15 min

15 min 1.1K

1.1KWhat Banks Accept Crypto: Top Picks for Your Financial Needs

Discover the best banks that accept crypto for your financial needs. Explore top picks to manage your digital assets effectively

I'll never forget the look on my banker's face when I asked about linking my account to a crypto exchange back in 2019. She literally pulled out a printed pamphlet about "high-risk activities" and suggested I "reconsider my investment choices." Fast-forward to last month, and that same bank is now advertising its new crypto services on every street corner.

The irony? I'm sitting here writing this while managing my Bitcoin holdings through three different crypto-friendly bank platforms, earning interest on my digital assets, and using a debit card that gives me cashback in crypto. How times have changed, right?

If you've been wondering what banks accept crypto in 2025, buckle up. I've been testing these platforms for the past year to figure out which ones are worth your time (and money). Spoiler alert: some are genuinely game-changing, while others are just jumping on the bandwagon.

Introduction to Crypto-Friendly Banking

Here's what nobody tells you about the crypto-banking revolution – it didn't happen overnight, and it definitely didn't happen because banks suddenly fell in love with Bitcoin. It happened because people like us forced their hand by moving our money elsewhere.

I remember when crypto transactions meant playing financial Twister: deposit money here, transfer there, convert this, and hope that platform doesn't get hacked. It was exhausting. The involvement of crypto friendly banks in the crypto market has significantly impacted the broader financial sector, influencing market expectations and ensuring secure crypto transactions.

The turning point came when mainstream financial institutions realized they were losing customers to fintech companies that actually understood digital assets. Suddenly, banks that had been crypto-skeptical were scrambling to launch their own crypto services. Some nailed it. Others... well, let's just say their first attempts were about as smooth as a roller coaster made of sandpaper.

What's fascinating is how this shift changed everything. We're not just talking about banks tolerating crypto anymore – we're seeing traditional banking services evolve to include comprehensive digital asset management, crypto-backed loans, and even Bitcoin rewards programs. The crypto space has officially gone mainstream.

Definition of Crypto-Friendly Banking

Let me break down what crypto-friendly actually means, because apparently, not everyone got the memo that it's more than just "we won't close your account if you mention Bitcoin."

True crypto friendly banking is when a financial institution doesn't just tolerate your crypto activities – they actively support and integrate them. We're talking about banks that have invested in blockchain technology and created user-friendly interface options that don't make you feel like you need a computer science degree.

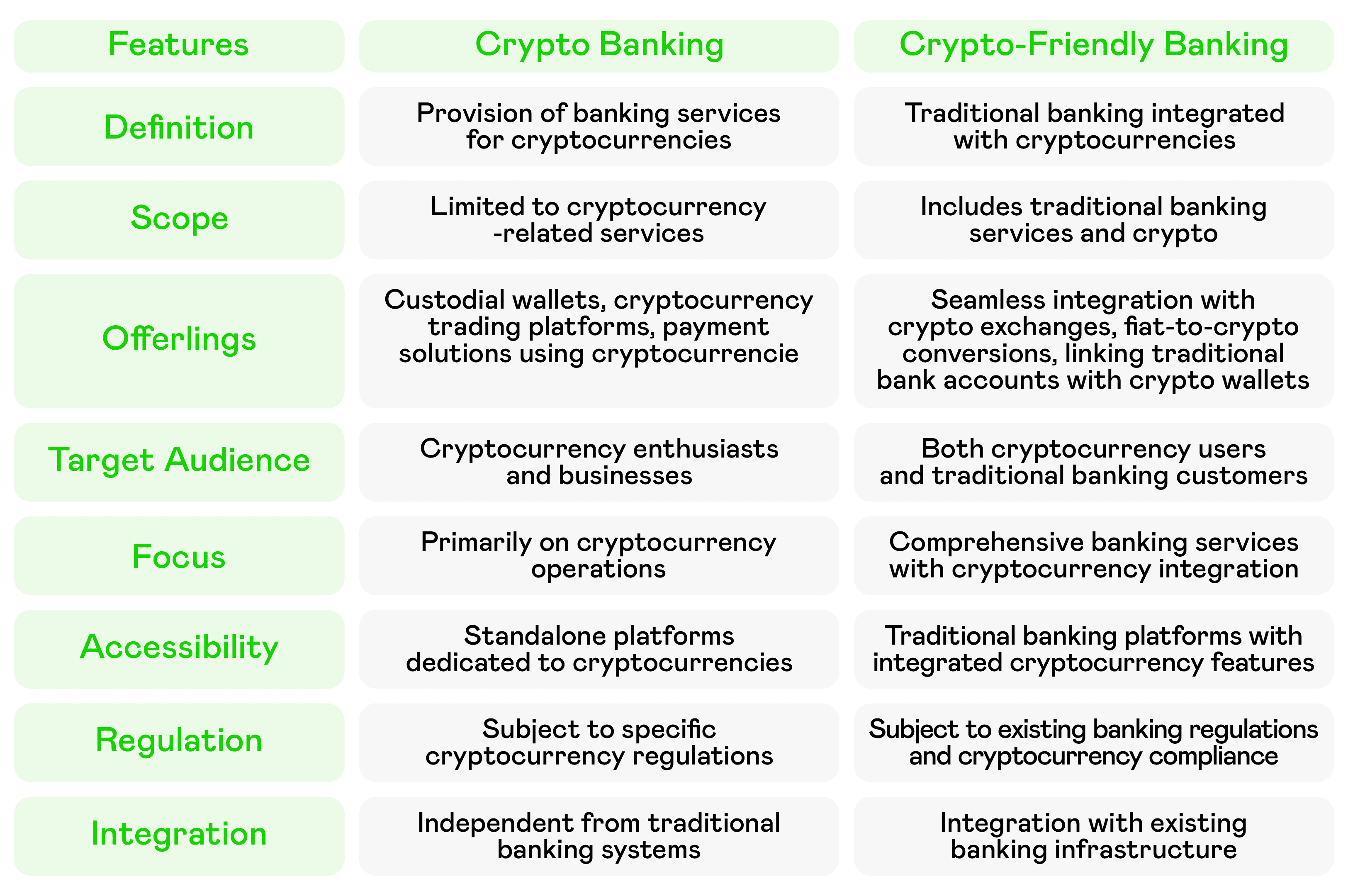

Comparison of features between crypto banking and crypto-friendly banking.

What Makes a Bank Truly Crypto-Friendly?

Direct Integration with Crypto Exchanges

No more jumping through hoops to move money between your bank account and platforms like Coinbase. The best crypto-friendly banks make these transfers seamless.

In-App Crypto Trading Capabilities

Some banks now offer direct crypto trading right within their banking apps. This eliminates the need for separate crypto trading platforms.

Transparent Transaction Fees

Real crypto-friendly banks are upfront about costs. No hidden fees that magically appear when you're trying to buy crypto.

Robust Compliance and Risk Management

These institutions have proper regulatory frameworks in place. They've done their homework on compliance requirements and implemented advanced risk management protocols.

Educational Resources

The best crypto banks don't just give you tools; they help you understand digital currencies and crypto markets safely.

Many crypto-friendly financial institutions now offer direct crypto trading capabilities, crypto-backed loans, and even bitcoin bank services that let you earn interest on your crypto holdings. The best crypto-friendly banks understand that today's customers want convenient fund management across all their assets - both traditional and digital.

❌ What's NOT Crypto-Friendly:

Banks that technically allow crypto but make the process so painful you'd rather use a sketchy exchange. Or worse, institutions that promise crypto services then hit you with ridiculous monthly fees and restrictions. The reality is that crypto-friendly banking encompasses everything from basic crypto purchases to sophisticated digital asset services for institutional clients.

What Banks Accept Crypto

After testing more platforms than I care to count, here are the banks that accept crypto and actually deliver on their promises. These financial institutions have embraced digital currencies and provide legitimate crypto services to their customers.

Revolut: The Crypto Trading Powerhouse

Revolut is a UK-based fintech company that offers cryptocurrency trading right within its mobile app, and they've set the bar high for everyone else. When I first tried their platform, I was blown away by how intuitive everything felt.

Key Features:

Supports trading of over 120 cryptocurrencies, including Bitcoin and Ethereum, within its mobile app in supported regions (e.g., UK, EEA, Australia).

Competitive fee structure with premium discounts

Real-time price alerts and portfolio tracking

Crypto rewards program offering Bitcoin cashback

Advanced security features with biometric authentication

The interface is so clean that my tech-challenged uncle managed his first crypto purchase without calling me for help. That's saying something.

Note: Revolut discontinued crypto services for U.S. customers in October 2023, so these features are unavailable in the U.S.

Ally Bank: From Traditional to Revolutionary

Ally Bank allows customers to use their accounts with external cryptocurrency exchanges for trading, making the whole process incredibly smooth. They've transformed from a simple online bank into a serious crypto player.

Key Features:

Zero-fee transfers between Ally accounts and major exchanges

Partnership with established crypto custodians for security

Interest-bearing savings accounts that work with crypto strategy

Comprehensive tax reporting tools

FDIC insurance coverage for traditional deposits

I've been using Ally for both my traditional banking services and crypto activities, and the integration is seamless. No more managing multiple platforms or dealing with confusing wire transfers.

Mercury: The Startup's Secret Weapon

If you're running any kind of business (especially in the crypto space), Mercury is your answer to "Why don't banks understand my needs?" They've positioned themselves as the go-to crypto-friendly bank for business accounts, and they absolutely nail it.

Key Features:

Unrestricted crypto purchases for business operations

Multi-user access control for team management

API access for developers building integrations

Mercury allows seamless bank transfers to major crypto exchanges

Treasury management for companies holding fiat and crypto

Dedicated support for crypto businesses

I've worked with several Web3 startups, and Mercury consistently gets mentioned as the platform that "just works" for crypto businesses. Their understanding of the space isn't just marketing – it's real.

JP Morgan Chase: When Wall Street Goes Crypto

This one surprised me more than anyone. JP Morgan Chase, the same institution that was crypto-skeptical not too long ago, now offers some genuinely impressive crypto services. JP Morgan Chase introduced the JPM Coin for instant cross-border payments and offers crypto-friendly banking services to institutional clients.

Key Features:

JPM Coin for institutional payments

Advanced compliance and risk management

Integration with traditional asset management

Chase Bank QuickBooks integration for business accounting

Robust security backed by banking experience

Support for both retail and institutional clients

Their approach is more conservative than some fintech companies, but if you value stability and regulatory compliance, they're hard to beat.

Juno: The Crypto Specialist

Juno provides specialized crypto accounts with crypto-backed loans and high-yield crypto savings accounts. Unlike traditional banks that added crypto features as afterthoughts, Juno built their platform around digital assets.

Key Features:

Crypto-backed loans without selling your Bitcoin

High-yield accounts specifically for digital assets

Interest rates that compete with DeFi protocols

Clean, crypto-native interface design

The lending feature is particularly impressive. I tested their crypto-backed loan service last year when I needed some quick fiat but didn't want to sell my Bitcoin (good thing, considering how that turned out). The process was surprisingly smooth – much better than the horror stories you hear about traditional banks trying to understand crypto collateral.

Cash App: The Beginner's Choice

Cash App enables users to invest in both traditional stocks and cryptocurrencies, including Bitcoin. They've mastered making complex financial products feel simple.

Key Features:

Dollar-cost averaging for automated crypto purchases

Simple interface that doesn't overwhelm newcomers

Fractional Bitcoin purchases

Round-up features investing spare change in Bitcoin

Cash App charges a 1.76% fee for crypto purchases, plus a service fee, which users should consider when budgeting.

I recommended Cash App to my cousin who was crypto-curious but intimidated by exchanges. Six months later, she's got a solid Bitcoin position and understands what she's doing. That's the power of good UX design.

Quontic: Bitcoin Bank Innovation

Quontic offers interest-bearing accounts for cryptocurrencies and even has a Bitcoin rewards checking account. They're pioneering the Bitcoin bank concept with crypto-native features.

Key Features:

Bitcoin Rewards Checking giving BTC for purchases

Interest-bearing crypto accounts with competitive rates

No monthly fees for crypto balances

Direct integration with crypto exchanges

Their Bitcoin rewards program is genuinely innovative. Instead of getting 1% cash back, you get the equivalent in Bitcoin. It's like having a built-in dollar-cost averaging system for your daily spending. The psychological effect is interesting too – you start thinking about purchases differently when the rewards might be worth more in the future.

Banks That Accept Crypto: Comparison Overview

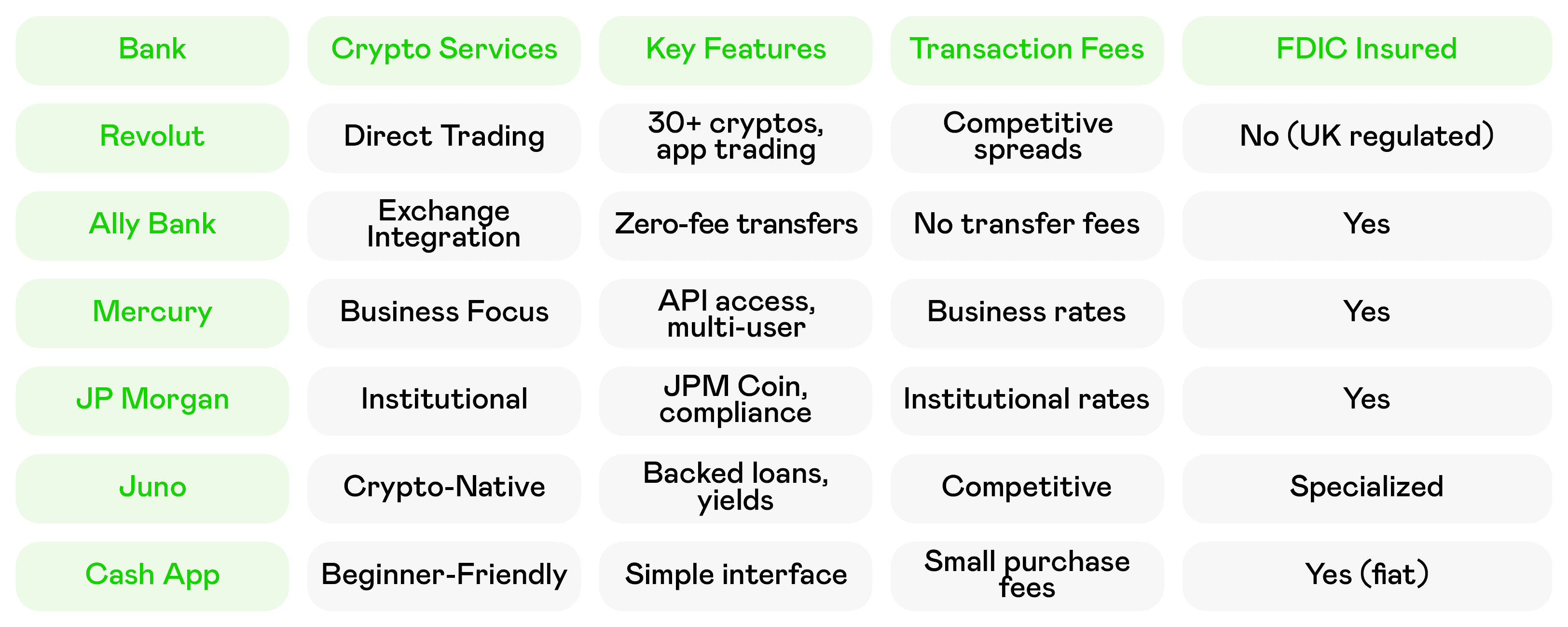

A comparison of the pros and cons of crypto-friendly banks.

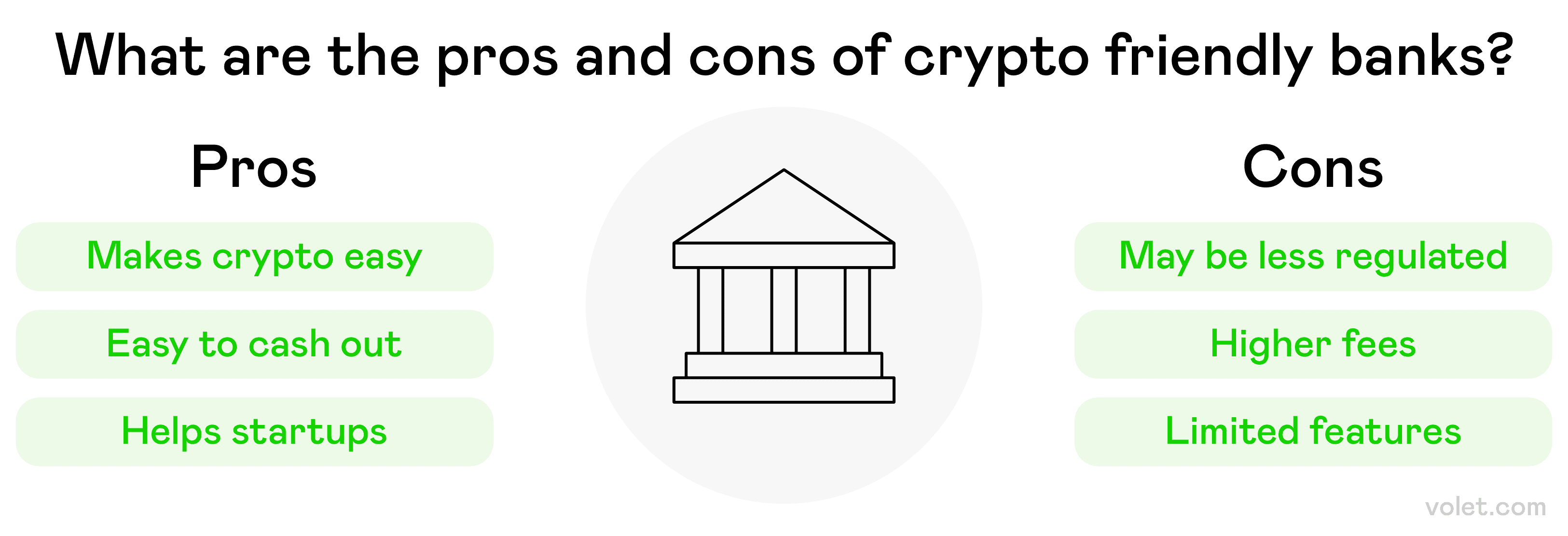

Benefits of Crypto-Friendly Banks

Let me tell you why switching to crypto-friendly banking services was one of the best financial decisions a couple of years ago. The benefits go way beyond just "convenience" – we're talking about a complete transformation in how you manage your financial life.

Seamless Asset Management

Remember the days of juggling multiple platforms, trying to keep track of your fiat currency here and digital currencies there? Those days are over. The best crypto-friendly banks let you manage everything from one dashboard.

I can check my savings accounts, monitor my crypto holdings, make crypto purchases, and even get insights into my overall portfolio – all from one app. It's like having a financial command center in your pocket.

Enhanced Security and Peace of Mind

Here's something that kept me up at night with traditional crypto exchanges: security. How many horror stories have we heard about exchanges getting hacked and people losing everything?

Crypto-friendly financial institutions bring institutional-grade security to the table:

Cold storage for digital assets

Multi-signature wallets

FDIC insurance coverage for fiat deposits

Regulatory compliance means something

24/7 monitoring and fraud detection

Cost Efficiency

This might surprise you, but good crypto banks can actually save you money. Sure, some charge higher fees for specialized services, but when you factor in everything, the math often works in your favor:

Reduced Transaction Fees: Direct integration with exchanges can lower costs, but fees vary (e.g., Cash App’s 1.76% crypto purchase fee, Revolut’s tiered fees from 0.49% to 1.49%). Always verify fee structures based on your usage.

Zero Currency Exchange Fees: Some banks offer this for premium users

No Wire Transfer Costs: Moving between crypto and traditional accounts

Bulk Trading Discounts: Better rates for frequent traders

Advanced Financial Services

The top crypto-friendly banks aren't just offering basic crypto purchases. We're talking about sophisticated financial products:

Interest-Bearing Crypto Accounts: Earn yield on digital assets

Automated Investment Tools: Dollar-cost averaging and rebalancing

Cross Border Payments: Instant international transfers

Digital Banking: Full integration with mobile banking apps

Business and Professional Benefits

If you're running crypto businesses or working in the digital asset space, crypto-friendly banks offer specialized services that traditional banks can't match:

Business Accounts designed for crypto companies

Advanced Accounting Automation for crypto-related transfers

Multi-user Access Control for team management

Customizable User Access for different roles

Platinum Business Checking with crypto capabilities

Integration with the Broader Crypto Ecosystem

The best crypto banks don't operate in isolation. They integrate with:

Major crypto exchanges for expanded trading options

DeFi protocols for decentralized finance opportunities

Regulated crypto exchanges for institutional-grade trading

Cross-platform portfolio tracking

Advanced accounting automation tools

How to Choose the Best Crypto-Friendly Banks

After testing dozens of platforms and making more than a few expensive mistakes, I've developed a systematic approach to choosing crypto-friendly banks. Let me walk you through my process so you can avoid the headaches I went through.

Step 1: Define Your Crypto Banking Needs

Before you start comparing features and fees, get clear on what you actually need. Trust me, this saves you from signing up for services you'll never use.

Are you a:

Casual Investor: Looking to buy crypto occasionally and hold long-term?

Active Trader: Need real-time trading and advanced charting tools?

Business Owner: Running crypto businesses or accepting digital payments?

Portfolio Diversifier: Want to integrate crypto with traditional investments?

Consider your usage patterns:

How often will you make crypto purchases?

Do you need business accounts or personal banking?

Are monthly fees a deal-breaker for your budget?

Do you need international transfer capabilities?

Step 2: Evaluate Security and Compliance

This is non-negotiable. Banks track crypto activities for good reasons – compliance and security. Look for institutions that take this seriously:

Essential Security Features:

- Look for banks that allow you to monitor your cryptocurrency holdings within their app

- Robust security features like cold storage and multi-signature wallets

- Banks that follow regulatory compliance and risk management frameworks

- Clear policies about how they protect digital assets

- FDIC insurance coverage for traditional deposits

- Two-factor authentication and biometric security

Red Flags:

- Vague security policies or unclear compliance standards

- History of security breaches without proper response

- Lack of regulatory oversight

- Poor customer reviews regarding security issues

Step 3: Analyze Costs and Fee Structures

Here's where many people get caught off guard. The "zero-fee" marketing can be misleading if you don't read the fine print.

Key Costs to Compare:

Transaction Fees: Vary significantly (e.g., Ally’s zero-fee transfers, Cash App’s 1.76% crypto purchase fee, Revolut’s 0.49%-1.49% spreads). Compare fees for crypto purchases, sales, and transfers.

Monthly Fees: Are there account maintenance charges?

Currency Exchange Fees: Costs for converting between fiat and crypto

Transfer Fees: Moving money between accounts or exchanges

Trading Spreads: The difference between buy and sell prices

International Transfer Costs: If you need cross-border payments

Pro Tip: Calculate total monthly costs based on your expected usage, and verify each bank’s fee schedule, as advertised “zero-fee” claims may exclude transaction-specific costs like Cash App’s 1.76% crypto fee or Revolut’s tiered spreads.

Step 4: Test User Experience and Interface

A crypto bank can have all the right features, but if the user-friendly interface isn't actually friendly, you'll hate using it. Here's how I test platforms:

Download and Try:

Sign up for a basic account (most offer this free)

Navigate through the crypto services section

Try making a small crypto purchase to test the process

Check how easy it is to link external crypto exchanges

Test their customer service response time

Look for:

Intuitive navigation that doesn't require a manual

Real-time price updates and portfolio tracking

Clear transaction histories

Easy-to-understand fee disclosures

Responsive mobile app performance

Step 5: Research Integration Capabilities

The whole point of crypto friendly banking is integration. Make sure your chosen bank plays well with the other financial tools you use:

Integration Checklist:

Crypto Exchanges: Does it connect with your preferred platforms?

Accounting Software: Business users need proper integration

Tax Software: Automated reporting saves massive headaches

Investment Platforms: For portfolio management

Payment Processors: If you're running a business

Step 6: Consider Long-Term Scalability

Your crypto needs will likely evolve. Choose a bank that can grow with you:

Future-Proofing Considerations:

Service Expansion: Are they actively adding new crypto services?

Asset Support: Do they regularly add new cryptocurrencies?

Business Services: Can you upgrade to business accounts if needed?

International Expansion: Will they support you if you move or expand globally?

Technology Investment: Are they staying current with blockchain developments?

My Personal Ranking System

Here's how I score crypto friendly banks (out of 10 points each):

Security & Compliance (2 points max): Non-negotiable foundation

Fee Structure (2 points max): Total cost of ownership

User Experience (2 points max): Daily usability matters

Integration (2 points max): How well it connects with your ecosystem

Customer Support (1 point max): When things go wrong

Innovation (1 point max): Staying ahead of the curve

Any bank scoring below 7/10 doesn't make my recommendation list.

Questions to Ask Before Signing Up

Before committing to any crypto-friendly financial institution, get clear answers to these questions:

What's the total cost for my expected usage pattern?

How do they handle security breaches or technical issues?

What's their policy on account freezes or crypto-related restrictions?

Do they offer educational resources for crypto newcomers?

What's their roadmap for adding new features or cryptocurrencies?

How do they handle tax reporting and compliance documentation?

Red Flags to Avoid ⚠️

From my experience testing various platforms, here are the warning signs that usually indicate problems:

❌ Pushy Sales Tactics: Good crypto banks let their features speak for themselves

❌ Unclear Fee Structures: If you can't easily understand their costs, look elsewhere

❌ Poor Customer Service: Test their support before you need it

❌ Limited Transparency: Vague policies about security or compliance

❌ Overpromising: Claims that sound too good to be true usually are

The key is finding a crypto friendly bank that aligns with your specific needs, risk tolerance, and financial goals. Don't just chase the flashiest features – focus on reliability, security, and long-term value.

Final Thoughts

The evolution from "banks that barely tolerate crypto" to "banks actively competing for crypto customers" has been remarkable. We've gone from hiding crypto activities to having institutional clients getting dedicated crypto services.

What excites me most is how this shift has made digital asset management accessible to everyone. You no longer need to be a tech expert to participate in the crypto economy. Proper crypto friendly banking services have democratized access to digital currencies while maintaining necessary security and regulatory compliance.

Disclaimer

This article is provided for informational purposes only and does not constitute legal, financial, or professional advice. All content is based on publicly available information and personal opinions. Readers are advised to seek professional guidance before making decisions or acting based on the material presented. The author and publisher assume no liability for any actions taken or not taken by the reader based on the information contained herein.

Frequently Asked Questions

Major crypto-friendly banks include Revolut (excl. U.S.), Ally Bank, Mercury, JP Morgan Chase, Juno, Cash App, and Quontic. These institutions offer varying crypto services from basic exchange connectivity to comprehensive digital asset management, crypto trading platforms, and specialized business solutions for crypto companies.

Crypto-friendly banks implement robust security measures including cold storage, multi-signature wallets, regulatory compliance frameworks, and FDIC insurance for fiat deposits. However, cybersecurity risks remain. Choose banks with strong security protocols and transparent risk management practices.

The best crypto-friendly banks follow strict regulatory compliance standards, implement comprehensive risk management frameworks, provide clear transaction reporting for tax purposes, and maintain transparency about security protocols. This compliance benefits users by providing stability and legal protection.

Fees vary significantly between institutions. Some banks like Ally offer zero-fee transfers to crypto exchanges, while others charge transaction fees, monthly account fees, currency exchange fees, and trading spreads. Calculate total costs based on expected usage patterns rather than advertised rates.

Yes, several crypto-friendly banks offer specialized business accounts for crypto companies. Mercury, JP Morgan Chase, and others provide multi-user access control, treasury management tools, API integrations, dedicated support for crypto businesses, plus advanced accounting automation and customizable user access features.