10 min

10 min 615

615What are DeFi NFTs? Understanding Their Role in the Crypto Ecosystem

Discover how DeFi NFTs fit into the crypto landscape, their benefits, and potential challenges. Learn more about their impact in our latest article.

I still remember the day I bought my first NFT. There I was, coffee in hand, staring at my screen and thinking, "What the heck am I doing?" 😅 As I clicked "confirm" on a digital art piece that cost more than my monthly grocery bill, I felt that familiar mix of excitement and terror that comes with diving into something new in the crypto world.

That was three years ago, and since then, I've gone deep down the rabbit hole of not just non-fungible tokens but how they intersect with decentralized finance. And let me tell you – it's been quite the ride!

So you're wondering about DeFi NFTs? Good timing! In this article, I'll share everything I've learned (often the hard way) about these fascinating digital assets and how they're reshaping our relationship with value, ownership, and financial systems.

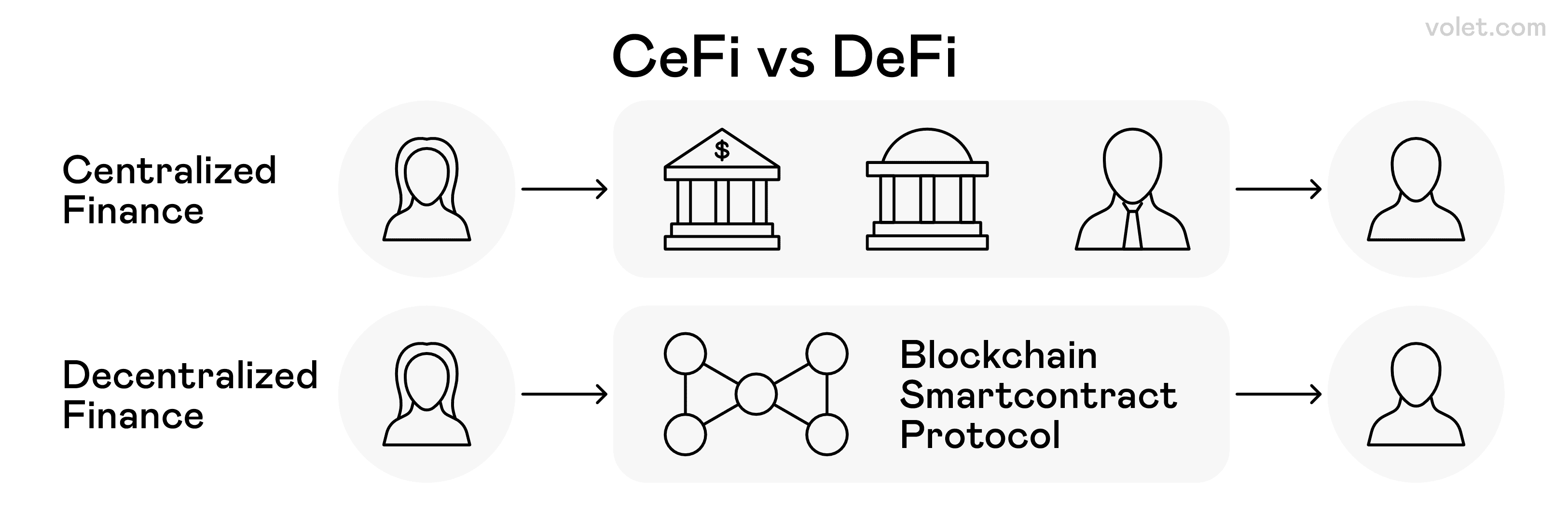

How decentralized finance (DeFi) enables users to send money using blockchain, smart contracts, and protocols, without intermediaries.

Decentralized Finance: The Foundation of a New Era

Before we dive into DeFi NFTs specifically, let's get our bearings in the broader landscape of decentralized finance.

Decentralized finance (DeFi) is essentially a peer-to-peer financial system that cuts out the middleman. Remember when you needed a bank to send money to someone? Or had to wait days for a transaction to clear? DeFi says "nope" to all that.

The key principle behind DeFi is removing third parties like banks from the financial system. This isn't just about being rebellious – it actually reduces costs and speeds up transaction times dramatically. The first time I sent crypto across the world in seconds (for pennies!), I genuinely couldn't believe it. Coming from traditional financial systems where international transfers could take days and cost ridiculous fees, this felt like magic.

DeFi applications allow people to use their money for a variety of purposes:

- Purchases ✅

- Loans ✅

- Trading ✅

- Investing ✅

All without a bank or financial institution acting as a gatekeeper. All you need is an internet connection and a wallet!

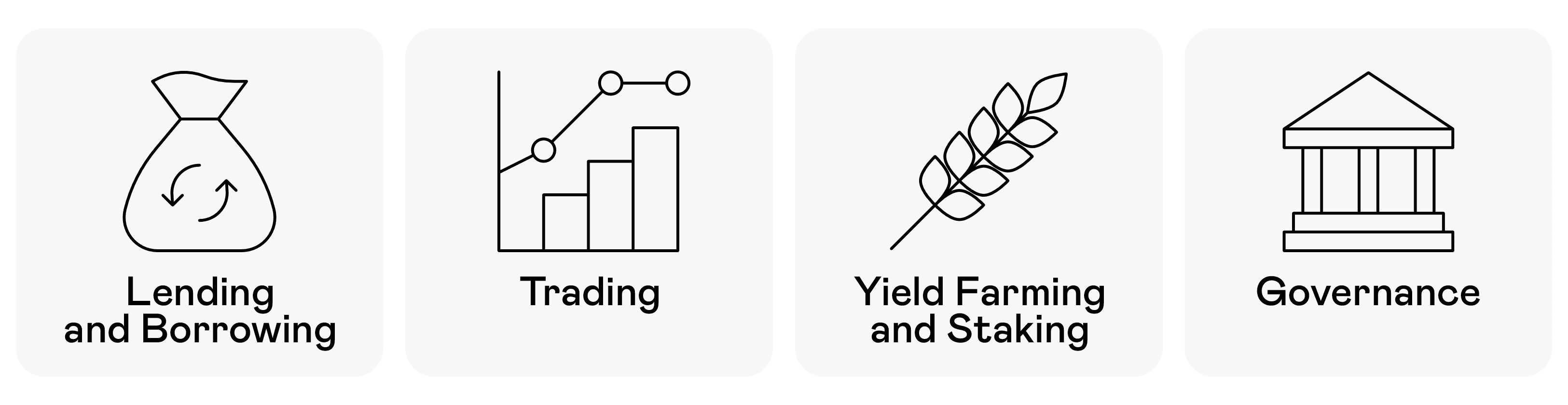

The core activities driving decentralized finance ecosystems.

How DeFi Protocols Are Changing the Game

DeFi protocols are the engines that power this new financial system. They're essentially sets of smart contracts (self-executing pieces of code) that automate financial transactions according to predefined rules.

Some popular DeFi platforms, like Uniswap and Aave, operate across various blockchain networks, offering services like:

- Decentralized exchanges (DEXs) – Where I can swap tokens directly with other users without an intermediary

- Lending platforms – Where I can borrow assets or earn interest by lending mine

- Yield farming – Where I can put my crypto to work earning more crypto (though I learned the hard way this comes with risks!)

The beauty of these DeFi applications is that they're accessible to anyone with an internet connection. When I think about the billions of people worldwide without access to banking services, I can't help but feel optimistic about what this technology could mean for financial inclusion.

That said, let's be real: the decentralized nature of DeFi presents significant security challenges. I've seen several high-profile hacks, like the 2022 Ronin Bridge exploit, occur over the past few years, and it's a sobering reminder that this space is still evolving. (Take it from someone who once lost a small sum to a sketchy protocol – always do your research!)

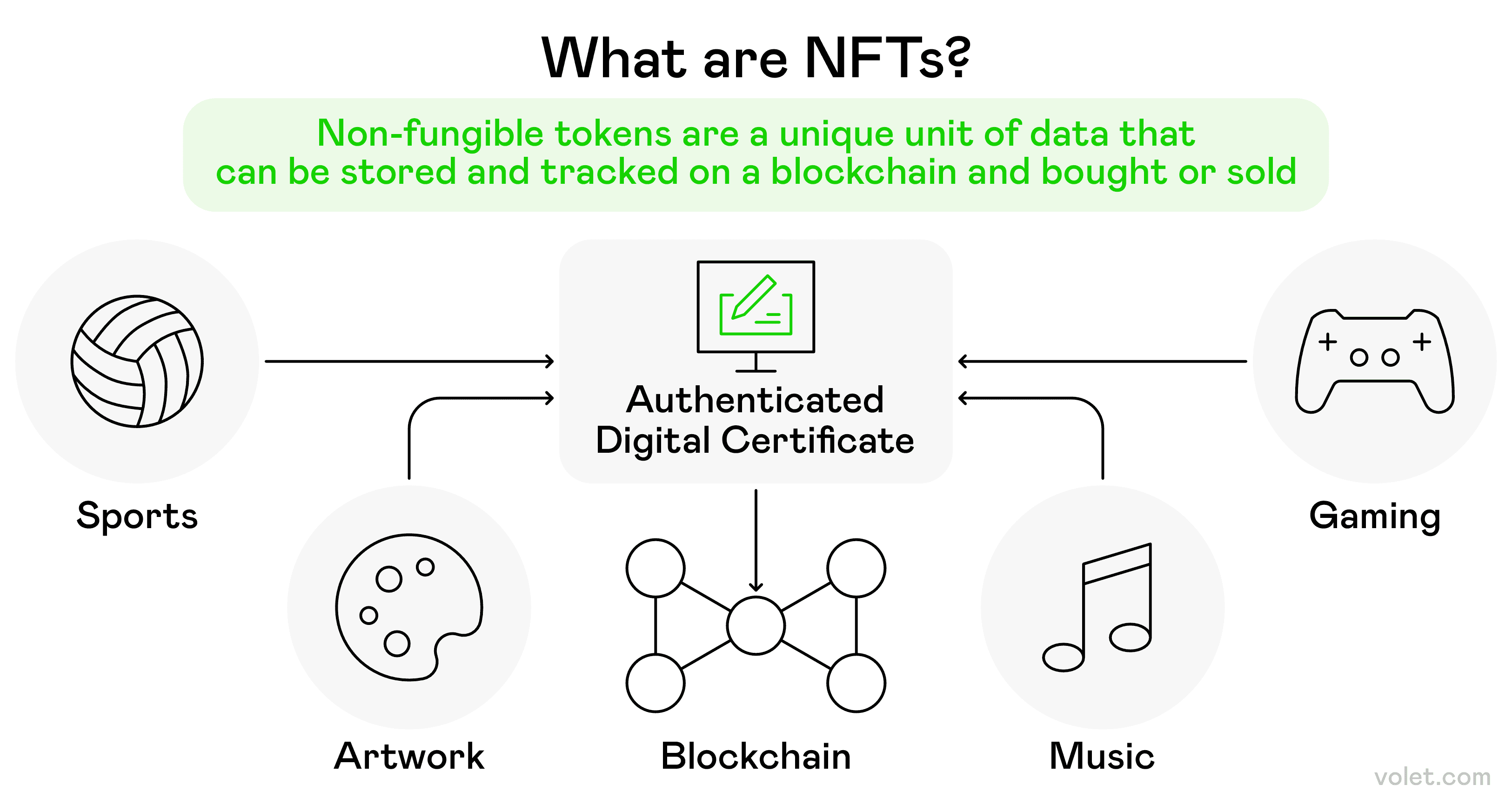

How NFTs use digital certificates on a blockchain to represent ownership of unique items.

Non-Fungible Tokens: More Than Just Digital Art

Now, let's talk about non-fungible tokens. NFTs are unique digital assets that represent ownership of a particular item – be it digital or physical.

Unlike cryptocurrencies such as Bitcoin or Ethereum, which are fungible tokens (meaning each unit is identical and interchangeable), NFTs are non-fungible. In plain English? Each NFT is one-of-a-kind and can't be replaced with something else.

When I first heard about NFTs, I thought they were just digital art – pictures of bored apes and pixelated punks selling for millions. But they're so much more than that.

What Makes Non-Fungible Tokens Special?

The magic of NFTs lies in how they enable ownership in the digital realm:

- Verifiable uniqueness – Each NFT has a distinct identifier on the blockchain

- Provable ownership – The blockchain keeps a permanent record of who owns what

- Transferability – NFTs are easily tradable on various marketplaces like OpenSea.

- Programmability – They can have special properties coded into them

The NFT market experienced tremendous growth during the pandemic as people sought alternative investments and new ways to connect digitally. I remember watching in awe as some collections skyrocketed in value overnight. (And yes, I had my share of FOMO purchases that didn't quite pan out! 😬)

While digital art grabs headlines, NFTs can represent ownership of virtually anything:

- Virtual real estate in metaverse platforms

- Music and entertainment rights

- Gaming items and characters

- Event tickets

- Physical items (through tokenization)

I once purchased an NFT that gave me access to a private community of creators, complete with workshops and networking opportunities. It fundamentally changed how I think about the value of digital assets.

DeFi and NFTs: A Powerful Combination

Now for the really interesting part – what happens when you combine decentralized finance with non-fungible tokens? You get DeFi NFTs, and they're reshaping how we think about value and utility in the crypto space.

What Are DeFi NFTs Exactly?

DeFi NFTs are non-fungible tokens that have financial utility built into them through smart contracts. They're not just collectibles; they're assets that can be integrated into the broader decentralized finance ecosystem.

In my experience, DeFi NFTs represent one of the most fascinating innovations in the entire blockchain space. They combine the uniqueness and ownership aspects of NFTs with the financial functionality of DeFi.

How DeFi NFTs Are Being Used

Here are some real-world applications that I've either used myself or followed closely:

NFT-Backed Loans

One of the coolest developments I've seen is using NFTs as collateral for loans. Rather than having your valuable NFT just sitting in your wallet, you can lock it in a DeFi lending protocol and borrow against its value.

I tried this with a mid-tier NFT I owned, and while the loan-to-value ratio wasn't amazing (these are risky assets after all), it was incredible to access liquidity without having to sell my NFT.

Fractional Ownership

Remember those headline-grabbing NFTs that sold for millions? Fractional ownership splits these high-value NFTs into smaller, more affordable pieces, allowing multiple users to collectively own a portion.

I've participated in a few fractional ownership projects, and it's an interesting way to get exposure to premium assets that would otherwise be out of reach. It's like owning a small piece of a famous painting!

Liquidity Pools and Providing Liquidity

Some DeFi projects use NFTs to represent shares in liquidity pools. As liquidity providers, users can earn fees and rewards while holding an NFT that represents their stake.

I jumped into providing liquidity on a decentralized exchange last year, and receiving an NFT that represented my position made tracking my investment much more intuitive than just watching numbers on a screen.

Governance and Decentralized autonomous organizations

Decentralized autonomous organizations (DAOs) sometimes use NFTs to represent membership or voting rights. These governance tokens give holders the ability to participate in decision-making.

Being part of a DAO through an NFT was an eye-opening experience for me. Participating in governance proposals and having a say in the project's direction created a sense of ownership that goes beyond financial return.

The Benefits and Challenges of DeFi NFTs

Like anything in the crypto space, DeFi NFTs come with their own set of advantages and potential pitfalls. Here's what I've learned from my personal journey:

✅ Benefits

- Enhanced liquidity for otherwise illiquid assets

- Greater control over your digital assets

- New revenue streams for creators through royalty sharing

- Innovative financial products that weren't possible before

- Transparent transactions with everything recorded on the blockchain

❌ Challenges

- Security risks – Smart contract vulnerabilities remain one of the biggest challenges

- Complexity – The learning curve can be steep (trust me on this one!)

- Regulatory uncertainty – Rules are still evolving across different jurisdictions

- Market volatility – Values can fluctuate wildly

- Environmental concerns – Though many networks are working to reduce their carbon footprint

Getting Started with DeFi NFTs

If you're intrigued and want to explore DeFi NFTs yourself, here's a quick guide based on my experience:

- Set up a secure wallet – Your gateway to DeFi and NFTs (I learned the hard way that security matters!)

- Acquire some crypto – You'll need this to make transactions

- Research platforms – Look for reputable DeFi protocols and NFT marketplaces

- Start small – Don't invest more than you can afford to lose

- Join communities – Discord servers and forums are great places to learn

Remember that famous crypto saying: "Don't trust, verify." I can't stress enough how important it is to do your own research before diving in.

The Future of DeFi NFTs

As someone who's been watching this space evolve, I'm cautiously optimistic about where DeFi NFTs are headed. We're seeing increasing demand for these versatile assets, with new use cases emerging regularly.

Some trends I'm particularly excited about:

- Improved interoperability – Assets working across different blockchain networks

- Real-world asset tokenization – Bringing physical items onto the blockchain

- More user-friendly interfaces – Making the technology accessible to everyone

- Integration with traditional finance – Bridging the gap between old and new systems

The entire NFT ecosystem is still finding its footing, but the innovation happening at the intersection of DeFi and NFTs is truly remarkable. I've made my share of mistakes in this space, but I remain convinced that we're witnessing the early days of a significant shift in how we think about ownership and financial transactions.

Closing Thoughts

My journey into DeFi NFTs has been equal parts exhilarating and humbling. I've had moments of feeling like a genius when a project took off, and plenty of head-scratching confusion when trying to understand complex protocols.

What excites me most is that we're still in the early chapters of this story. The combination of decentralized finance and non-fungible tokens is creating new opportunities that were unimaginable just a few years ago.

Are there risks? Absolutely. The space is volatile, complex, and sometimes downright wild. But there's also remarkable innovation happening that could fundamentally reshape our relationship with value and ownership.

Whether you're a curious observer or ready to dive in, I hope sharing my experience helps you navigate this fascinating intersection of technology and finance. Whatever you do, start small, keep learning, and enjoy the ride!

Disclaimer

This article is provided for informational purposes only and does not constitute legal, financial, or professional advice. All content is based on publicly available information and personal opinions. Readers are advised to seek professional guidance before making decisions or acting based on the material presented. The author and publisher assume no liability for any actions taken or not taken by the reader based on the information contained herein.

Frequently Asked Questions

Decentralized finance operates without intermediaries like banks or financial institutions, instead using blockchain technology to enable peer-to-peer transactions that are faster, often have lower fees, and are accessible to anyone with an internet connection.

Yes, certain DeFi protocols allow NFT owners to use their assets as collateral for loans, creating liquidity without having to sell the NFT.

Smart contracts are self-executing pieces of code that automate transactions when predefined conditions are met. They're essential for DeFi NFTs as they enable the financial functionality and enforce the rules of ownership and transfers.

While blockchain technology provides certain security benefits, DeFi NFTs still face risks from smart contract vulnerabilities, market volatility, and potential scams. Users should always conduct thorough research and consider security best practices.

Valuing DeFi NFTs involves considering multiple factors including utility within DeFi protocols, rarity, creator reputation, historical sales data, and current demand in the market.