

Crypto experts consistently recommend starting with:

- Bitcoin (store of value and market leader)

- Ethereum (smart contract platform and defi protocols foundation)

- A few solid altcoins with real-world utility

2. Research the Fundamentals (Like Crypto Experts Do)

✅ Active development team with regular updates

✅ Real-world problems they're solving effectively

✅ Strong community engagement and growth

✅ Clear roadmap and consistent execution

✅ Partnerships with real institutions

❌ Anonymous teams with no track record

❌ Promises of guaranteed returns

❌ No clear use case or real-world utility

❌ Toxic community vibes

❌ Unrealistic marketing claims

3. Diversify Smartly Across Market Caps

Don't put all the money in one basket. I learned this by watching my portfolio get cut in half during the last bear market. Here's what crypto experts recommend:

Balanced Portfolio Approach:

- 40% Large market cap (Bitcoin, Ethereum)

- 30% Mid market cap altcoins (Solana, Cardano ADA, etc.)

- 20% Small market cap with growth potential

- 10% High-risk investments (upcoming tokens, token presale opportunities)

Cryptocurrencies to Invest in 2025: Expert Watchlist 📋

Beyond the top 10, here are some crypto assets that analysts and I are keeping an eye on:

Layer 2 Solutions and Scaling

The Ethereum blockchain is still slow and expensive. Layer 2s are fixing this, and early access to good L2 tokens could be profitable according to blockchain technology experts.

Why Experts Like Layer 2s:

- Solving real-world problems with Ethereum scaling

- Growing defi protocols adoption

- Lower fees for decentralized applications

- A bridge between current limitations and future potential

DeFi Protocols Evolution

Decentralized finance isn't going anywhere. New Defi protocols are making traditional banking look ancient, and crypto experts see massive growth potential.

DeFi Trends Experts Are Watching:

- More sophisticated yield farming strategies

- Integration with traditional finance

- Better user interfaces for mainstream adoption

- Regulatory compliance solutions

Real-World Utility Projects

I'm tired of coins that don't do anything. Give me projects solving real-world problems, with real adoption metrics. Crypto experts consistently emphasize the importance of underlying technology and practical applications.

AI Integration and Innovation

The ai agent trend is just getting started. Projects combining AI with blockchain are worth watching, but crypto experts recommend approaching with caution:

- Mind tokens for AI-powered portfolio management

- Automated trading and prediction systems

- AI-enhanced decentralized apps

- Smart contract automation with AI

Crypto to Buy: Risk Management That Saved My Portfolio 🛡️

The 1% Rule (Crypto Expert Approved)

Never invest more than 1% of your portfolio in any high-risk investment that could go to zero. Trust me on this one – I've watched too many people get wrecked chasing 100x gains. Every seasoned crypto expert I know follows this rule.

Dollar-cost averaging (DCA)

Instead of trying to time market conditions (spoiler: you can't), I buy a little bit every week. Crypto experts consistently recommend this approach because:

- It reduces the impact of volatility

- Removes emotion from investing decisions

- Works in both bull and bear markets

- Helps build discipline over time

Take Profits Strategy

This was the hardest lesson. When you're up 300%, take some profits. The crypto space is volatile – what goes up can come down fast according to market history and expert analysis.

Profit-Taking Rules I Follow:

- Take 25% profits at 2x gains

- Take 50% profits at 5x gains

- Let the rest ride with stop-losses

- Never feel bad about taking profits

The Staking Rewards Strategy

Instead of just hodling, I earn staking rewards on coins like Cardano ADA, Ethereum 2.0, and others. It's like getting paid dividends in traditional stocks. Some projects offer higher staking rewards than others, so shop around according to crypto experts.

Best Staking Opportunities:

- Cardano ADA for steady returns

- Ethereum 2.0 for long-term holding

- Newer blockchain platforms with higher staking rewards

- DeFi protocols with yield farming options

Highlights of key mistakes to avoid when investing in cryptocurrency.

All the Money Mistakes (So You Don't Make Them) 🤦

Let me share some expensive lessons that even crypto experts warned me about:

Mistake #1: FOMO Buying Based on Crypto News

Saw a coin pumping 500% after some crypto news and bought at the top. Spoiler alert: it dumped the next day. Market sentiment can change faster than you can say "diamond hands."

Mistake #2: Not Having an Exit Strategy

Made 10x on a small market cap coin and didn't sell. Watched it crash back to where I started. Crypto experts always emphasize having clear exit strategies.

Mistake #3: Ignoring Market Sentiment and Broader Crypto Markets

Market sentiment affects everything in crypto. Bull markets make everyone look smart; bear markets humble everyone. The broader crypto markets move together more often than not.

Mistake #4: Following Crypto Experts Blindly

Crypto experts can be wrong too. Sometimes very wrong. Do your own research, always. Even the best analysts get caught off guard by market conditions.

Mistake #5: Not Understanding Market Capitalization

Market cap matters more than crypto coin price. A $0.001 coin with a 1 trillion supply isn't going to $1. Math doesn't lie, and crypto experts constantly remind people of this basic principle.

Mistake #6: Chasing Penny Cryptos Without Research

Those upcoming tokens and penny cryptos look tempting, but most lack real-world utility or strong community support. I learned to focus on fundamentals rather than just potential gains.

Closing Thoughts

Look, I've been in this game long enough to know that cryptocurrency predictions are part analysis, part educated guessing, and part wishful thinking. The crypto scene changes fast – faster than I can keep up with sometimes.

But here's what I believe based on everything I've experienced and learned from crypto experts: we're still in the early stages of a financial revolution. The combination of improving blockchain technology, growing institutional adoption, clearer regulations, and increasing real-world utility creates a compelling case for continued growth.

The market sentiment around crypto has fundamentally shifted. We're not just speculating on digital collectibles anymore – we're building the infrastructure for a decentralized internet, revolutionizing financial services through defi protocols, and creating new economic models that didn't exist before.

Yes, this remains a high-risk investment category. Yes, you can lose money (I have, multiple times). But the crypto assets that survive and thrive will be the ones solving real-world problems, building strong communities, and executing on their vision consistently.

Whether you're looking at established players like Bitcoin and Ethereum, exploring the potential of Cardano ada and other smart contract platforms, or taking calculated risks on upcoming tokens with significant upside potential, remember this: the best investment strategy is one you can stick with through both bull and bear markets.

Disclaimer

This article is provided for informational purposes only and does not constitute legal, financial, or professional advice. All content is based on publicly available information and personal opinions. Readers are advised to seek professional guidance before making decisions or acting based on the material presented. The author and publisher assume no liability for any actions taken or not taken by the reader based on the information contained herein.

Frequently Asked Questions

According to analysts, Bitcoin is projected to trade between $80,000 and $200,000, Ethereum between $2,500 and $6,000, and Solana between $120 and $600 in 2025, based on current market trends and adoption. Cryptocurrency markets remain highly volatile, requiring thorough research and risk assessment.

Industry analysts consistently point to Bitcoin and Ethereum as foundational investments due to their market dominance and established ecosystems. Other cryptocurrencies with strong potential include Solana for transaction speed, Cardano ADA for energy efficiency, and XRP for institutional partnerships. The best crypto investments depend on individual risk tolerance, investment timelines, and market conditions.

Crypto experts recommend starting with established cryptocurrencies like Bitcoin and Ethereum, only investing money you can afford to lose, and using dollar-cost averaging to reduce volatility impact. It's essential to research projects thoroughly, understand their real-world utility, and consider diversifying across different types of crypto assets rather than concentrating on single positions.

Key factors include institutional adoption, regulatory developments, technological improvements, market sentiment, and real-world utility according to crypto experts. Supply mechanics like Bitcoin's limited 21 million coin cap, Ethereum's fee-burning mechanism, and overall market capitalization also play significant roles in price movements and expert predictions.

While some meme coins have generated substantial returns and strong community support, crypto experts warn they carry extremely high risks and often lack fundamental value beyond the social media hype. If considering these high-risk investments, limit exposure to money you can completely afford to lose and focus primarily on established cryptocurrencies with proven utility and active development teams.